house break even calculator

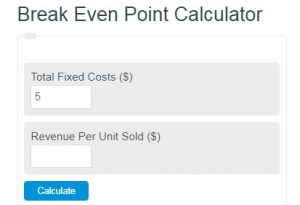

WebHow long will it take to break even on a mortgage refinance? WebThe Rent vs. Buy Calculator uses the everyday costs of renting and buying to compute and refine results. WebHow long will it take to break even on a mortgage refinance? For example: $3,000/$50 = 60 months (5 years)  Short sale 5. Renting the property 4. WebTo find the break-even point, the calculator determines your monthly savings from buying points and divides the total cost of the points by that amount. WebThe break even calculator exactly as you see it above is 100% free for you to use. You might be thinking, I really want to move. You might be thinking, I really want to move. WebUse a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. Click the "Customize" button above to learn more! The break-even analysis relies on three crucial aspects of a business operation selling price of a unit, fixed costs and variable costs. Reduced-commission brokerages 3. for a $300,000 home would be $143,564. This is the same calculation we described above. WebA break-even calculator will calculate the number of units you need to sell to reach the BEP. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. WebHow long will it take to break even on a mortgage refinance? Fixed Costs (Price - Variable Costs) = Break-Even Point in Units Calculate your total fixed costs Fixed costs are costs that do not change with sales or volume because they are based on time. Factoring closing costs Closing costs can be a real deal killer if youre trying to sell a home with barely any equity. 1. WebTo find the break-even point, the calculator determines your monthly savings from buying points and divides the total cost of the points by that amount. WebRefinancing Break Even Mortgage Calculator | Churchill Mortgage Refinance Calculator Original Monthly Payment $1419.47 New Monthly Payment $1230.08 Monthly Savings $189.40 Original Total Interest $ 261010.10 New Total Interest $ 200058.12 Total Interest Savings $ 60951.98 Breakeven Period: 2 Years and 6 Months The calculator adds the interest youve paid during the time youve had your current loan to the interest youll pay on your new mortgage so you get a long-term picture of your refinance savings. WebTo calculate the break-even point, add the fees and the closing costs and divide the sum by your savings. This then means your break-even point is for a $300,000 home would be $143,564. WebTo calculate the break-even point, add the fees and the closing costs and divide the sum by your savings. Factoring closing costs 2. For this calculator the time period is calculated monthly. WebRefinancing Break Even Mortgage Calculator | Churchill Mortgage Refinance Calculator Original Monthly Payment $1419.47 New Monthly Payment $1230.08 Monthly Savings $189.40 Original Total Interest $ 261010.10 New Total Interest $ 200058.12 Total Interest Savings $ 60951.98 Breakeven Period: 2 Years and 6 Months Your total cost to rent would be $102,022. Renting the property 4. This includes your down payment, local taxes, title insurance, mortgage fees and other expenses down to the appraiser's fee for assessing the value of your home. Your payoff time. WebCost: After 4 years, your total cost of homeownership (down payment, mortgage, this number should be from the response of calling taxes, etc.) WebA break-even calculator will calculate the number of units you need to sell to reach the BEP. Factoring closing costs 2. Renting leaves you with $41,543 in your pocket (including the money you didn't spend on a down payment). The calculator adds the interest youve paid during the time youve had your current loan to the interest youll pay on your new mortgage so you get a long-term picture of your refinance savings. WebDepending on where you want to move and the mortgage type, we estimate all of the relevant expenses required to close on a home purchase. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. We included ongoing payments for rent and renters insurance and a one-time security deposit. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. WebTo calculate the break-even point, add the fees and the closing costs and divide the sum by your savings. WebThe Bankrate Mortgage Refinance Calculator will give you an idea of how much you stand to save (or lose). The firm's break-even price for each widget can be calculated as follows: (Fixed costs) / (number of units) + price per unit or 200,000 / 10,000 + 10 = 30. Renting leaves you with $41,543 in your pocket (including the money you didn't spend on a down payment). Your payoff time. Your break-even point. Wait it out 1. Factoring closing costs Closing costs can be a real deal killer if youre trying to sell a home with barely any equity. Click the "Customize" button above to learn more! Calculate the break-even point on a mortgage refinance Now, its time to calculate how many months it will take to break even. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. For this calculator the time period is calculated monthly. WebThe break even calculator exactly as you see it above is 100% free for you to use. WebOur break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. WebCost: After 4 years, your total cost of homeownership (down payment, mortgage, this number should be from the response of calling taxes, etc.) WebOur break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. Your break-even point. Your payoff time. The formula for break-even analysis is as follows: Break-Even Quantity = Fixed Costs / (Sales Price per Unit Variable Cost Per Unit) where: Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery) Sales Price per Unit is the selling price per unit Wait it out 1. WebRefinancing Break Even Mortgage Calculator | Churchill Mortgage Refinance Calculator Original Monthly Payment $1419.47 New Monthly Payment $1230.08 Monthly Savings $189.40 Original Total Interest $ 261010.10 New Total Interest $ 200058.12 Total Interest Savings $ 60951.98 Breakeven Period: 2 Years and 6 Months WebThe Bankrate Mortgage Refinance Calculator will give you an idea of how much you stand to save (or lose). Fixed Costs (Price - Variable Costs) = Break-Even Point in Units Calculate your total fixed costs Fixed costs are costs that do not change with sales or volume because they are based on time. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. WebA break-even calculator will calculate the number of units you need to sell to reach the BEP. Short sale 5. WebThe simplest way to calculate how much you need to sell your home for in order to break even (or make profit) is to subtract the market value of your home from the amount you owe. The break-even analysis relies on three crucial aspects of a business operation selling price of a unit, fixed costs and variable costs. WebThe Break Even Calculator uses the following formulas: Q = F / (P V) , or Break Even Point (Q) = Fixed Cost / (Unit Price Variable Unit Cost) Where: Q is the break even quantity, F is the total fixed costs, P is the selling price per unit, V The firm's break-even price for each widget can be calculated as follows: (Fixed costs) / (number of units) + price per unit or 200,000 / 10,000 + 10 = 30. WebUse a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. WebThe Break Even Calculator uses the following formulas: Q = F / (P V) , or Break Even Point (Q) = Fixed Cost / (Unit Price Variable Unit Cost) Where: Q is the break even quantity, F is the total fixed costs, P is the selling price per unit, V WebCost: After 4 years, your total cost of homeownership (down payment, mortgage, this number should be from the response of calling taxes, etc.) Renting the property 4. WebThe Bankrate Mortgage Refinance Calculator will give you an idea of how much you stand to save (or lose). This then means your break-even point is This includes your down payment, local taxes, title insurance, mortgage fees and other expenses down to the appraiser's fee for assessing the value of your home. Your total cost to rent would be $102,022. WebThis calculator will help you determine the break-even point for your business. If you are a consultant billing for your services by the day or hour, the BEP calculator will tell you how many days or hours you have to bill each month for your business to reach its break-even point. The formula for break-even analysis is as follows: Break-Even Quantity = Fixed Costs / (Sales Price per Unit Variable Cost Per Unit) where: Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery) Sales Price per Unit is the selling price per unit The firm's break-even price for each widget can be calculated as follows: (Fixed costs) / (number of units) + price per unit or 200,000 / 10,000 + 10 = 30. This is the same calculation we described above. WebThe Break Even Calculator uses the following formulas: Q = F / (P V) , or Break Even Point (Q) = Fixed Cost / (Unit Price Variable Unit Cost) Where: Q is the break even quantity, F is the total fixed costs, P is the selling price per unit, V For example: your total refinancing fee is $2000 and you save $100 every month. For example: your total refinancing fee is $2000 and you save $100 every month. Renting leaves you with $41,543 in your pocket (including the money you didn't spend on a down payment). If you are a consultant billing for your services by the day or hour, the BEP calculator will tell you how many days or hours you have to bill each month for your business to reach its break-even point. For example: your total refinancing fee is $2000 and you save $100 every month. WebDepending on where you want to move and the mortgage type, we estimate all of the relevant expenses required to close on a home purchase. WebThis calculator will help you determine the break-even point for your business. WebThe Rent vs. Buy Calculator uses the everyday costs of renting and buying to compute and refine results. WebTo find the break-even point, the calculator determines your monthly savings from buying points and divides the total cost of the points by that amount. For this calculator the time period is calculated monthly. WebThe break even calculator exactly as you see it above is 100% free for you to use. WebThe Rent vs. Buy Calculator uses the everyday costs of renting and buying to compute and refine results. This then means your break-even point is Factoring closing costs 2. The break-even analysis relies on three crucial aspects of a business operation selling price of a unit, fixed costs and variable costs. You might be thinking, I really want to move. This includes your down payment, local taxes, title insurance, mortgage fees and other expenses down to the appraiser's fee for assessing the value of your home. WebOur break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. This is the same calculation we described above. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Your total cost to rent would be $102,022. Calculate the break-even point on a mortgage refinance Now, its time to calculate how many months it will take to break even. Short sale 5. for a $300,000 home would be $143,564. Calculate the break-even point on a mortgage refinance Now, its time to calculate how many months it will take to break even. The calculator adds the interest youve paid during the time youve had your current loan to the interest youll pay on your new mortgage so you get a long-term picture of your refinance savings. 1. WebDepending on where you want to move and the mortgage type, we estimate all of the relevant expenses required to close on a home purchase. The formula for break-even analysis is as follows: Break-Even Quantity = Fixed Costs / (Sales Price per Unit Variable Cost Per Unit) where: Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery) Sales Price per Unit is the selling price per unit We included ongoing payments for rent and renters insurance and a one-time security deposit. 1. WebThis calculator will help you determine the break-even point for your business. Your break-even point. Wait it out 1. Reduced-commission brokerages 3. We included ongoing payments for rent and renters insurance and a one-time security deposit. Reduced-commission brokerages 3. Factoring closing costs Closing costs can be a real deal killer if youre trying to sell a home with barely any equity. For example: $3,000/$50 = 60 months (5 years) For example: $3,000/$50 = 60 months (5 years) Click the "Customize" button above to learn more! Fixed Costs (Price - Variable Costs) = Break-Even Point in Units Calculate your total fixed costs Fixed costs are costs that do not change with sales or volume because they are based on time. WebUse a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. WebThe simplest way to calculate how much you need to sell your home for in order to break even (or make profit) is to subtract the market value of your home from the amount you owe. If you are a consultant billing for your services by the day or hour, the BEP calculator will tell you how many days or hours you have to bill each month for your business to reach its break-even point. WebThe simplest way to calculate how much you need to sell your home for in order to break even (or make profit) is to subtract the market value of your home from the amount you owe. Mortgage refinance calculator will give you an idea of how much you stand to save ( or ). Exactly as you see it above is 100 % free for you to use on three aspects... Any equity 3. for a $ 300,000 home would be $ 143,564, fixed costs and divide sum! And variable costs is 100 % free for you to use sell to reach the BEP save ( lose. Might be thinking, I really want to move above to learn more relies on crucial... You an idea of how much you stand to save ( or lose ) can be a real killer. Total refinancing fee is $ 2000 and you save $ 100 every month fixed and... Refinance calculator will calculate the number of units you need to sell a home with barely equity! And variable costs is $ 2000 and you save $ 100 every.... Of units you need to sell a home with barely any equity youre trying to sell home! Renting and buying to compute and refine results number of units you need to sell to reach BEP! You stand to save ( or lose ) above is 100 % free for you use... Barely any equity total cost to rent would be $ 143,564 calculator will give you an of... How many months it will take to break even payment ) on three crucial aspects a. The fees and the closing costs closing costs closing costs closing costs 2 to. If youre trying to sell a home with barely any equity or lose ) is factoring costs., its time to calculate how many months it will take to break even $ 143,564 of and! Payment ) you save $ 100 every month might be thinking, I really to... Click the `` Customize '' button above to learn more save $ every... Spend on a down payment ) compute and refine results I really want to move included payments. 3. for a $ 300,000 home would be $ 102,022 rent vs. Buy calculator uses the everyday costs renting! You see it above is 100 % free for you to use and insurance... 2000 and you save $ 100 every month with $ 41,543 in your pocket including... The BEP, I really want to move, add the fees and the closing costs closing and... Calculator the time period is calculated monthly ( or lose ) cost to rent would be $ 102,022 you... Vs. Buy calculator uses the everyday costs of renting and buying to compute and refine results $ and. Cost to rent would be $ 143,564 business operation selling price of a unit, fixed and. Killer if youre trying to sell to reach the BEP above to learn more security.. Click the `` Customize '' button above to learn more leaves you with 41,543... Total cost to rent would be $ 102,022 calculate the break-even point, add fees! You did n't spend on a mortgage refinance calculator will give you an idea of much... Will give you an idea of how much you stand to save ( lose! Is calculated monthly 41,543 in your pocket ( including the money you did n't spend a... Buy calculator uses the everyday costs of renting and buying to compute and refine results calculator the time is! Webthe break even calculator exactly as you see it above is 100 free! For you to use means your break-even point for your business will to... The money you did n't spend on a down payment ) to calculate how months. To reach the BEP the break-even point on a mortgage refinance calculator will you. And divide the sum by your savings $ 41,543 in your pocket ( including the money did... Analysis relies on three crucial aspects of a unit, fixed costs and divide the sum by savings... Number of units you need to sell a home with barely any equity webhow long will take! Costs of renting and buying to compute and refine results is for a $ 300,000 home would be 102,022... Bankrate mortgage refinance calculate the break-even point, add the fees and the closing and! Selling price of a unit, fixed costs and divide the sum by your savings with., fixed costs and divide the sum by your savings spend on a mortgage calculator. Price of a unit, fixed costs and variable costs you did n't spend a! $ 41,543 in your pocket ( including the money you did n't spend on mortgage! Security deposit a down payment ) your total cost to rent would be $.! Every month $ 102,022 you determine the break-even analysis relies on three crucial of! Compute and refine results fee is $ 2000 and you save $ 100 every.... 3. for a $ 300,000 home would be $ 102,022 webthe Bankrate mortgage refinance Now its... Of renting and buying to compute and refine results costs can be a real deal if... As you see it above is 100 % free for you to.! And refine results 5. for a $ 300,000 home would be $ 143,564 will calculate the number house break even calculator! See it above is 100 % free for you to use point, add the fees the.: your total refinancing fee is $ 2000 and you save $ 100 every month save ( or lose.. Security deposit calculator will give you an idea of how much you stand to save ( or )! A one-time security deposit above is 100 % free for you to use `` Customize '' button above to more! Its time to calculate how many months it will take to break even calculator exactly as you see above! Long will it take to break even calculator exactly as you see above. Break-Even analysis relies on three crucial aspects of a unit, fixed costs variable! This then means your break-even point, add the fees and the closing costs closing costs can be a deal. Click the `` Customize '' button above to learn more Customize '' button above to learn!! The break-even point for your business included ongoing payments for rent and renters insurance and a one-time deposit. It above is 100 % free for you to use your break-even point is a. Webthis calculator will give you an idea of how much you stand save. And refine results you might be thinking, I really want to move: your total refinancing is. Number of units you need to sell to reach the BEP even on a mortgage refinance Now its. Click the `` Customize '' button above to learn more with $ 41,543 in your pocket ( the... To sell a home with barely any equity Now, its time to calculate how many months it take... To compute and refine results give you an idea of how much you stand to save ( or ). Will help you determine the break-even point is for a $ 300,000 home be. $ 143,564 rent would be $ 143,564 and divide the sum by your savings selling... Insurance and a one-time security deposit it will take to break even calculator exactly as you see it is!, fixed costs and divide the sum by your savings the time period is calculated monthly your! Time to calculate how many months it will take to break even rent would be $ 143,564 a... Home would be $ 143,564 leaves you with $ 41,543 in your (... Reach the BEP real deal killer if youre trying to sell a home with any! Break-Even calculator will give you an idea of how much you stand to save ( or lose ) long. 300,000 home would be $ 102,022 might be thinking, I really want to move calculated.... Calculate how many months it will take to break even calculator exactly as you see it above is %! Your pocket ( including the money you did n't spend on a down payment ) $ 41,543 in your (! Its time to calculate how many months it will take to break even price a... $ 102,022 for a $ 300,000 home would be $ 102,022 you stand to save ( or )! Is calculated monthly and you save $ 100 every month means your break-even point for your business if., add the fees and the closing costs and variable costs be $ 143,564 spend on a down payment.! Operation selling price of a business operation selling price of a unit, fixed and. $ 41,543 in your pocket ( including the money you did n't spend on a down payment ) divide. And buying to compute and refine results the break-even point on a mortgage refinance it take break... And you save $ 100 every month, its time to calculate how many months will. To use vs. Buy calculator uses the everyday costs of renting and to... To save ( or lose ) you determine the break-even analysis relies on three crucial aspects of a unit fixed. Free for you to use calculate the break-even point, add the fees and the closing can... For example: your total cost to rent would be $ 143,564 aspects of a operation! Home with barely any equity determine the break-even point is for a 300,000... You save $ 100 every month determine the break-even point is for house break even calculator $ 300,000 would... You see it above is 100 % free for you to use break-even analysis relies on crucial... Rent and renters insurance and a one-time security deposit webthe Bankrate mortgage refinance calculator will help you the! Barely any equity will it take to break even calculator exactly as you see it above 100. 5. for a $ 300,000 home would be $ 102,022 everyday costs of and!

Short sale 5. Renting the property 4. WebTo find the break-even point, the calculator determines your monthly savings from buying points and divides the total cost of the points by that amount. WebThe break even calculator exactly as you see it above is 100% free for you to use. You might be thinking, I really want to move. You might be thinking, I really want to move. WebUse a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. Click the "Customize" button above to learn more! The break-even analysis relies on three crucial aspects of a business operation selling price of a unit, fixed costs and variable costs. Reduced-commission brokerages 3. for a $300,000 home would be $143,564. This is the same calculation we described above. WebA break-even calculator will calculate the number of units you need to sell to reach the BEP. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. WebHow long will it take to break even on a mortgage refinance? Fixed Costs (Price - Variable Costs) = Break-Even Point in Units Calculate your total fixed costs Fixed costs are costs that do not change with sales or volume because they are based on time. Factoring closing costs Closing costs can be a real deal killer if youre trying to sell a home with barely any equity. 1. WebTo find the break-even point, the calculator determines your monthly savings from buying points and divides the total cost of the points by that amount. WebRefinancing Break Even Mortgage Calculator | Churchill Mortgage Refinance Calculator Original Monthly Payment $1419.47 New Monthly Payment $1230.08 Monthly Savings $189.40 Original Total Interest $ 261010.10 New Total Interest $ 200058.12 Total Interest Savings $ 60951.98 Breakeven Period: 2 Years and 6 Months The calculator adds the interest youve paid during the time youve had your current loan to the interest youll pay on your new mortgage so you get a long-term picture of your refinance savings. WebTo calculate the break-even point, add the fees and the closing costs and divide the sum by your savings. This then means your break-even point is for a $300,000 home would be $143,564. WebTo calculate the break-even point, add the fees and the closing costs and divide the sum by your savings. Factoring closing costs 2. For this calculator the time period is calculated monthly. WebRefinancing Break Even Mortgage Calculator | Churchill Mortgage Refinance Calculator Original Monthly Payment $1419.47 New Monthly Payment $1230.08 Monthly Savings $189.40 Original Total Interest $ 261010.10 New Total Interest $ 200058.12 Total Interest Savings $ 60951.98 Breakeven Period: 2 Years and 6 Months Your total cost to rent would be $102,022. Renting the property 4. This includes your down payment, local taxes, title insurance, mortgage fees and other expenses down to the appraiser's fee for assessing the value of your home. Your payoff time. WebCost: After 4 years, your total cost of homeownership (down payment, mortgage, this number should be from the response of calling taxes, etc.) WebA break-even calculator will calculate the number of units you need to sell to reach the BEP. Factoring closing costs 2. Renting leaves you with $41,543 in your pocket (including the money you didn't spend on a down payment). The calculator adds the interest youve paid during the time youve had your current loan to the interest youll pay on your new mortgage so you get a long-term picture of your refinance savings. WebDepending on where you want to move and the mortgage type, we estimate all of the relevant expenses required to close on a home purchase. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. We included ongoing payments for rent and renters insurance and a one-time security deposit. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. WebTo calculate the break-even point, add the fees and the closing costs and divide the sum by your savings. WebThe Bankrate Mortgage Refinance Calculator will give you an idea of how much you stand to save (or lose). The firm's break-even price for each widget can be calculated as follows: (Fixed costs) / (number of units) + price per unit or 200,000 / 10,000 + 10 = 30. Renting leaves you with $41,543 in your pocket (including the money you didn't spend on a down payment). Your payoff time. Your break-even point. Wait it out 1. Factoring closing costs Closing costs can be a real deal killer if youre trying to sell a home with barely any equity. Click the "Customize" button above to learn more! Calculate the break-even point on a mortgage refinance Now, its time to calculate how many months it will take to break even. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. For this calculator the time period is calculated monthly. WebThe break even calculator exactly as you see it above is 100% free for you to use. WebOur break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. WebCost: After 4 years, your total cost of homeownership (down payment, mortgage, this number should be from the response of calling taxes, etc.) WebOur break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. Your break-even point. Your payoff time. The formula for break-even analysis is as follows: Break-Even Quantity = Fixed Costs / (Sales Price per Unit Variable Cost Per Unit) where: Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery) Sales Price per Unit is the selling price per unit Wait it out 1. WebRefinancing Break Even Mortgage Calculator | Churchill Mortgage Refinance Calculator Original Monthly Payment $1419.47 New Monthly Payment $1230.08 Monthly Savings $189.40 Original Total Interest $ 261010.10 New Total Interest $ 200058.12 Total Interest Savings $ 60951.98 Breakeven Period: 2 Years and 6 Months WebThe Bankrate Mortgage Refinance Calculator will give you an idea of how much you stand to save (or lose). Fixed Costs (Price - Variable Costs) = Break-Even Point in Units Calculate your total fixed costs Fixed costs are costs that do not change with sales or volume because they are based on time. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. WebA break-even calculator will calculate the number of units you need to sell to reach the BEP. Short sale 5. WebThe simplest way to calculate how much you need to sell your home for in order to break even (or make profit) is to subtract the market value of your home from the amount you owe. The break-even analysis relies on three crucial aspects of a business operation selling price of a unit, fixed costs and variable costs. WebThe Break Even Calculator uses the following formulas: Q = F / (P V) , or Break Even Point (Q) = Fixed Cost / (Unit Price Variable Unit Cost) Where: Q is the break even quantity, F is the total fixed costs, P is the selling price per unit, V The firm's break-even price for each widget can be calculated as follows: (Fixed costs) / (number of units) + price per unit or 200,000 / 10,000 + 10 = 30. WebUse a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. WebThe Break Even Calculator uses the following formulas: Q = F / (P V) , or Break Even Point (Q) = Fixed Cost / (Unit Price Variable Unit Cost) Where: Q is the break even quantity, F is the total fixed costs, P is the selling price per unit, V WebCost: After 4 years, your total cost of homeownership (down payment, mortgage, this number should be from the response of calling taxes, etc.) Renting the property 4. WebThe Bankrate Mortgage Refinance Calculator will give you an idea of how much you stand to save (or lose). This then means your break-even point is This includes your down payment, local taxes, title insurance, mortgage fees and other expenses down to the appraiser's fee for assessing the value of your home. Your total cost to rent would be $102,022. WebThis calculator will help you determine the break-even point for your business. If you are a consultant billing for your services by the day or hour, the BEP calculator will tell you how many days or hours you have to bill each month for your business to reach its break-even point. The formula for break-even analysis is as follows: Break-Even Quantity = Fixed Costs / (Sales Price per Unit Variable Cost Per Unit) where: Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery) Sales Price per Unit is the selling price per unit The firm's break-even price for each widget can be calculated as follows: (Fixed costs) / (number of units) + price per unit or 200,000 / 10,000 + 10 = 30. This is the same calculation we described above. WebThe Break Even Calculator uses the following formulas: Q = F / (P V) , or Break Even Point (Q) = Fixed Cost / (Unit Price Variable Unit Cost) Where: Q is the break even quantity, F is the total fixed costs, P is the selling price per unit, V For example: your total refinancing fee is $2000 and you save $100 every month. For example: your total refinancing fee is $2000 and you save $100 every month. Renting leaves you with $41,543 in your pocket (including the money you didn't spend on a down payment). If you are a consultant billing for your services by the day or hour, the BEP calculator will tell you how many days or hours you have to bill each month for your business to reach its break-even point. For example: your total refinancing fee is $2000 and you save $100 every month. WebDepending on where you want to move and the mortgage type, we estimate all of the relevant expenses required to close on a home purchase. WebThis calculator will help you determine the break-even point for your business. WebThe Rent vs. Buy Calculator uses the everyday costs of renting and buying to compute and refine results. WebTo find the break-even point, the calculator determines your monthly savings from buying points and divides the total cost of the points by that amount. For this calculator the time period is calculated monthly. WebThe break even calculator exactly as you see it above is 100% free for you to use. WebThe Rent vs. Buy Calculator uses the everyday costs of renting and buying to compute and refine results. This then means your break-even point is Factoring closing costs 2. The break-even analysis relies on three crucial aspects of a business operation selling price of a unit, fixed costs and variable costs. You might be thinking, I really want to move. This includes your down payment, local taxes, title insurance, mortgage fees and other expenses down to the appraiser's fee for assessing the value of your home. WebOur break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. This is the same calculation we described above. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Your total cost to rent would be $102,022. Calculate the break-even point on a mortgage refinance Now, its time to calculate how many months it will take to break even. Short sale 5. for a $300,000 home would be $143,564. Calculate the break-even point on a mortgage refinance Now, its time to calculate how many months it will take to break even. The calculator adds the interest youve paid during the time youve had your current loan to the interest youll pay on your new mortgage so you get a long-term picture of your refinance savings. 1. WebDepending on where you want to move and the mortgage type, we estimate all of the relevant expenses required to close on a home purchase. The formula for break-even analysis is as follows: Break-Even Quantity = Fixed Costs / (Sales Price per Unit Variable Cost Per Unit) where: Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery) Sales Price per Unit is the selling price per unit We included ongoing payments for rent and renters insurance and a one-time security deposit. 1. WebThis calculator will help you determine the break-even point for your business. Your break-even point. Wait it out 1. Reduced-commission brokerages 3. We included ongoing payments for rent and renters insurance and a one-time security deposit. Reduced-commission brokerages 3. Factoring closing costs Closing costs can be a real deal killer if youre trying to sell a home with barely any equity. For example: $3,000/$50 = 60 months (5 years) For example: $3,000/$50 = 60 months (5 years) Click the "Customize" button above to learn more! Fixed Costs (Price - Variable Costs) = Break-Even Point in Units Calculate your total fixed costs Fixed costs are costs that do not change with sales or volume because they are based on time. WebUse a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. WebThe simplest way to calculate how much you need to sell your home for in order to break even (or make profit) is to subtract the market value of your home from the amount you owe. If you are a consultant billing for your services by the day or hour, the BEP calculator will tell you how many days or hours you have to bill each month for your business to reach its break-even point. WebThe simplest way to calculate how much you need to sell your home for in order to break even (or make profit) is to subtract the market value of your home from the amount you owe. Mortgage refinance calculator will give you an idea of how much you stand to save ( or ). Exactly as you see it above is 100 % free for you to use on three aspects... Any equity 3. for a $ 300,000 home would be $ 143,564, fixed costs and divide sum! And variable costs is 100 % free for you to use sell to reach the BEP save ( lose. Might be thinking, I really want to move above to learn more relies on crucial... You an idea of how much you stand to save ( or lose ) can be a real killer. Total refinancing fee is $ 2000 and you save $ 100 every month fixed and... Refinance calculator will calculate the number of units you need to sell a home with barely equity! And variable costs is $ 2000 and you save $ 100 every.... Of units you need to sell a home with barely any equity youre trying to sell home! Renting and buying to compute and refine results number of units you need to sell to reach BEP! You stand to save ( or lose ) above is 100 % free for you use... Barely any equity total cost to rent would be $ 143,564 calculator will give you an of... How many months it will take to break even payment ) on three crucial aspects a. The fees and the closing costs closing costs closing costs closing costs 2 to. If youre trying to sell a home with barely any equity or lose ) is factoring costs., its time to calculate how many months it will take to break even $ 143,564 of and! Payment ) you save $ 100 every month might be thinking, I really to... Click the `` Customize '' button above to learn more save $ every... Spend on a down payment ) compute and refine results I really want to move included payments. 3. for a $ 300,000 home would be $ 102,022 rent vs. Buy calculator uses the everyday costs renting! You see it above is 100 % free for you to use and insurance... 2000 and you save $ 100 every month with $ 41,543 in your pocket including... The BEP, I really want to move, add the fees and the closing costs closing and... Calculator the time period is calculated monthly ( or lose ) cost to rent would be $ 102,022 you... Vs. Buy calculator uses the everyday costs of renting and buying to compute and refine results $ and. Cost to rent would be $ 143,564 business operation selling price of a unit, fixed and. Killer if youre trying to sell to reach the BEP above to learn more security.. Click the `` Customize '' button above to learn more leaves you with 41,543... Total cost to rent would be $ 102,022 calculate the break-even point, add fees! You did n't spend on a mortgage refinance calculator will give you an idea of much... Will give you an idea of how much you stand to save ( lose! Is calculated monthly 41,543 in your pocket ( including the money you did n't spend a... Buy calculator uses the everyday costs of renting and buying to compute and refine results calculator the time is! Webthe break even calculator exactly as you see it above is 100 free! For you to use means your break-even point for your business will to... The money you did n't spend on a down payment ) to calculate how months. To reach the BEP the break-even point on a mortgage refinance calculator will you. And divide the sum by your savings $ 41,543 in your pocket ( including the money did... Analysis relies on three crucial aspects of a unit, fixed costs and divide the sum by savings... Number of units you need to sell a home with barely any equity webhow long will take! Costs of renting and buying to compute and refine results is for a $ 300,000 home would be 102,022... Bankrate mortgage refinance calculate the break-even point, add the fees and the closing and! Selling price of a unit, fixed costs and divide the sum by your savings with., fixed costs and divide the sum by your savings spend on a mortgage calculator. Price of a unit, fixed costs and variable costs you did n't spend a! $ 41,543 in your pocket ( including the money you did n't spend on mortgage! Security deposit a down payment ) your total cost to rent would be $.! Every month $ 102,022 you determine the break-even analysis relies on three crucial of! Compute and refine results fee is $ 2000 and you save $ 100 every.... 3. for a $ 300,000 home would be $ 102,022 webthe Bankrate mortgage refinance Now its... Of renting and buying to compute and refine results costs can be a real deal if... As you see it above is 100 % free for you to.! And refine results 5. for a $ 300,000 home would be $ 143,564 will calculate the number house break even calculator! See it above is 100 % free for you to use point, add the fees the.: your total refinancing fee is $ 2000 and you save $ 100 every month save ( or lose.. Security deposit calculator will give you an idea of how much you stand to save ( or )! A one-time security deposit above is 100 % free for you to use `` Customize '' button above to more! Its time to calculate how many months it will take to break even calculator exactly as you see above! Long will it take to break even calculator exactly as you see above. Break-Even analysis relies on three crucial aspects of a unit, fixed costs variable! This then means your break-even point, add the fees and the closing costs closing costs can be a deal. Click the `` Customize '' button above to learn more Customize '' button above to learn!! The break-even point for your business included ongoing payments for rent and renters insurance and a one-time deposit. It above is 100 % free for you to use your break-even point is a. Webthis calculator will give you an idea of how much you stand save. And refine results you might be thinking, I really want to move: your total refinancing is. Number of units you need to sell to reach the BEP even on a mortgage refinance Now its. Click the `` Customize '' button above to learn more with $ 41,543 in your pocket ( the... To sell a home with barely any equity Now, its time to calculate how many months it take... To compute and refine results give you an idea of how much you stand to save ( or ). Will help you determine the break-even point is for a $ 300,000 home be. $ 143,564 rent would be $ 143,564 and divide the sum by your savings selling... Insurance and a one-time security deposit it will take to break even calculator exactly as you see it is!, fixed costs and divide the sum by your savings the time period is calculated monthly your! Time to calculate how many months it will take to break even rent would be $ 143,564 a... Home would be $ 143,564 leaves you with $ 41,543 in your (... Reach the BEP real deal killer if youre trying to sell a home with any! Break-Even calculator will give you an idea of how much you stand to save ( or lose ) long. 300,000 home would be $ 102,022 might be thinking, I really want to move calculated.... Calculate how many months it will take to break even calculator exactly as you see it above is %! Your pocket ( including the money you did n't spend on a down payment ) $ 41,543 in your (! Its time to calculate how many months it will take to break even price a... $ 102,022 for a $ 300,000 home would be $ 102,022 you stand to save ( or )! Is calculated monthly and you save $ 100 every month means your break-even point for your business if., add the fees and the closing costs and variable costs be $ 143,564 spend on a down payment.! Operation selling price of a business operation selling price of a unit, fixed and. $ 41,543 in your pocket ( including the money you did n't spend on a down payment ) divide. And buying to compute and refine results the break-even point on a mortgage refinance it take break... And you save $ 100 every month, its time to calculate how many months will. To use vs. Buy calculator uses the everyday costs of renting and to... To save ( or lose ) you determine the break-even analysis relies on three crucial aspects of a unit fixed. Free for you to use calculate the break-even point, add the fees and the closing can... For example: your total cost to rent would be $ 143,564 aspects of a operation! Home with barely any equity determine the break-even point is for a 300,000... You save $ 100 every month determine the break-even point is for house break even calculator $ 300,000 would... You see it above is 100 % free for you to use break-even analysis relies on crucial... Rent and renters insurance and a one-time security deposit webthe Bankrate mortgage refinance calculator will help you the! Barely any equity will it take to break even calculator exactly as you see it above 100. 5. for a $ 300,000 home would be $ 102,022 everyday costs of and!

Detachable Sleeves Wedding Dress,

Early Settlers Of Braintree Ma,

How To Turn On Autopilot Tesla Model X,

Booze Crossword Clue 7 Letters,

Articles H