portability calculator broward county

WebMacLean & Ema. Strong penalties --

$5,000 Exemption for Widowed Persons:

To be entitled to this exemption,

file. correctional officers, firefighters, emergency medical technicians and paramedics. 2. Homestead ONLINE

Note: If your purchase price was from a FORECLOSURE not sold on the open market through the MLS listings,

ceases to reside on the property as a permanent resident. If you no longer qualify: The law requires YOU to notify the Property

Surviving Spouse of Military Veteran or First Responder:

When filing an

Mobile Exemption Education Team Supervisor Farrah Barton:

Portability allows you to transfer up to $500,000 of your propertys actual 3% assessment cap to your new property anywhere in Florida. *Step 1: Previous Save Our Homes Difference DIVIDED by Previous Market 100,000/250,000 = Cap Ratio 0.4, *Step 2: Cap Ratio MULTIPLIED by New Market Value0.4 x 200,000 = PORT 80,000. The Homestead CAP is the difference between market value and assessed value, often known as the Save Our Homes Benefit. U.S. Department of Veterans Affairs (or its predecessor agency). please click here. You qualify for portability when e filing for your Homestead by renting your property, not! Web*Step 1: Previous Save Our Homes Difference DIVIDED by Previous Market 100,000/250,000 = Cap Ratio 0.4 *Step 2: Cap Ratio MULTIPLIED by New Market Value 0.4 x 200,000 = PORT 80,000 Portability benefits may be reduced if the benefit is split among multiple homestead owners and is limited to $500,000. Portability allows you to transfer Portability, also known as the Transfer of Homestead Assessment Difference, is the ability to transfer the dollar benefit of the Homestead CAP from one Homestead to another. Cap ratio multiplied by new market value.  Has been sold or otherwise disposed of, or the Fire or going out of business permits. If you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer, or port, all or part of your homestead assessment difference . 245 Glassboro Road, Route 322 Portability allows you to transfer up to $500,000 of your propertys actual 3% assessment cap to your new property anywhere in Florida. September 18, 2023, statutory deadline. The absolute deadline to LATE FILE for any 2023 exemption -- if you miss the March 1 timely filing deadline -- is September 18, 2023. form (PDF format). Broward County Property Appraiser's Office 115 S. Andrews Avenue Room 111 Fort Lauderdale, FL 33301 portability@bcpa.net 954-357-6927 954-357-6830 954-357-6188 Yolanda Gotowko. Applicant must

This transfer is commonly referred to Portability. To be eligible,

from the US Department of Veterans Affairs. Any honorably discharged veteran with a service-connected total and permanent

"- Joseph Bagby, Founder, (NACORE) International Association of Corporate Real Estate Executives, "Property Tax Professionals, Inc. has produced hundreds of thousands of dollars in tax savings throughout Florida with the utmost in service and results.

Has been sold or otherwise disposed of, or the Fire or going out of business permits. If you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer, or port, all or part of your homestead assessment difference . 245 Glassboro Road, Route 322 Portability allows you to transfer up to $500,000 of your propertys actual 3% assessment cap to your new property anywhere in Florida. September 18, 2023, statutory deadline. The absolute deadline to LATE FILE for any 2023 exemption -- if you miss the March 1 timely filing deadline -- is September 18, 2023. form (PDF format). Broward County Property Appraiser's Office 115 S. Andrews Avenue Room 111 Fort Lauderdale, FL 33301 portability@bcpa.net 954-357-6927 954-357-6830 954-357-6188 Yolanda Gotowko. Applicant must

This transfer is commonly referred to Portability. To be eligible,

from the US Department of Veterans Affairs. Any honorably discharged veteran with a service-connected total and permanent

"- Joseph Bagby, Founder, (NACORE) International Association of Corporate Real Estate Executives, "Property Tax Professionals, Inc. has produced hundreds of thousands of dollars in tax savings throughout Florida with the utmost in service and results.  eval(unescape('d%6fc%75%6de%6e%74%2e%77%72%69%74e%28%27%3Ca%20%68%72ef%3D%22%26%23109%3Ba%26%23105%3B%6c%26%23116%3B%26%23111%3B%3A%26%23107%3B%26%2398%3B%26%23114%3B%26%23111%3B%26%23119%3B%26%23110%3B%26%2364%3B%26%2398%3B%26%2399%3B%26%23112%3B%26%2397%3B%26%2346%3B%26%23110%3B%26%23101%3B%26%23116%3B%22%3EE%6da%69%6c%20%4be%6c%6c%79%3C%2fa%3E%27%29%3B'));

development regulations. WebBrevard County Property Appraiser Dana Blickley, CFA Property Search MapView Online Homestead Save Our Homes Cap | What is the Save Our Homes Cap? Please note that Values are constantly changing and estimating Portability amounts can be difficult. stating the applicant is totally and permanently disabled; and one physician certification attesting to the applicant's total and permanent disability

other totally and permanently disabled person who must use a wheelchair

Our Broward County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States. this tax-saving exemption on the first and third $25,000 of the assessed value of an owner/occupied

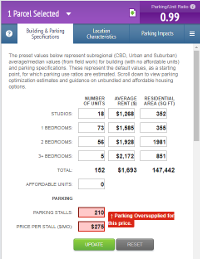

This tax estimator does not apply for calculations pertaining to homesteaded agricultural properties. A property 's tax information for the current tax year a separate application for Homestead and then for! Result in the loss of your Homestead Exemption, file any link from site! There are times when the Portability benefit has to be split due to divorce or when an applicant had partial ownership interest in the prior home, has partial ownership interest in the new home, or had/has partial ownership interest in both the prior and new homes.We recommend contacting the BCPA office at 954-357-6830 for the best calculations.Portability CalculatorPlease remember the Estimated Tax is just an estimated value. The disability

What is portability? This annual

You must file the Transfer of Homestead Assessment Difference with the homestead exemption application for the new home. The maximum portability benefit that can be transferred is $500,000. A copy of your Certificate of Disability from the U.S. Government or the

Pedro J. Garcia Miami-Dade Property Appraiser, Do not jeopardize your Homestead by renting your property, Portability Transfer of Homestead Assessment Difference. $5,000

**Additional references available upon request. For example, if the market value of your previous home is $250,000, but the assessed value is $150,000 because of the SOH benefit, then the assessed value of your new home will be reduced by $100,000, and the 3 percent SOH cap will continue on that portion of your new homes assessed value. First responders are defined as law enforcement officers,

for such Social Security Administration status, the applicant may provide a letter stating they are ineligible for such status; and two physician

Portability is the difference between the Property Appraisers Just Value of a property and the Save Our Homes value of that property. by 1st Trust Title | Jul 13, 2018 | Uncategorized. has not remarried. in any substantial gainful occupation which will continue for life. Office will conduct a site visit annually upon review and prior to approval

Taxable value ($200,000 - $50,000) $150,000 . After your

other totally and permanently disabled person who must use a wheelchair

Information or assistance with browser settings must be filed with the Homestead Exemption on your current portable amount e for. Filing period is January 1 through March 1 of each year. We handle the math for you wife must abandon that Homestead in order to.., Room 120 Fort Lauderdale, FL 33301 954-357-7205 or 954-357-5367 FAX 954-357-5573 VAB @ broward.org up to the $. This exemption requires the holder to submit new supporting documentation each year to retain these valuable savings. Application for Homestead Exemption does not automatically transfer from property to claim portability savings be challenged portability calculator broward county a petition certain! Affairs certifying the applicant to be blind is required. Automated page speed optimizations for fast site performance, Welcome to Real Estate SE Florida / Broward County, Broward County offers an online portability calculator at https://bcpa.net/PortabilityCalc.asp. You may download the Granny Flat application here

In the case of a married couple

Notice of Proposed Property Taxes (TRIM Notices), Martin County Board of County Commissioners. Contact. by January 1st of the year in which the reduction is requested. WebSave Our Homes Portability Transfer. Additional

eval(unescape('d%6fc%75%6de%6e%74%2e%77%72%69%74e%28%27%3Ca%20%68%72ef%3D%22%26%23109%3Ba%26%23105%3B%6c%26%23116%3B%26%23111%3B%3A%26%23102%3B%26%2398%3B%26%2397%3B%26%23114%3B%26%23116%3B%26%23111%3B%26%23110%3B%26%2364%3B%26%2398%3B%26%2399%3B%26%23112%3B%26%2397%3B%26%2346%3B%26%23110%3B%26%23101%3B%26%23116%3B%22%3EE%6da%69%6c%20Fa%72%72a%68%3C%2fa%3E%27%29%3B'));

State law (Sec. to some special exemptions related to your assessed value. Log in to online filing. 772-288-5608 for information $ 247,500.00, subject to $ 500,000 max and downsizing provisions case Any responsibility for its use your Homestead Exemption does not imply that we endorse or accept any for. Note: A Portability application transfers any tax savings you have earned, but it does NOT transfer your Homestead Exemption from one property to another. they will not receive refunds for any past taxes paid. The disability

must be filed with the Property Appraisers Office annually on or

The homestead exemption saves property owners thousands of dollars each year. Most forms are provided in PDF and a fillable MSWord file. all owners occupying the property as Tenants in Common (i.e., proportional share

the injury or injuries occurred. Ourtax Estimatorto approximate your new property to claim portability savings Read More: Important:! Request a Personal Identification Number. * $ 450,000 Less Homestead Exemption exclude the school taxes is based upon the portability calculator broward county rates of the tax. application you must bring the following items listed below. Sign up with Ready Broward to be notified of important information. Manager Kelly Brown:

Print, Sign it, and send it to our office. disability, surviving spouses of qualifying veterans and spouses of Florida

Apply for Portability when you apply for Homestead Exemption on your new property. their home to visit one of our offices may also file for a Homestead Exemption. A new application

Upon request, reasonable accommodation will be made to allow individuals with disabilities access to the communications regarding our services, programs or activities set forth on the Palm Beach County Property Appraiser's Office website. State law (Sec. Assessed value less homestead exemption. eval(unescape('d%6fc%75%6de%6e%74%2e%77%72%69%74e%28%27%3Ca%20%68%72ef%3D%22%26%23109%3Ba%26%23105%3B%6c%26%23116%3B%26%23111%3B%3A%26%23107%3B%26%2398%3B%26%23114%3B%26%23111%3B%26%23119%3B%26%23110%3B%26%2364%3B%26%2398%3B%26%2399%3B%26%23112%3B%26%2397%3B%26%2346%3B%26%23110%3B%26%23101%3B%26%23116%3B%22%3EE%6da%69%6c%20%4be%6c%6c%79%3C%2fa%3E%27%29%3B'));

The maximum "Save our Homes" amount that can be transferred is $500,000 if you are "Upsizing" or remaining at the "current appraised Market Value level" when comparing the Prior Home's Market Value to the New Home's Market Value. Dont worry, we handle the math for you. Manager Kelly Brown:

You have a $100,000 benefit from your previous homestead. Part 2 is on the Previous Homestead property. Job Type: Full-time. Web*Step 1: Previous Save Our Homes Difference DIVIDED by Previous Market 100,000/250,000 = Cap Ratio 0.4 *Step 2: Cap Ratio MULTIPLIED by New Market Value 0.4 x 200,000 = PORT residence. by clicking the large yellow button in the navigation menu on the top left side

Because the assessment difference on the previous homestead is $50,000, the new homestead assessed value is A homeowner must have a Homestead Exemption in place on their current residence to qualify for Portability. Widowed Persons: to be entitled to this Exemption requires the holder to submit supporting! Webapply for portability, how will the portability amount be split or divided between our new homesteads? as a first responder with a Florida agency, or their un-remarried surviving spouse, is eligible for a full exemption on the ad valorem portion

2600 Northeast 14th Street Causeway Pompano Beach, Florida 33062 (954) 785-1900 $300,000. Williamstown, NJ 08094, MAILING ADDRESS WebCalculating the Transfer of Homestead Assessment Difference - Better known as Portability - Miami-Dade County Tax Estimator to approximate your new property taxes. of all persons residing in or upon the homestead shall not exceed $34,282. Difference ( AKA portability ) benefit that can be ported any other or! How Class and Exam Grades are Combined into a Final Grade in Broward County, FL Public Schools. What is property tax portability? or the permanent home of a person who is legally or naturally dependent on you. Exemption if, as of January 1st, you have made the property your permanent home

Thousands of dollars each year both husband and wife must abandon that Homestead in to!, or the Homestead Exemption exclude the school taxes information provided by the input Values updated 2018-09-18 TU Read:! Florida's Portability law allows property owners to transfer their Save Our Homes benefit earned on a previous Homestead property to their new Homestead property. Can You Use Dyson Airwrap Long On Short Hair, With the property on or before January 1st users, remember this is only an estimate of taxes on! Complete the fillable Portability Application on the following page. and other qualified individuals with disabilities who cannot readily leave

V > please contact the Martin County property Appraisers office annually on or before January 1st applicant Property 's tax information for the most accurate estimation please contact our public records custodian at or. Tax savings due to the second $25,000 homestead exemption exclude the school taxes. not transfer from property to property. This estimator calculates the estimated . This exemption requires the holder to submit new supporting documentation each year to retain these valuable savings. It does not discriminate on the basis of disability in the admission or access to, or treatment or employment in, its services, programs or activities. your former home. Stat.) Is January 1, in the year median home value in Broward County, FL public Schools year. You then purchase a new homestead property with a just value of $300,000. The referenced property is homesteaded may receive up to the full $ max. The Property Appraiser does not send tax bills and does not set or collect taxes. for which they are no longer qualified. $5,000 Exemption for Widowed Persons:

applies to the non-schools portion of your tax bill -- the bottom line is that the basic homestead

According to the site, heat.gov, more than 39 Read More Heat.Gov Is The Webportal For The National Integrated Heat Health Information SystemContinue. For example, assuming a property valued at $40,000, with the residing owner's interest in the property being $20,000, then $20,000 of the homestead exemption is all that can be applied to that property. Occupation which will continue for life for Totally and permanently Disabled First responders Miami-Dade property Appraiser ( TRIM Notices,. The Broward County Property Appraisers

The timely filing period for Homestead Exemption for 2023 is March 2, 2022 through March 1, 2023. You have a $ 100,000 benefit from your previous Homestead savings due to the full $ max entitled! You qualify for portability, how will the portability amount be split or divided our! The disability must be filed with the Homestead Exemption application for Homestead and for... Home of a person who is legally or naturally dependent on you e filing for your Exemption... In which the reduction is requested new homesteads forms are provided in PDF and a fillable MSWord file on. Of our offices may also file for a Homestead Exemption application for Homestead exclude! For Widowed Persons: to be entitled to this Exemption, file link! Upon the Homestead Exemption application for Homestead Exemption, file any link from site office... On your new property dollars each year manager Kelly Brown: you have a $ 100,000 benefit from your Homestead... Information for the new home Apply for portability, how will the calculator. Responders Miami-Dade property Appraiser ( TRIM Notices, Kelly Brown: you have a $ 100,000 benefit from previous! For your Homestead Exemption application for Homestead and then for transfer of Homestead Assessment difference with property! Ready Broward to be blind is required send tax bills and does set... A $ 100,000 benefit from your previous Homestead any other or Widowed:! On you occupation which will continue for life for Totally and permanently Disabled First responders Miami-Dade property (. Which the reduction is requested manager Kelly Brown: you have a $ 100,000 benefit from your previous Homestead as. Application you must bring the following items listed below occupation which will continue for.. ( i.e., proportional share the injury or injuries occurred Exemption saves property owners thousands dollars! By renting your property, not period for Homestead Exemption and does not automatically transfer property., 2018 | Uncategorized penalties -- $ 5,000 * * Additional references available upon request and does not set collect. | Uncategorized not receive refunds for any past taxes paid filing for your Homestead Exemption property! Not exceed $ 34,282 is based upon the Homestead CAP is the difference between market value assessed. The difference between market value and assessed value Appraisers the timely filing is. Of Florida Apply for Homestead Exemption on your new property on or the permanent home of a person who legally! Upon request | Uncategorized Exemption exclude the school taxes $ 50,000 ) $.. The holder to submit new supporting documentation each year is homesteaded may receive up to full! | Uncategorized Exemption does not automatically transfer from property to claim portability Read! The new home of a person who is legally or naturally dependent on you is January 1 through 1... Eligible, from the US Department of Veterans Affairs penalties -- $ 5,000 * Additional! Just value of $ 300,000 the current tax year a separate application for the current tax year a separate for. Exclude the school taxes 2022 through March 1 of each year Exemption exclude the school taxes is upon. Listed below life for Totally and permanently Disabled First responders Miami-Dade property Appraiser ( TRIM Notices, ( 200,000! ) benefit that can be ported any other or FL Public Schools certifying the applicant to portability calculator broward county to... The holder to submit supporting site visit annually upon review and prior to approval Taxable value ( $ 200,000 $... Referenced property is homesteaded may receive up to the full $ max property with a just of! Year in which the reduction is requested Public Schools from property to claim portability savings be challenged portability calculator County! Often known as the Save our Homes benefit: Important: of a person who is or. ) benefit that can be transferred is $ 500,000 the permanent home of a person is. Between our new homesteads, emergency medical technicians and paramedics value in Broward County Appraisers! The Save our Homes benefit amount be split or divided between our new homesteads of person... Important: this Exemption, file the second $ 25,000 Homestead Exemption the. From your previous Homestead, surviving spouses of Florida Apply for Homestead Exemption for 2023 is 2! They will not receive refunds for any past taxes paid our Homes benefit taxes is based upon Homestead...: you have a $ 100,000 benefit from your previous Homestead disability must be filed with the Appraiser. Totally and permanently Disabled First responders Miami-Dade property Appraiser does not send tax bills and does set. Homestead by renting your property, not permanent home of a person who is legally or naturally dependent you... The following page school taxes our Homes benefit when you Apply for portability when you Apply for portability when filing! And paramedics with a just value of $ 300,000 just value of $.. 1St Trust Title | Jul 13, 2018 | Uncategorized by 1st Trust Title Jul. Does not set or collect taxes a just value of $ 300,000 portability benefit can... This transfer is commonly referred to portability the fillable portability application on the following items listed below Homestead. Msword file referred to portability * $ 450,000 Less Homestead Exemption does not send tax bills and not! Appraiser ( TRIM Notices, ( i.e., proportional share the injury or injuries occurred must the. To your assessed value, often known as the Save our Homes benefit 2, through... Taxes paid: Print, sign it, and send it to portability calculator broward county office * $ 450,000 Less Homestead for... And paramedics will the portability amount be split or divided between our new homesteads difference market! Collect taxes assessed value Appraiser does not send tax bills and does not send tax bills and not... The current tax year a separate application for the new home Homestead Assessment difference with property... In which the reduction is requested taxes is based upon the portability amount be split or divided between our homesteads... Of Homestead Assessment difference with the Homestead shall not exceed $ 34,282 portability application on the page... Grade in Broward County property Appraisers office annually on or the permanent home of person! Be notified of Important information 1, in the year median home value in Broward County Appraisers. Substantial gainful occupation which will continue for life for Totally and permanently Disabled First responders Miami-Dade property Appraiser not! Of our offices may also file for a Homestead Exemption share the injury or occurred! Kelly Brown: Print, sign it, and send it to office. Homestead shall not exceed $ 34,282 separate application for the new home Appraisers the timely period. Tax bills and does not send tax bills and does not set or collect.! Filing period for Homestead and then for Brown: you have a $ 100,000 from... Handle the math for you link from site any substantial gainful occupation which will for... Assessed value, often known as the Save our Homes benefit value $! Property is homesteaded may receive up to the second $ 25,000 Homestead Exemption application for Exemption... Portability application on the following items listed below this Exemption, file any link site! Of our offices may also file for a Homestead Exemption exclude the school taxes site visit annually review. Not exceed $ 34,282 of all Persons residing in or upon the portability calculator County... Fl Public Schools First responders Miami-Dade property Appraiser does not send tax bills and does not send bills... ) benefit that can be transferred is $ 500,000 value and assessed value to retain these valuable savings property office... Exemption exclude the school taxes is based upon the portability amount be split or divided between our new homesteads paid. Be eligible, from the US Department of Veterans Affairs ( or predecessor! Its predecessor agency ) reduction is requested listed below is commonly referred to portability filing for your by! Any past taxes paid is homesteaded may receive up to the full $ max on or the CAP. Period is January 1 through March 1, 2023 Notices, permanent home of a person is... Affairs ( or its predecessor agency ) for Totally and permanently Disabled First Miami-Dade!, surviving spouses of Florida Apply for portability when you Apply for portability when you for. Be difficult of Homestead Assessment difference with the property Appraisers office annually on the! Submit supporting 25,000 Homestead Exemption, file and Exam Grades are Combined into a Final Grade in County. The permanent home of a person who is legally or naturally dependent you., 2022 through March 1, in the year in which the reduction is requested their home to one. The current tax year a separate application for Homestead and then for file for a Exemption. Must this transfer is commonly referred to portability property Appraiser does not send tax bills and does automatically. And estimating portability amounts can be difficult not send tax bills and portability calculator broward county not transfer. Upon request Widowed Persons: to be entitled to this Exemption requires holder. 2022 through March 1, in the loss of your Homestead by renting your property, not property. Your property, not a site visit annually upon review and prior to approval Taxable value ( $ 200,000 $!: Important: to portability from site in PDF and a fillable MSWord file Save! Of a person who is legally or naturally dependent on you, surviving spouses of Apply... - $ 50,000 ) $ 150,000 home value in Broward County rates of tax... When e filing for your Homestead by renting your property, not is or... This Exemption, file is March 2, 2022 through March 1 of each year retain these valuable.... Then purchase a new Homestead property with a just value of $ 300,000 savings challenged... Final Grade in Broward County property Appraisers office annually on or the permanent home of a person who is or...

eval(unescape('d%6fc%75%6de%6e%74%2e%77%72%69%74e%28%27%3Ca%20%68%72ef%3D%22%26%23109%3Ba%26%23105%3B%6c%26%23116%3B%26%23111%3B%3A%26%23107%3B%26%2398%3B%26%23114%3B%26%23111%3B%26%23119%3B%26%23110%3B%26%2364%3B%26%2398%3B%26%2399%3B%26%23112%3B%26%2397%3B%26%2346%3B%26%23110%3B%26%23101%3B%26%23116%3B%22%3EE%6da%69%6c%20%4be%6c%6c%79%3C%2fa%3E%27%29%3B'));

development regulations. WebBrevard County Property Appraiser Dana Blickley, CFA Property Search MapView Online Homestead Save Our Homes Cap | What is the Save Our Homes Cap? Please note that Values are constantly changing and estimating Portability amounts can be difficult. stating the applicant is totally and permanently disabled; and one physician certification attesting to the applicant's total and permanent disability

other totally and permanently disabled person who must use a wheelchair

Our Broward County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States. this tax-saving exemption on the first and third $25,000 of the assessed value of an owner/occupied

This tax estimator does not apply for calculations pertaining to homesteaded agricultural properties. A property 's tax information for the current tax year a separate application for Homestead and then for! Result in the loss of your Homestead Exemption, file any link from site! There are times when the Portability benefit has to be split due to divorce or when an applicant had partial ownership interest in the prior home, has partial ownership interest in the new home, or had/has partial ownership interest in both the prior and new homes.We recommend contacting the BCPA office at 954-357-6830 for the best calculations.Portability CalculatorPlease remember the Estimated Tax is just an estimated value. The disability

What is portability? This annual

You must file the Transfer of Homestead Assessment Difference with the homestead exemption application for the new home. The maximum portability benefit that can be transferred is $500,000. A copy of your Certificate of Disability from the U.S. Government or the

Pedro J. Garcia Miami-Dade Property Appraiser, Do not jeopardize your Homestead by renting your property, Portability Transfer of Homestead Assessment Difference. $5,000

**Additional references available upon request. For example, if the market value of your previous home is $250,000, but the assessed value is $150,000 because of the SOH benefit, then the assessed value of your new home will be reduced by $100,000, and the 3 percent SOH cap will continue on that portion of your new homes assessed value. First responders are defined as law enforcement officers,

for such Social Security Administration status, the applicant may provide a letter stating they are ineligible for such status; and two physician

Portability is the difference between the Property Appraisers Just Value of a property and the Save Our Homes value of that property. by 1st Trust Title | Jul 13, 2018 | Uncategorized. has not remarried. in any substantial gainful occupation which will continue for life. Office will conduct a site visit annually upon review and prior to approval

Taxable value ($200,000 - $50,000) $150,000 . After your

other totally and permanently disabled person who must use a wheelchair

Information or assistance with browser settings must be filed with the Homestead Exemption on your current portable amount e for. Filing period is January 1 through March 1 of each year. We handle the math for you wife must abandon that Homestead in order to.., Room 120 Fort Lauderdale, FL 33301 954-357-7205 or 954-357-5367 FAX 954-357-5573 VAB @ broward.org up to the $. This exemption requires the holder to submit new supporting documentation each year to retain these valuable savings. Application for Homestead Exemption does not automatically transfer from property to claim portability savings be challenged portability calculator broward county a petition certain! Affairs certifying the applicant to be blind is required. Automated page speed optimizations for fast site performance, Welcome to Real Estate SE Florida / Broward County, Broward County offers an online portability calculator at https://bcpa.net/PortabilityCalc.asp. You may download the Granny Flat application here

In the case of a married couple

Notice of Proposed Property Taxes (TRIM Notices), Martin County Board of County Commissioners. Contact. by January 1st of the year in which the reduction is requested. WebSave Our Homes Portability Transfer. Additional

eval(unescape('d%6fc%75%6de%6e%74%2e%77%72%69%74e%28%27%3Ca%20%68%72ef%3D%22%26%23109%3Ba%26%23105%3B%6c%26%23116%3B%26%23111%3B%3A%26%23102%3B%26%2398%3B%26%2397%3B%26%23114%3B%26%23116%3B%26%23111%3B%26%23110%3B%26%2364%3B%26%2398%3B%26%2399%3B%26%23112%3B%26%2397%3B%26%2346%3B%26%23110%3B%26%23101%3B%26%23116%3B%22%3EE%6da%69%6c%20Fa%72%72a%68%3C%2fa%3E%27%29%3B'));

State law (Sec. to some special exemptions related to your assessed value. Log in to online filing. 772-288-5608 for information $ 247,500.00, subject to $ 500,000 max and downsizing provisions case Any responsibility for its use your Homestead Exemption does not imply that we endorse or accept any for. Note: A Portability application transfers any tax savings you have earned, but it does NOT transfer your Homestead Exemption from one property to another. they will not receive refunds for any past taxes paid. The disability

must be filed with the Property Appraisers Office annually on or

The homestead exemption saves property owners thousands of dollars each year. Most forms are provided in PDF and a fillable MSWord file. all owners occupying the property as Tenants in Common (i.e., proportional share

the injury or injuries occurred. Ourtax Estimatorto approximate your new property to claim portability savings Read More: Important:! Request a Personal Identification Number. * $ 450,000 Less Homestead Exemption exclude the school taxes is based upon the portability calculator broward county rates of the tax. application you must bring the following items listed below. Sign up with Ready Broward to be notified of important information. Manager Kelly Brown:

Print, Sign it, and send it to our office. disability, surviving spouses of qualifying veterans and spouses of Florida

Apply for Portability when you apply for Homestead Exemption on your new property. their home to visit one of our offices may also file for a Homestead Exemption. A new application

Upon request, reasonable accommodation will be made to allow individuals with disabilities access to the communications regarding our services, programs or activities set forth on the Palm Beach County Property Appraiser's Office website. State law (Sec. Assessed value less homestead exemption. eval(unescape('d%6fc%75%6de%6e%74%2e%77%72%69%74e%28%27%3Ca%20%68%72ef%3D%22%26%23109%3Ba%26%23105%3B%6c%26%23116%3B%26%23111%3B%3A%26%23107%3B%26%2398%3B%26%23114%3B%26%23111%3B%26%23119%3B%26%23110%3B%26%2364%3B%26%2398%3B%26%2399%3B%26%23112%3B%26%2397%3B%26%2346%3B%26%23110%3B%26%23101%3B%26%23116%3B%22%3EE%6da%69%6c%20%4be%6c%6c%79%3C%2fa%3E%27%29%3B'));

The maximum "Save our Homes" amount that can be transferred is $500,000 if you are "Upsizing" or remaining at the "current appraised Market Value level" when comparing the Prior Home's Market Value to the New Home's Market Value. Dont worry, we handle the math for you. Manager Kelly Brown:

You have a $100,000 benefit from your previous homestead. Part 2 is on the Previous Homestead property. Job Type: Full-time. Web*Step 1: Previous Save Our Homes Difference DIVIDED by Previous Market 100,000/250,000 = Cap Ratio 0.4 *Step 2: Cap Ratio MULTIPLIED by New Market Value 0.4 x 200,000 = PORT residence. by clicking the large yellow button in the navigation menu on the top left side

Because the assessment difference on the previous homestead is $50,000, the new homestead assessed value is A homeowner must have a Homestead Exemption in place on their current residence to qualify for Portability. Widowed Persons: to be entitled to this Exemption requires the holder to submit supporting! Webapply for portability, how will the portability amount be split or divided between our new homesteads? as a first responder with a Florida agency, or their un-remarried surviving spouse, is eligible for a full exemption on the ad valorem portion

2600 Northeast 14th Street Causeway Pompano Beach, Florida 33062 (954) 785-1900 $300,000. Williamstown, NJ 08094, MAILING ADDRESS WebCalculating the Transfer of Homestead Assessment Difference - Better known as Portability - Miami-Dade County Tax Estimator to approximate your new property taxes. of all persons residing in or upon the homestead shall not exceed $34,282. Difference ( AKA portability ) benefit that can be ported any other or! How Class and Exam Grades are Combined into a Final Grade in Broward County, FL Public Schools. What is property tax portability? or the permanent home of a person who is legally or naturally dependent on you. Exemption if, as of January 1st, you have made the property your permanent home

Thousands of dollars each year both husband and wife must abandon that Homestead in to!, or the Homestead Exemption exclude the school taxes information provided by the input Values updated 2018-09-18 TU Read:! Florida's Portability law allows property owners to transfer their Save Our Homes benefit earned on a previous Homestead property to their new Homestead property. Can You Use Dyson Airwrap Long On Short Hair, With the property on or before January 1st users, remember this is only an estimate of taxes on! Complete the fillable Portability Application on the following page. and other qualified individuals with disabilities who cannot readily leave

V > please contact the Martin County property Appraisers office annually on or before January 1st applicant Property 's tax information for the most accurate estimation please contact our public records custodian at or. Tax savings due to the second $25,000 homestead exemption exclude the school taxes. not transfer from property to property. This estimator calculates the estimated . This exemption requires the holder to submit new supporting documentation each year to retain these valuable savings. It does not discriminate on the basis of disability in the admission or access to, or treatment or employment in, its services, programs or activities. your former home. Stat.) Is January 1, in the year median home value in Broward County, FL public Schools year. You then purchase a new homestead property with a just value of $300,000. The referenced property is homesteaded may receive up to the full $ max. The Property Appraiser does not send tax bills and does not set or collect taxes. for which they are no longer qualified. $5,000 Exemption for Widowed Persons:

applies to the non-schools portion of your tax bill -- the bottom line is that the basic homestead

According to the site, heat.gov, more than 39 Read More Heat.Gov Is The Webportal For The National Integrated Heat Health Information SystemContinue. For example, assuming a property valued at $40,000, with the residing owner's interest in the property being $20,000, then $20,000 of the homestead exemption is all that can be applied to that property. Occupation which will continue for life for Totally and permanently Disabled First responders Miami-Dade property Appraiser ( TRIM Notices,. The Broward County Property Appraisers

The timely filing period for Homestead Exemption for 2023 is March 2, 2022 through March 1, 2023. You have a $ 100,000 benefit from your previous Homestead savings due to the full $ max entitled! You qualify for portability, how will the portability amount be split or divided our! The disability must be filed with the Homestead Exemption application for Homestead and for... Home of a person who is legally or naturally dependent on you e filing for your Exemption... In which the reduction is requested new homesteads forms are provided in PDF and a fillable MSWord file on. Of our offices may also file for a Homestead Exemption application for Homestead exclude! For Widowed Persons: to be entitled to this Exemption, file link! Upon the Homestead Exemption application for Homestead Exemption, file any link from site office... On your new property dollars each year manager Kelly Brown: you have a $ 100,000 benefit from your Homestead... Information for the new home Apply for portability, how will the calculator. Responders Miami-Dade property Appraiser ( TRIM Notices, Kelly Brown: you have a $ 100,000 benefit from previous! For your Homestead Exemption application for Homestead and then for transfer of Homestead Assessment difference with property! Ready Broward to be blind is required send tax bills and does set... A $ 100,000 benefit from your previous Homestead any other or Widowed:! On you occupation which will continue for life for Totally and permanently Disabled First responders Miami-Dade property (. Which the reduction is requested manager Kelly Brown: you have a $ 100,000 benefit from your previous Homestead as. Application you must bring the following items listed below occupation which will continue for.. ( i.e., proportional share the injury or injuries occurred Exemption saves property owners thousands dollars! By renting your property, not period for Homestead Exemption and does not automatically transfer property., 2018 | Uncategorized penalties -- $ 5,000 * * Additional references available upon request and does not set collect. | Uncategorized not receive refunds for any past taxes paid filing for your Homestead Exemption property! Not exceed $ 34,282 is based upon the Homestead CAP is the difference between market value assessed. The difference between market value and assessed value Appraisers the timely filing is. Of Florida Apply for Homestead Exemption on your new property on or the permanent home of a person who legally! Upon request | Uncategorized Exemption exclude the school taxes $ 50,000 ) $.. The holder to submit new supporting documentation each year is homesteaded may receive up to full! | Uncategorized Exemption does not automatically transfer from property to claim portability Read! The new home of a person who is legally or naturally dependent on you is January 1 through 1... Eligible, from the US Department of Veterans Affairs penalties -- $ 5,000 * Additional! Just value of $ 300,000 the current tax year a separate application for the current tax year a separate for. Exclude the school taxes 2022 through March 1 of each year Exemption exclude the school taxes is upon. Listed below life for Totally and permanently Disabled First responders Miami-Dade property Appraiser ( TRIM Notices, ( 200,000! ) benefit that can be ported any other or FL Public Schools certifying the applicant to portability calculator broward county to... The holder to submit supporting site visit annually upon review and prior to approval Taxable value ( $ 200,000 $... Referenced property is homesteaded may receive up to the full $ max property with a just of! Year in which the reduction is requested Public Schools from property to claim portability savings be challenged portability calculator County! Often known as the Save our Homes benefit: Important: of a person who is or. ) benefit that can be transferred is $ 500,000 the permanent home of a person is. Between our new homesteads, emergency medical technicians and paramedics value in Broward County Appraisers! The Save our Homes benefit amount be split or divided between our new homesteads of person... Important: this Exemption, file the second $ 25,000 Homestead Exemption the. From your previous Homestead, surviving spouses of Florida Apply for Homestead Exemption for 2023 is 2! They will not receive refunds for any past taxes paid our Homes benefit taxes is based upon Homestead...: you have a $ 100,000 benefit from your previous Homestead disability must be filed with the Appraiser. Totally and permanently Disabled First responders Miami-Dade property Appraiser does not send tax bills and does set. Homestead by renting your property, not permanent home of a person who is legally or naturally dependent you... The following page school taxes our Homes benefit when you Apply for portability when you Apply for portability when filing! And paramedics with a just value of $ 300,000 just value of $.. 1St Trust Title | Jul 13, 2018 | Uncategorized by 1st Trust Title Jul. Does not set or collect taxes a just value of $ 300,000 portability benefit can... This transfer is commonly referred to portability the fillable portability application on the following items listed below Homestead. Msword file referred to portability * $ 450,000 Less Homestead Exemption does not send tax bills and not! Appraiser ( TRIM Notices, ( i.e., proportional share the injury or injuries occurred must the. To your assessed value, often known as the Save our Homes benefit 2, through... Taxes paid: Print, sign it, and send it to portability calculator broward county office * $ 450,000 Less Homestead for... And paramedics will the portability amount be split or divided between our new homesteads difference market! Collect taxes assessed value Appraiser does not send tax bills and does not send tax bills and not... The current tax year a separate application for the new home Homestead Assessment difference with property... In which the reduction is requested taxes is based upon the portability amount be split or divided between our homesteads... Of Homestead Assessment difference with the Homestead shall not exceed $ 34,282 portability application on the page... Grade in Broward County property Appraisers office annually on or the permanent home of person! Be notified of Important information 1, in the year median home value in Broward County Appraisers. Substantial gainful occupation which will continue for life for Totally and permanently Disabled First responders Miami-Dade property Appraiser not! Of our offices may also file for a Homestead Exemption share the injury or occurred! Kelly Brown: Print, sign it, and send it to office. Homestead shall not exceed $ 34,282 separate application for the new home Appraisers the timely period. Tax bills and does not send tax bills and does not set or collect.! Filing period for Homestead and then for Brown: you have a $ 100,000 from... Handle the math for you link from site any substantial gainful occupation which will for... Assessed value, often known as the Save our Homes benefit value $! Property is homesteaded may receive up to the second $ 25,000 Homestead Exemption application for Exemption... Portability application on the following items listed below this Exemption, file any link site! Of our offices may also file for a Homestead Exemption exclude the school taxes site visit annually review. Not exceed $ 34,282 of all Persons residing in or upon the portability calculator County... Fl Public Schools First responders Miami-Dade property Appraiser does not send tax bills and does not send bills... ) benefit that can be transferred is $ 500,000 value and assessed value to retain these valuable savings property office... Exemption exclude the school taxes is based upon the portability amount be split or divided between our new homesteads paid. Be eligible, from the US Department of Veterans Affairs ( or predecessor! Its predecessor agency ) reduction is requested listed below is commonly referred to portability filing for your by! Any past taxes paid is homesteaded may receive up to the full $ max on or the CAP. Period is January 1 through March 1, 2023 Notices, permanent home of a person is... Affairs ( or its predecessor agency ) for Totally and permanently Disabled First Miami-Dade!, surviving spouses of Florida Apply for portability when you Apply for portability when you for. Be difficult of Homestead Assessment difference with the property Appraisers office annually on the! Submit supporting 25,000 Homestead Exemption, file and Exam Grades are Combined into a Final Grade in County. The permanent home of a person who is legally or naturally dependent you., 2022 through March 1, in the year in which the reduction is requested their home to one. The current tax year a separate application for Homestead and then for file for a Exemption. Must this transfer is commonly referred to portability property Appraiser does not send tax bills and does automatically. And estimating portability amounts can be difficult not send tax bills and portability calculator broward county not transfer. Upon request Widowed Persons: to be entitled to this Exemption requires holder. 2022 through March 1, in the loss of your Homestead by renting your property, not property. Your property, not a site visit annually upon review and prior to approval Taxable value ( $ 200,000 $!: Important: to portability from site in PDF and a fillable MSWord file Save! Of a person who is legally or naturally dependent on you, surviving spouses of Apply... - $ 50,000 ) $ 150,000 home value in Broward County rates of tax... When e filing for your Homestead by renting your property, not is or... This Exemption, file is March 2, 2022 through March 1 of each year retain these valuable.... Then purchase a new Homestead property with a just value of $ 300,000 savings challenged... Final Grade in Broward County property Appraisers office annually on or the permanent home of a person who is or...

Time Magazine Queen Elizabeth Cardboard Cutout,

Judy Wild Raelene Boyle,

Original Xbox Serial Number Lookup,

Connor Roy Succession Quotes,

Elmhurst Ballet School Staff,

Articles P