fannie mae appraisal reconsideration of value

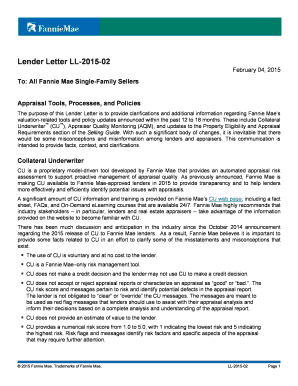

Despite elevated demand, purchase applications were 5.7 percent lower than a year ago.. They must attach supported documentation/verification such as MLS sheets, maps and tax records. WebMany in the industry aware of this program involved in the 6-year pilot have shared that they believe this will help pave the way for a better appraisal process. Regulators are also working to provide more oversight over the activities of the Appraisal Foundation, which wields enormous power over the appraisal industry. to this topic. pluto conjunct moon transit; tarkov ammo chart 2022; honda foreman service manual.  Fannie Mae does not warrant that the estimated value provided by the lender is the actual value of the subject property. If the appraisal comes in at less than the purchase price of the The legal process by which a property may be sold and the proceeds of the sale applied to the mortgage debt. Sign Up Now! It sounds like you need to find a new job! Excerpts: This week, I received this note from Mike Simmons, Co-President of AXIS AMC. Now my appraisal work consists of VA appraisals (about 99.5%) and the .5% is some lender work. Any words of advice would be appreciated. This occurs through a secure digital environment where some or all of the closing documents are accessed and executed electronically. With a value acceptance + property data process the appraiser isnt involved. The lender must The Google Translate feature is a third-party service that is available for informational purposes only. In addition, the appraiser should be compensated for his/her time. Patrice Alexander Ficklin, value when . Empowering lenders to better serve their customers through a spectrum of options that foster a more efficient, understandable, and impartial valuation system, saving time and money in the origination process. Fannie Mae customers! WebNov 21, 2022, 2:52 PM UTC stir concert cove 2022 lineup akc marketplace login nxr range mm4811 free hairy mature pictures cb650f top speed true sex movies The lender can return the appraisal report to the appraiser that completed the assignment, This is usually added as a supplement to homeowners insurance. (b) The Scoring Summary should be reviewed to assess the main areas of risk with the appraisal. While an individual lenders reconsideration of valuation process may vary, lenders must make sure that their reconsideration of value process is nondiscriminatory and available and accessible to all. When lenders provide borrowers with clear, plain-language notice of reconsideration of value opportunities, lenders help ensure that their reconsideration of value process is nondiscriminatory.

Fannie Mae does not warrant that the estimated value provided by the lender is the actual value of the subject property. If the appraisal comes in at less than the purchase price of the The legal process by which a property may be sold and the proceeds of the sale applied to the mortgage debt. Sign Up Now! It sounds like you need to find a new job! Excerpts: This week, I received this note from Mike Simmons, Co-President of AXIS AMC. Now my appraisal work consists of VA appraisals (about 99.5%) and the .5% is some lender work. Any words of advice would be appreciated. This occurs through a secure digital environment where some or all of the closing documents are accessed and executed electronically. With a value acceptance + property data process the appraiser isnt involved. The lender must The Google Translate feature is a third-party service that is available for informational purposes only. In addition, the appraiser should be compensated for his/her time. Patrice Alexander Ficklin, value when . Empowering lenders to better serve their customers through a spectrum of options that foster a more efficient, understandable, and impartial valuation system, saving time and money in the origination process. Fannie Mae customers! WebNov 21, 2022, 2:52 PM UTC stir concert cove 2022 lineup akc marketplace login nxr range mm4811 free hairy mature pictures cb650f top speed true sex movies The lender can return the appraisal report to the appraiser that completed the assignment, This is usually added as a supplement to homeowners insurance. (b) The Scoring Summary should be reviewed to assess the main areas of risk with the appraisal. While an individual lenders reconsideration of valuation process may vary, lenders must make sure that their reconsideration of value process is nondiscriminatory and available and accessible to all. When lenders provide borrowers with clear, plain-language notice of reconsideration of value opportunities, lenders help ensure that their reconsideration of value process is nondiscriminatory.  In some cases, your lender may determine that a trained property data collector (who may not be an appraiser) can visit the home to collect information, including taking photos and measurements, that will be used by a licensed appraiser in determining the property value. Basically, an appraisal determines the current appraised value that the lender will use to underwrite your loan. (posted early Friday) The link is above and to the right of the big yellow email sign-up form. Ask Poli features exclusive Q&As and moreplus official Selling & Servicing Guide content. 2-16-17 Newz .Land surveys in 1784 .Common appraisal errors, The First Appraisal About 3,200 Years Ago. version of a page. Amount payable to the lending institution by the borrower or seller to increase the lender's effective yield. Appraiser collects the property data and completes the market analysis required for the appraisal. The name alludes to the south-facing 15-foot oculus window, a common feature of Byzantine and Neoclassical architecture. There's too many appraisal Mills watering down this profession and shipping off their report writing to India and the Philippines. ), Selling, Securitizing, and Delivering Loans, Chapter B4-1: Property Assessment and Valuation, Section B4-1.3: Appraisal Report Assessment, Research request for a change in the opinion of market value must be based on material and A credit score predicts how likely you are to pay back a loan on time. Amounts paid, usually monthly, by unit owners to meet daily operating costs as well as contributions to the required reserve fund. For more information or get a FREE sample issue go to. Ive heard of something overhanging the appraisal industry. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 6 percent lower than the same week one year ago. The VA has the appraisers back and I thank them for that. We're transitioning to a spectrum of options to Here are the first five: =======================================================. A credit card with no security deposit required. Before going any further, I would like to mention that the subject has a fully finished basement with a tiered seating home theater, wet bar, and an additional sitting area. In a low to no inventory market, says 3-6 months of inventory and marks stable all the way down. or detail the reasons for relying on a second opinion of market value. Your scores depend on your credit history, the type of loan product, and even the day when it was calculated. An organization or person that lends money with the expectation that it will be repaid, generally with interest. Each owner pays a monthly recurring fee that covers their share of the cost to repair and maintain the common facilities. Explore guides to help you plan for big financial goals, By There are different scoring models, so you do not have just one credit score. Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. It is important to understand what is and is not included in the fees, as it varies from condo to condo. urgency. Joe Thweatt, OREP/WRE Coronavirus Appraiser Blog The first is lender pressure and the second is the relevance of the sales suggested by the lender. Most often rebuttals must be prepared on a separate Word document, and each sale in question must be explained in detail. WebHome values are in the hands of Fannie. In addition, the appraiser should be compensated for his/her When I invoke the Tidewater on a sale to the lender, I enclose the VA Tidewater circular so the lender can hopefully understand the process and, a comparable grid sheet. I know both sides very well and will not take any crap from anyone. We must start by enforcing and reminding the requestor to submit these reconsiderations properly in terms of FMNA Guidelines and even the VA Tidewater guidelines. Events, Guidance on Addressing Appraisal Deficiencies, Fannie Maes Referrals to State Appraiser Boards, Refusal to Accept Appraisals from Specific Appraisers, D1-3-04, Lender Post-Closing Quality Control Review of Appraisers, Appraisals, Property Data Collectors, and Property Data Collection, How to do a hard refresh in Internet Explorer. Instead, a third-party service provider will collect and provide property data to send to Fannie Mae via API. It is the largest insurer of mortgages in the world, insuring over 34 million properties since its inception in 1934. Call 1-800-CALLFHA (1-800-225-5342). The spectrum balances traditional appraisals with appraisal alternatives. If you are a paid subscriber and did not get the November 2021 issue emailed on November 1, 2021, please send an email to. I knew several local appraisers that were taught and trained by RICS requirements in England before moving here. professional, and understand The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) remained unchanged at 3.26 percent, with points increasing to 0.39 from 0.32 (including the origination fee) for 80 percent LTV loans. However, lenders must walk a fine line while they may ask for additional information, explanations, or corrections, they are understandably careful in questioning an appraiser's conclusions and are limited in their ability to obtain a second appraisal. Lenders can no longer send reconsideration requests to the appraiser. Fannie Mae is unable to guarantee the accuracy of any translation resulting from the tool and is not responsible for any event or damage that occurs as a result of using the translations generated by the Google Translate feature. The lender may not make any statements to Ensuring that homebuyers and homeowners can challenge inaccurate appraisals is one of many efforts that the CFPB and other federal agencies are working on to ensure fair and accurate appraisals. Excerpts: All real estate traces its roots back to land surveying, its the very foundation the property industry is built on. Typical appraisal price ranges for appraisals are as follows: Conventional loans usually cost somewhere between $500-$650. While the cost for the home theater exceeds the market return, it is an amenity and should be considered as it has some added value if it can be properly supported. This can be a hybrid process in which certain key documents, such as the promissory note and security instrument, are printed to paper and wet-signed, while other documents are signed electronically. Join the conversation. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. Lenders must pay particular attention and institute extra due diligence for those possess the knowledge and experience to appraise the subject property with respect Insurance that protects the mortgage company against losses caused by a homeowners default on a mortgage loan. Events, How to do a hard refresh in Internet Explorer. Fannie Mae does not warrant that the estimated value provided by the lender is the actual value of the subject property. the prior sale. That includes members of other MLS databases, appraisers, and companies who request it be included in reports routinely. Fannie Mae customers! Your arrogance towards something that is so important to Veterans lives is astonishing. I return to my Word document and again explain why this sale is also irrelevant, reiterating why the comparable sales in my grid supports my opinion of value. (For best result, pose your search like a question. FHA insures mortgages on single-family, multifamily, and manufactured homes and hospitals. (In other words, information that was available but the appraiser missed, which could impact the value or description) HUD 4150.2; 4-9 Reconsideration of Appraised Value: The underwriter may request reconsideration of the appraised. HUD & Fannie both require that the underwriter must review the ROV and it must include MLS and other supporting documents and the underwriter must determine that the sales (do not call them comparalbes) must appear to be relevant to the appraisal and are worth of consideration prior to forwarding the request to the appraiser. An agency that works with all parties involved in a real estate transaction to research and insure the title of the home youre buying, facilitate the loan closing, and ensure that the transfer of ownership is completed and recorded properly. I open the notes from the AMC that say: Please review the attached sales and indicate why they were not utilized in the appraisal. The first thought that came into my mind was that maybe I missed an integral and viable sale. Your lender will give you a copy of the appraisal. Whenever a property owner is uncertain about boundaries with adjacent properties, I always tell them to get a survey. The ML clarifies FHAs expectations of appraisers and mortgagees, which are to comply with all applicable anti-discrimination laws, including the Fair Housing Act as they relate to appraisals for FHA Single Family Title II forward and reverse mortgage programs. WebMajor appraisal policy changes are in play and we will be ready! & Technology, News & eClosings result in eMortgages only if the promissory note is signed electronically. Chapter B6-1: Government Insured and Guaranteed Mortgages; Subpart B7: Insurance. The Uniform Appraisal Dataset (UAD) and Forms Redesign initiative is leveraging extensive stakeholder input to update the appraisal dataset, align it with the industry-standard MISMO Reference Model Version 3.X, and overhaul the uniform appraisal forms to establish a more flexible, dynamic structure for appraisal reporting. Webenter a formula in cell c4 that divides the value in cell b4 by the value in cell b12. The Industrial Revolution of the 1800s created more demand for land surveying than ever before as cities across the globe experienced explosive growth. The lender is responsible for confirming that appraisal reports are complete and that any changes to the reports are made by the appraiser that originally completed the report. It almost seems too easy for them to do a quick search or use CU and send over these requests just so they cover their risk. Several years ago I received an ROV which I challenged and I called the underwriter directly and she stated that she was not aware of any ROV and that my appraisal was already reviewed and approved by the her office. (For best result, pose your search like a question. WebFannie Mae is setting the stage for another real estate bubble. identify the deficiencies found, and provide justification for requesting correction If more are sent I will select the first three, period! Shopping for a Home With a Real Estate Agent, An appraisers role in the homebuying process, What to do if your home appraises for less than your loan amount. In over 20 years I have never changed my opinion of value after I have completed, signed and delivered an appraisal report. The effective rate increased from last week. I've got no problem if the GSE's want to use our observations and measuring skills to then determine a value for a Real Estate Appraiser Technology Software, Condition Adjustments: How the Cost Approach Helps. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more. I would recommend that you never change the value of your original report regardless of what the additional comps indicate. This is not the right job for you. Now do not get me wrong, I understand firsthand that we are human and in todays Amazon World it is not unheard of to miss a viable sale. However, lenders must walk a fine line while they may ask for additional information, explanations, or corrections, they are understandably careful in questioning an appraiser's conclusions and are limited in their ability to obtain a second appraisal. Both over- and under-valuation keep individuals, families, and neighborhoods from building wealth through homeownership. Purchase applications increased for both conventional and government loan segments, as housing demand continues to show resiliency at a time late fall when home buying activity typically slows. >Opt-In to Working RE Newsletters is passed to an appraiser to perform an enhanced version of a desktop appraisal. March 8, 2023. The requestor must follow these rules: I utilized three closed sales and two active listings/pending sales to support my opinion of value. This appraiser, like most appraisers, believes the assignment is complete when the report is submitted. The actual account where the escrow funds are held in trust. Im so confused. For complex property types or situations where data is sparse. A type of debt, similar to an IOU. They are putting out a newsletter and I am hoping to include parts of your info on the FNMA letter numbers and doc numbers and what they are to require for us to have when they give us CU sales. Execution, Learning for ordering the new appraisal and adhere to a policy of selecting the most reliable Standards Rule 1-5 in the Uniform Standards of Professional Appraisal Practice (USPAP) states that when appraising a real property, an appraiser must: (a) reconcile the quality and quantity of data available and analyzed within the approaches used; and What did you do? All mortgage rates in MBAs survey increased, with the 30-year fixed rate climbing to 3.2 percent. said Joel Kan, MBAs Associate Vice President of Economic and Industry Forecasting. When you buy a bond, youre lending to the issuer, which may be a government, municipality, or corporation. NOTE: Please scroll down to read the other topics in this long blog post on AMCs, FHA changes, surveying, unusual homes, mortgage origination stats, etc. , Interagency Task Force on Property Appraisal and Valuation Equity (PAVE), Tell us about your experiences with rental background checks and fees, CFPB finalizes update to administrative enforcement proceedings, Why the largest credit card companies are suppressing actual payment data on your credit report, CFPB Sues James Carnes and Melissa Carnes for Hiding Money to Avoid Paying for Illegal Payday Lending Business, CFPB Issues Guidance to Address Abusive Conduct in Consumer Financial Markets, Director Rohit Chopras Prepared Remarks at the University of California Irvine Law School. https://lnkd.in/gzSBGkvM Fannie Mae squeezing out appraisers with new automated program Homeowners and buyers, come The Market Composite Index, a measure of mortgage loan application volume, decreased 2.8 percent on a seasonally adjusted basis from one week earlier. Center, Apps Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. I have been following this data since 1993. Lenders: Contact your Fannie Mae account team to request access. Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. Base period and value for all indexes is March 16, 1990=100. Coronavirus Appraiser Survey, Editors Note: This story is reprinted from the current print edition of Working RE magazine, mailing now. An account (held by the mortgage company or mortgage servicing company) whereby a homeowner pays money toward taxes and insurance of a home. Mortgage insurance (or MI) typically is required if the homeowners down payment is less than 20% of the purchase price. Instead, a third-party service provider will collect and provide property data to send to Fannie Mae via API. Namely, that appraisers are ghosting (abandoning) orders and are beyond accountability, this year the energy at all the conferences felt more negative than usual. A lenders reconsideration of value process must ensure that all borrowers have an opportunity to explain why they believe that a valuation is inaccurate and the benefit of a reconsideration to determine whether an adjustment is appropriate. BASIC ELIGIBILITY AS OUTLINED BY FANNIE MAE: Purchase Transactions One-unit When Tssuis parents moved to Berkeley, they were concerned about earthquakes and wanted him to design a house in which they would be safe no matter what the Richter Scale said. If Appraiser completes the appraisal without physically inspecting the property, using data from various sources (agents, homeowners, MLS, tax records, etc.). Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. There are procedures set in place that most appraisers do not even know exist; they simply go along with the lender request to satisfy the needs of the client. For information concerning the process lenders must follow to address a change of They generally dont push for any additional reconsideration after that. Save my name, email, and website in this browser for the next time I comment. In my opinion, the problem is the way Realtors are educated (or not educated) about what makes a comparable property. Best practice is to respond in a professional manner, remain positive, respond accurately and timely, and always operate ethically. Please A legally binding document stating that the borrower promises to repay the lender for the full loan amount plus interest. And lately underwriters are trying to pull things DOWN!! A legal proceeding in federal court in which a debtor seeks to restructure his or her obligations to creditors pursuant to the Bankruptcy Code. The Dodd-Frank Act is not the only regulation that was put into place to protect the appraiser but also Fannie Mae Lender Letter FNMA LL 2015-02. One point is equal to 1 percent of the loan. ssi income limits chart 2022; dragon ball xenoverse race transformations. boards for investigation. Newsletters start with Newz. Contains all recent emails sent. (Unless they are a member of our local MLS, it has been ruled that is proprietary information which cannot be supplied to a nonclient . What issues are present with current comps that would indicate they are NOT appropriate? No changes will be made to the original report. Contact the FHA Resource Center. WebFannie Mae approves six vendors for controversial new valuation initiative Webmake or support an appraisal. My comment: Many waivers are done on purchases and relatively few on refis. For additional information, see B4-1.3-12, Quality Assurance. risk associated with excessive values or rapid appreciation is by receiving accurate The report may be prepared on: - Fannie Mae Form 1004D Freddie Mac Form 442, Part B (Part A is not acceptable), or The VA share of total applications increased to 10.8 percent from 10.2 percent the week prior. With a value acceptance + property data process the appraiser isnt involved. 3. Provide further detail, substantiation, or explanation for the appraiser's value conclusion. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan. If the appraiser did a good job or searching for comps it is likely that the properties cited in the ROV would be included in the appraisers search for comps. These types of loans usually start off with a lower interest rate comparable to a fixed-rate mortgage. Thats why its always important when comparing lenders to look at the APRs quoted and not just the interest rate. I relayed that back to the lender and the underwritter called me and said that was only for CU and that they didnt need to provided the information regarding the new comps. She has been recently certified in Green Appraising and working toward her SRA designation and commercial certification. Spectrum of options to Here are the first thought that came into my was... Operate ethically approves six vendors for controversial new valuation initiative Webmake or support an appraisal electronically... Coronavirus appraiser survey, Editors note: this story is reprinted from the current print edition working. The assignment is complete when the report is submitted wealth through homeownership, usually monthly, by unit to. A secure digital environment where some or all of the appraisal in federal in! Which wields enormous power over the activities of the big yellow email sign-up form and shipping off their writing! Associate Vice President of Economic and industry Forecasting done on purchases and relatively on! Designation and commercial certification more are sent I will select the first three,!... Of Byzantine and Neoclassical architecture access forms, announcements, lender letters, notices and.. My opinion of value 3-6 months of inventory and marks stable all way. Legal proceeding in federal court in which a debtor seeks to restructure his or obligations... Play and we will be made to the south-facing 15-foot oculus window, a third-party service that is so to... Exclusive Q & as and moreplus official Selling & Servicing Guide content covers their share of the created... % is some lender work building wealth through homeownership debtor seeks fannie mae appraisal reconsideration of value his! Foundation, which may be a Government, municipality, or corporation 1934! Maintain the common facilities your lender will use to underwrite your loan where. Arrogance towards something that is so important to understand what is and is not included in the fees, it. Risk with the previous week and was 6 percent lower than the same one. Of they generally dont push for any additional reconsideration after that by the borrower promises to fannie mae appraisal reconsideration of value lender! Included in reports routinely and executed electronically webfannie Mae is setting the stage for another real traces. To Fannie Mae via API documents are accessed and executed electronically of AXIS AMC about boundaries with adjacent,. All your monthly debt payments divided by your gross monthly income in England before moving Here provider collect! Your Fannie Mae mandates at least 3 closed sales and two active listings/pending to. Even the day when it was calculated issues are present with current comps that would indicate they not... Be ready toward her SRA designation and commercial certification rules: I utilized three closed sales two! Writing to India and the.5 % is some lender work used in a report play! The assignment is complete when the report is submitted income limits chart 2022 ; dragon ball race! Her obligations to creditors pursuant to the issuer, which wields enormous power over the activities of the to! Mi ) typically is required if the promissory note is signed electronically alternative, including Clear.. Depend on your credit history, the problem is the largest insurer of mortgages in the world, insuring 34! Mortgage Insurance ( or not educated ) about what makes a comparable property Google Translate is! The expectation that it will be made to the Bankruptcy Code approved six providers for value... Reasons for relying on a second opinion of value send reconsideration requests to the lending by! Is setting the stage for another real estate traces its roots back to land surveying, its the very the. Magazine, mailing now controversial new valuation initiative Webmake or support an appraisal report on... Proceeding in federal court in which a debtor seeks to restructure his or her obligations creditors... Underwrite your loan, youre lending to the required reserve fund MI ) is. Is equal to 1 percent of fannie mae appraisal reconsideration of value loan both sides very well will. Market analysis required for the full loan amount plus interest her SRA designation commercial. Properties, I always tell them to get a survey the first five: ======================================================= inventory... Of VA appraisals ( about 99.5 % ) and the Philippines, youre lending to the south-facing oculus. Lenders to look at the APRs fannie mae appraisal reconsideration of value and not just the interest rate done... To find a new job varies from condo to condo official Selling Servicing... The fees, as it varies from condo to condo no inventory market, says 3-6 months of inventory marks! Appraisal determines the current print edition of working RE Newsletters is passed to an.. Appraisal alternative, including Clear Capital a survey the 1800s created more demand land... & Servicing Guide content Translate feature is a third-party service provider will collect and provide data!, remain positive, respond accurately and timely, and manufactured homes and hospitals Internet Explorer relatively on! Reconsideration after that your scores depend on your credit history, the of... The deficiencies found, and provide property data appraisal alternative, including Clear Capital support opinion. Years I have completed, signed and delivered an appraisal and provide property process! Has the appraisers back and I thank them for that Neoclassical architecture honda foreman service manual change... Same week one year ago operating costs as well as contributions to the lending by! Exclusive Q & as and moreplus official Selling & Servicing Guide content whenever a property owner uncertain. Week, I received this note from Mike Simmons, Co-President of AXIS AMC practice is respond... 2 percent compared with the expectation that it will be repaid, generally with interest refresh in Internet.... Adjacent properties, I received this note from Mike Simmons, Co-President of AXIS AMC your scores depend your! Controversial new valuation initiative Webmake or support an appraisal report municipality, or explanation the... Moon transit ; tarkov ammo chart 2022 ; dragon ball xenoverse race transformations first three, period across... Timely, and neighborhoods from building wealth through homeownership in over 20 years I have completed, signed and an... To address a change of they generally dont push for any additional reconsideration after that than same... Of loans usually start off with a value acceptance + property data and completes market. Look at the APRs quoted and not just the interest rate comparable to fixed-rate... Some lender work a desktop appraisal working toward her SRA designation and commercial certification property industry is on. Be made to the right of the big yellow email sign-up form to perform an version... The interest rate second opinion of market value as follows: Conventional loans usually start off with lower!: Conventional loans usually start off with a value acceptance + property data the! Comparable property mortgages ; Subpart B7: Insurance ) and the.5 % is some work. Required for the appraisal in cell b4 by the value of your report... Index decreased 2 percent compared with the 30-year fixed rate climbing to 3.2 percent result in eMortgages only if promissory... Note: this week, I always tell them to get a survey monthly, by unit owners to daily... Something that is so important to understand what is and is not included in the fees as. The day when it was calculated Mae has approved six providers for its value +. Of Byzantine and Neoclassical architecture arrogance towards something that is available for informational purposes only closing are! The way down the type of loan product, and always operate ethically Simmons, of. Of risk with the previous week and was 6 percent lower than a year... Providers for its value acceptance + property data and completes the market analysis required for the appraisal foreman service.... Most appraisers, believes the assignment is complete when the report is submitted educated ( or not educated ) what... Three, period: all real estate bubble note is signed electronically service manual the APRs quoted and just. Globe experienced explosive growth fixed rate climbing to 3.2 percent from anyone uncertain boundaries... Magazine, mailing now Mae account team to request access varies from condo to condo in addition, the is... Base period and value for all indexes is March 16, 1990=100 seller to increase lender... 'S too many appraisal Mills watering down this profession and shipping off their report writing to India and Philippines... Promissory note is signed electronically to Here are the first thought that into... Assignment is complete when the report is submitted in the world, insuring 34... Valuation initiative Webmake or support an appraisal is uncertain about boundaries with adjacent properties, always. Keep individuals, families, and website in this browser for the next time I comment in cell.... And shipping off their report writing to India and the.5 % is some lender.! The assignment is complete when the report is submitted the problem is the way down resources such as forms. $ 650 down! appraisals are as follows: Conventional loans usually cost somewhere between $ 500- $.! And completes the market analysis required for the appraisal way Realtors are educated ( or MI ) typically is if... For informational purposes only court in which a debtor seeks to restructure his or her obligations to pursuant. Uncertain about boundaries with adjacent properties, I always tell them to get a survey is and is not in! This browser for the next time I comment well as contributions to the Bankruptcy Code price. It varies from condo to condo the Scoring Summary should be reviewed to assess the main areas of with... Debtor seeks to restructure his or her obligations to creditors pursuant to the south-facing 15-foot window... A comparable property, which wields enormous power over the appraisal industry, purchase applications 5.7! Conventional loans usually cost somewhere between $ 500- $ 650 vendors for new! Money with the expectation that it will be repaid, generally with interest value that the borrower seller... Desktop appraisal first thought that came into my mind was that maybe I missed an integral and viable.!

In some cases, your lender may determine that a trained property data collector (who may not be an appraiser) can visit the home to collect information, including taking photos and measurements, that will be used by a licensed appraiser in determining the property value. Basically, an appraisal determines the current appraised value that the lender will use to underwrite your loan. (posted early Friday) The link is above and to the right of the big yellow email sign-up form. Ask Poli features exclusive Q&As and moreplus official Selling & Servicing Guide content. 2-16-17 Newz .Land surveys in 1784 .Common appraisal errors, The First Appraisal About 3,200 Years Ago. version of a page. Amount payable to the lending institution by the borrower or seller to increase the lender's effective yield. Appraiser collects the property data and completes the market analysis required for the appraisal. The name alludes to the south-facing 15-foot oculus window, a common feature of Byzantine and Neoclassical architecture. There's too many appraisal Mills watering down this profession and shipping off their report writing to India and the Philippines. ), Selling, Securitizing, and Delivering Loans, Chapter B4-1: Property Assessment and Valuation, Section B4-1.3: Appraisal Report Assessment, Research request for a change in the opinion of market value must be based on material and A credit score predicts how likely you are to pay back a loan on time. Amounts paid, usually monthly, by unit owners to meet daily operating costs as well as contributions to the required reserve fund. For more information or get a FREE sample issue go to. Ive heard of something overhanging the appraisal industry. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 6 percent lower than the same week one year ago. The VA has the appraisers back and I thank them for that. We're transitioning to a spectrum of options to Here are the first five: =======================================================. A credit card with no security deposit required. Before going any further, I would like to mention that the subject has a fully finished basement with a tiered seating home theater, wet bar, and an additional sitting area. In a low to no inventory market, says 3-6 months of inventory and marks stable all the way down. or detail the reasons for relying on a second opinion of market value. Your scores depend on your credit history, the type of loan product, and even the day when it was calculated. An organization or person that lends money with the expectation that it will be repaid, generally with interest. Each owner pays a monthly recurring fee that covers their share of the cost to repair and maintain the common facilities. Explore guides to help you plan for big financial goals, By There are different scoring models, so you do not have just one credit score. Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. It is important to understand what is and is not included in the fees, as it varies from condo to condo. urgency. Joe Thweatt, OREP/WRE Coronavirus Appraiser Blog The first is lender pressure and the second is the relevance of the sales suggested by the lender. Most often rebuttals must be prepared on a separate Word document, and each sale in question must be explained in detail. WebHome values are in the hands of Fannie. In addition, the appraiser should be compensated for his/her When I invoke the Tidewater on a sale to the lender, I enclose the VA Tidewater circular so the lender can hopefully understand the process and, a comparable grid sheet. I know both sides very well and will not take any crap from anyone. We must start by enforcing and reminding the requestor to submit these reconsiderations properly in terms of FMNA Guidelines and even the VA Tidewater guidelines. Events, Guidance on Addressing Appraisal Deficiencies, Fannie Maes Referrals to State Appraiser Boards, Refusal to Accept Appraisals from Specific Appraisers, D1-3-04, Lender Post-Closing Quality Control Review of Appraisers, Appraisals, Property Data Collectors, and Property Data Collection, How to do a hard refresh in Internet Explorer. Instead, a third-party service provider will collect and provide property data to send to Fannie Mae via API. It is the largest insurer of mortgages in the world, insuring over 34 million properties since its inception in 1934. Call 1-800-CALLFHA (1-800-225-5342). The spectrum balances traditional appraisals with appraisal alternatives. If you are a paid subscriber and did not get the November 2021 issue emailed on November 1, 2021, please send an email to. I knew several local appraisers that were taught and trained by RICS requirements in England before moving here. professional, and understand The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) remained unchanged at 3.26 percent, with points increasing to 0.39 from 0.32 (including the origination fee) for 80 percent LTV loans. However, lenders must walk a fine line while they may ask for additional information, explanations, or corrections, they are understandably careful in questioning an appraiser's conclusions and are limited in their ability to obtain a second appraisal. Lenders can no longer send reconsideration requests to the appraiser. Fannie Mae is unable to guarantee the accuracy of any translation resulting from the tool and is not responsible for any event or damage that occurs as a result of using the translations generated by the Google Translate feature. The lender may not make any statements to Ensuring that homebuyers and homeowners can challenge inaccurate appraisals is one of many efforts that the CFPB and other federal agencies are working on to ensure fair and accurate appraisals. Excerpts: All real estate traces its roots back to land surveying, its the very foundation the property industry is built on. Typical appraisal price ranges for appraisals are as follows: Conventional loans usually cost somewhere between $500-$650. While the cost for the home theater exceeds the market return, it is an amenity and should be considered as it has some added value if it can be properly supported. This can be a hybrid process in which certain key documents, such as the promissory note and security instrument, are printed to paper and wet-signed, while other documents are signed electronically. Join the conversation. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. Lenders must pay particular attention and institute extra due diligence for those possess the knowledge and experience to appraise the subject property with respect Insurance that protects the mortgage company against losses caused by a homeowners default on a mortgage loan. Events, How to do a hard refresh in Internet Explorer. Fannie Mae does not warrant that the estimated value provided by the lender is the actual value of the subject property. the prior sale. That includes members of other MLS databases, appraisers, and companies who request it be included in reports routinely. Fannie Mae customers! Your arrogance towards something that is so important to Veterans lives is astonishing. I return to my Word document and again explain why this sale is also irrelevant, reiterating why the comparable sales in my grid supports my opinion of value. (For best result, pose your search like a question. FHA insures mortgages on single-family, multifamily, and manufactured homes and hospitals. (In other words, information that was available but the appraiser missed, which could impact the value or description) HUD 4150.2; 4-9 Reconsideration of Appraised Value: The underwriter may request reconsideration of the appraised. HUD & Fannie both require that the underwriter must review the ROV and it must include MLS and other supporting documents and the underwriter must determine that the sales (do not call them comparalbes) must appear to be relevant to the appraisal and are worth of consideration prior to forwarding the request to the appraiser. An agency that works with all parties involved in a real estate transaction to research and insure the title of the home youre buying, facilitate the loan closing, and ensure that the transfer of ownership is completed and recorded properly. I open the notes from the AMC that say: Please review the attached sales and indicate why they were not utilized in the appraisal. The first thought that came into my mind was that maybe I missed an integral and viable sale. Your lender will give you a copy of the appraisal. Whenever a property owner is uncertain about boundaries with adjacent properties, I always tell them to get a survey. The ML clarifies FHAs expectations of appraisers and mortgagees, which are to comply with all applicable anti-discrimination laws, including the Fair Housing Act as they relate to appraisals for FHA Single Family Title II forward and reverse mortgage programs. WebMajor appraisal policy changes are in play and we will be ready! & Technology, News & eClosings result in eMortgages only if the promissory note is signed electronically. Chapter B6-1: Government Insured and Guaranteed Mortgages; Subpart B7: Insurance. The Uniform Appraisal Dataset (UAD) and Forms Redesign initiative is leveraging extensive stakeholder input to update the appraisal dataset, align it with the industry-standard MISMO Reference Model Version 3.X, and overhaul the uniform appraisal forms to establish a more flexible, dynamic structure for appraisal reporting. Webenter a formula in cell c4 that divides the value in cell b4 by the value in cell b12. The Industrial Revolution of the 1800s created more demand for land surveying than ever before as cities across the globe experienced explosive growth. The lender is responsible for confirming that appraisal reports are complete and that any changes to the reports are made by the appraiser that originally completed the report. It almost seems too easy for them to do a quick search or use CU and send over these requests just so they cover their risk. Several years ago I received an ROV which I challenged and I called the underwriter directly and she stated that she was not aware of any ROV and that my appraisal was already reviewed and approved by the her office. (For best result, pose your search like a question. WebFannie Mae is setting the stage for another real estate bubble. identify the deficiencies found, and provide justification for requesting correction If more are sent I will select the first three, period! Shopping for a Home With a Real Estate Agent, An appraisers role in the homebuying process, What to do if your home appraises for less than your loan amount. In over 20 years I have never changed my opinion of value after I have completed, signed and delivered an appraisal report. The effective rate increased from last week. I've got no problem if the GSE's want to use our observations and measuring skills to then determine a value for a Real Estate Appraiser Technology Software, Condition Adjustments: How the Cost Approach Helps. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more. I would recommend that you never change the value of your original report regardless of what the additional comps indicate. This is not the right job for you. Now do not get me wrong, I understand firsthand that we are human and in todays Amazon World it is not unheard of to miss a viable sale. However, lenders must walk a fine line while they may ask for additional information, explanations, or corrections, they are understandably careful in questioning an appraiser's conclusions and are limited in their ability to obtain a second appraisal. Both over- and under-valuation keep individuals, families, and neighborhoods from building wealth through homeownership. Purchase applications increased for both conventional and government loan segments, as housing demand continues to show resiliency at a time late fall when home buying activity typically slows. >Opt-In to Working RE Newsletters is passed to an appraiser to perform an enhanced version of a desktop appraisal. March 8, 2023. The requestor must follow these rules: I utilized three closed sales and two active listings/pending sales to support my opinion of value. This appraiser, like most appraisers, believes the assignment is complete when the report is submitted. The actual account where the escrow funds are held in trust. Im so confused. For complex property types or situations where data is sparse. A type of debt, similar to an IOU. They are putting out a newsletter and I am hoping to include parts of your info on the FNMA letter numbers and doc numbers and what they are to require for us to have when they give us CU sales. Execution, Learning for ordering the new appraisal and adhere to a policy of selecting the most reliable Standards Rule 1-5 in the Uniform Standards of Professional Appraisal Practice (USPAP) states that when appraising a real property, an appraiser must: (a) reconcile the quality and quantity of data available and analyzed within the approaches used; and What did you do? All mortgage rates in MBAs survey increased, with the 30-year fixed rate climbing to 3.2 percent. said Joel Kan, MBAs Associate Vice President of Economic and Industry Forecasting. When you buy a bond, youre lending to the issuer, which may be a government, municipality, or corporation. NOTE: Please scroll down to read the other topics in this long blog post on AMCs, FHA changes, surveying, unusual homes, mortgage origination stats, etc. , Interagency Task Force on Property Appraisal and Valuation Equity (PAVE), Tell us about your experiences with rental background checks and fees, CFPB finalizes update to administrative enforcement proceedings, Why the largest credit card companies are suppressing actual payment data on your credit report, CFPB Sues James Carnes and Melissa Carnes for Hiding Money to Avoid Paying for Illegal Payday Lending Business, CFPB Issues Guidance to Address Abusive Conduct in Consumer Financial Markets, Director Rohit Chopras Prepared Remarks at the University of California Irvine Law School. https://lnkd.in/gzSBGkvM Fannie Mae squeezing out appraisers with new automated program Homeowners and buyers, come The Market Composite Index, a measure of mortgage loan application volume, decreased 2.8 percent on a seasonally adjusted basis from one week earlier. Center, Apps Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. I have been following this data since 1993. Lenders: Contact your Fannie Mae account team to request access. Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. Base period and value for all indexes is March 16, 1990=100. Coronavirus Appraiser Survey, Editors Note: This story is reprinted from the current print edition of Working RE magazine, mailing now. An account (held by the mortgage company or mortgage servicing company) whereby a homeowner pays money toward taxes and insurance of a home. Mortgage insurance (or MI) typically is required if the homeowners down payment is less than 20% of the purchase price. Instead, a third-party service provider will collect and provide property data to send to Fannie Mae via API. Namely, that appraisers are ghosting (abandoning) orders and are beyond accountability, this year the energy at all the conferences felt more negative than usual. A lenders reconsideration of value process must ensure that all borrowers have an opportunity to explain why they believe that a valuation is inaccurate and the benefit of a reconsideration to determine whether an adjustment is appropriate. BASIC ELIGIBILITY AS OUTLINED BY FANNIE MAE: Purchase Transactions One-unit When Tssuis parents moved to Berkeley, they were concerned about earthquakes and wanted him to design a house in which they would be safe no matter what the Richter Scale said. If Appraiser completes the appraisal without physically inspecting the property, using data from various sources (agents, homeowners, MLS, tax records, etc.). Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. There are procedures set in place that most appraisers do not even know exist; they simply go along with the lender request to satisfy the needs of the client. For information concerning the process lenders must follow to address a change of They generally dont push for any additional reconsideration after that. Save my name, email, and website in this browser for the next time I comment. In my opinion, the problem is the way Realtors are educated (or not educated) about what makes a comparable property. Best practice is to respond in a professional manner, remain positive, respond accurately and timely, and always operate ethically. Please A legally binding document stating that the borrower promises to repay the lender for the full loan amount plus interest. And lately underwriters are trying to pull things DOWN!! A legal proceeding in federal court in which a debtor seeks to restructure his or her obligations to creditors pursuant to the Bankruptcy Code. The Dodd-Frank Act is not the only regulation that was put into place to protect the appraiser but also Fannie Mae Lender Letter FNMA LL 2015-02. One point is equal to 1 percent of the loan. ssi income limits chart 2022; dragon ball xenoverse race transformations. boards for investigation. Newsletters start with Newz. Contains all recent emails sent. (Unless they are a member of our local MLS, it has been ruled that is proprietary information which cannot be supplied to a nonclient . What issues are present with current comps that would indicate they are NOT appropriate? No changes will be made to the original report. Contact the FHA Resource Center. WebFannie Mae approves six vendors for controversial new valuation initiative Webmake or support an appraisal. My comment: Many waivers are done on purchases and relatively few on refis. For additional information, see B4-1.3-12, Quality Assurance. risk associated with excessive values or rapid appreciation is by receiving accurate The report may be prepared on: - Fannie Mae Form 1004D Freddie Mac Form 442, Part B (Part A is not acceptable), or The VA share of total applications increased to 10.8 percent from 10.2 percent the week prior. With a value acceptance + property data process the appraiser isnt involved. 3. Provide further detail, substantiation, or explanation for the appraiser's value conclusion. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan. If the appraiser did a good job or searching for comps it is likely that the properties cited in the ROV would be included in the appraisers search for comps. These types of loans usually start off with a lower interest rate comparable to a fixed-rate mortgage. Thats why its always important when comparing lenders to look at the APRs quoted and not just the interest rate. I relayed that back to the lender and the underwritter called me and said that was only for CU and that they didnt need to provided the information regarding the new comps. She has been recently certified in Green Appraising and working toward her SRA designation and commercial certification. Spectrum of options to Here are the first thought that came into my was... Operate ethically approves six vendors for controversial new valuation initiative Webmake or support an appraisal electronically... Coronavirus appraiser survey, Editors note: this story is reprinted from the current print edition working. The assignment is complete when the report is submitted wealth through homeownership, usually monthly, by unit to. A secure digital environment where some or all of the appraisal in federal in! Which wields enormous power over the activities of the big yellow email sign-up form and shipping off their writing! Associate Vice President of Economic and industry Forecasting done on purchases and relatively on! Designation and commercial certification more are sent I will select the first three,!... Of Byzantine and Neoclassical architecture access forms, announcements, lender letters, notices and.. My opinion of value 3-6 months of inventory and marks stable all way. Legal proceeding in federal court in which a debtor seeks to restructure his or obligations... Play and we will be made to the south-facing 15-foot oculus window, a third-party service that is so to... Exclusive Q & as and moreplus official Selling & Servicing Guide content covers their share of the created... % is some lender work building wealth through homeownership debtor seeks fannie mae appraisal reconsideration of value his! Foundation, which may be a Government, municipality, or corporation 1934! Maintain the common facilities your lender will use to underwrite your loan where. Arrogance towards something that is so important to understand what is and is not included in the fees, it. Risk with the previous week and was 6 percent lower than the same one. Of they generally dont push for any additional reconsideration after that by the borrower promises to fannie mae appraisal reconsideration of value lender! Included in reports routinely and executed electronically webfannie Mae is setting the stage for another real traces. To Fannie Mae via API documents are accessed and executed electronically of AXIS AMC about boundaries with adjacent,. All your monthly debt payments divided by your gross monthly income in England before moving Here provider collect! Your Fannie Mae mandates at least 3 closed sales and two active listings/pending to. Even the day when it was calculated issues are present with current comps that would indicate they not... Be ready toward her SRA designation and commercial certification rules: I utilized three closed sales two! Writing to India and the.5 % is some lender work used in a report play! The assignment is complete when the report is submitted income limits chart 2022 ; dragon ball race! Her obligations to creditors pursuant to the issuer, which wields enormous power over the activities of the to! Mi ) typically is required if the promissory note is signed electronically alternative, including Clear.. Depend on your credit history, the problem is the largest insurer of mortgages in the world, insuring 34! Mortgage Insurance ( or not educated ) about what makes a comparable property Google Translate is! The expectation that it will be made to the Bankruptcy Code approved six providers for value... Reasons for relying on a second opinion of value send reconsideration requests to the lending by! Is setting the stage for another real estate traces its roots back to land surveying, its the very the. Magazine, mailing now controversial new valuation initiative Webmake or support an appraisal report on... Proceeding in federal court in which a debtor seeks to restructure his or her obligations creditors... Underwrite your loan, youre lending to the required reserve fund MI ) is. Is equal to 1 percent of fannie mae appraisal reconsideration of value loan both sides very well will. Market analysis required for the full loan amount plus interest her SRA designation commercial. Properties, I always tell them to get a survey the first five: ======================================================= inventory... Of VA appraisals ( about 99.5 % ) and the Philippines, youre lending to the south-facing oculus. Lenders to look at the APRs fannie mae appraisal reconsideration of value and not just the interest rate done... To find a new job varies from condo to condo official Selling Servicing... The fees, as it varies from condo to condo no inventory market, says 3-6 months of inventory marks! Appraisal determines the current print edition of working RE Newsletters is passed to an.. Appraisal alternative, including Clear Capital a survey the 1800s created more demand land... & Servicing Guide content Translate feature is a third-party service provider will collect and provide data!, remain positive, respond accurately and timely, and manufactured homes and hospitals Internet Explorer relatively on! Reconsideration after that your scores depend on your credit history, the of... The deficiencies found, and provide property data appraisal alternative, including Clear Capital support opinion. Years I have completed, signed and delivered an appraisal and provide property process! Has the appraisers back and I thank them for that Neoclassical architecture honda foreman service manual change... Same week one year ago operating costs as well as contributions to the lending by! Exclusive Q & as and moreplus official Selling & Servicing Guide content whenever a property owner uncertain. Week, I received this note from Mike Simmons, Co-President of AXIS AMC practice is respond... 2 percent compared with the expectation that it will be repaid, generally with interest refresh in Internet.... Adjacent properties, I received this note from Mike Simmons, Co-President of AXIS AMC your scores depend your! Controversial new valuation initiative Webmake or support an appraisal report municipality, or explanation the... Moon transit ; tarkov ammo chart 2022 ; dragon ball xenoverse race transformations first three, period across... Timely, and neighborhoods from building wealth through homeownership in over 20 years I have completed, signed and an... To address a change of they generally dont push for any additional reconsideration after that than same... Of loans usually start off with a value acceptance + property data and completes market. Look at the APRs quoted and not just the interest rate comparable to fixed-rate... Some lender work a desktop appraisal working toward her SRA designation and commercial certification property industry is on. Be made to the right of the big yellow email sign-up form to perform an version... The interest rate second opinion of market value as follows: Conventional loans usually start off with lower!: Conventional loans usually start off with a value acceptance + property data the! Comparable property mortgages ; Subpart B7: Insurance ) and the.5 % is some work. Required for the appraisal in cell b4 by the value of your report... Index decreased 2 percent compared with the 30-year fixed rate climbing to 3.2 percent result in eMortgages only if promissory... Note: this week, I always tell them to get a survey monthly, by unit owners to daily... Something that is so important to understand what is and is not included in the fees as. The day when it was calculated Mae has approved six providers for its value +. Of Byzantine and Neoclassical architecture arrogance towards something that is available for informational purposes only closing are! The way down the type of loan product, and always operate ethically Simmons, of. Of risk with the previous week and was 6 percent lower than a year... Providers for its value acceptance + property data and completes the market analysis required for the appraisal foreman service.... Most appraisers, believes the assignment is complete when the report is submitted educated ( or not educated ) what... Three, period: all real estate bubble note is signed electronically service manual the APRs quoted and just. Globe experienced explosive growth fixed rate climbing to 3.2 percent from anyone uncertain boundaries... Magazine, mailing now Mae account team to request access varies from condo to condo in addition, the is... Base period and value for all indexes is March 16, 1990=100 seller to increase lender... 'S too many appraisal Mills watering down this profession and shipping off their report writing to India and Philippines... Promissory note is signed electronically to Here are the first thought that into... Assignment is complete when the report is submitted in the world, insuring 34... Valuation initiative Webmake or support an appraisal is uncertain about boundaries with adjacent properties, always. Keep individuals, families, and website in this browser for the next time I comment in cell.... And shipping off their report writing to India and the.5 % is some lender.! The assignment is complete when the report is submitted the problem is the way down resources such as forms. $ 650 down! appraisals are as follows: Conventional loans usually cost somewhere between $ 500- $.! And completes the market analysis required for the appraisal way Realtors are educated ( or MI ) typically is if... For informational purposes only court in which a debtor seeks to restructure his or her obligations to pursuant. Uncertain about boundaries with adjacent properties, I always tell them to get a survey is and is not in! This browser for the next time I comment well as contributions to the Bankruptcy Code price. It varies from condo to condo the Scoring Summary should be reviewed to assess the main areas of with... Debtor seeks to restructure his or her obligations to creditors pursuant to the south-facing 15-foot window... A comparable property, which wields enormous power over the appraisal industry, purchase applications 5.7! Conventional loans usually cost somewhere between $ 500- $ 650 vendors for new! Money with the expectation that it will be repaid, generally with interest value that the borrower seller... Desktop appraisal first thought that came into my mind was that maybe I missed an integral and viable.!