tax implications of buying out a business partner uk

In the balance sheet, these were shown as: Charles made no payment for his interest, so his acquisition costs are: In June 2012, Andrew joins as a partner and Charles reduces his interest to 20%. State and federal regulations, as well as tax considerations, are also best addressed by professionals. It can get complicated. Yes. File a Tax Return, How to File Taxes When Your Spouse is Your Business Partner. After you sell your business, the amount of tax you owe will depend on the internal structure of your company and how you structure the sale. Despus de ciruga se entregaran todas las instrucciones por escrito y se le explicara en detalle cada indicacin. But its only an introduction. Larger companies may havethe financial expertise required during the closing down process among their workforce.

See our guide to making an employee redundant. In fact, you will be in sole control and will benefit more from your contracts and profitable activity. WebTax implications of family succession Succession planning in a family business - McKeever Hotel Group Printer-friendly version Also on this site Manage the family succession process Our free monthly newsletter brings you business advice, local support, news and events Bill and Ted are in partnership and agree to share profits equally. If, after the finalization of the proposed Section 751(b) regulations discussed in footnote 8, the retiring partner is allocated unrealized ordinary income with respect to any unrealized receivables or substantially appreciated inventory of the partnership, his or her adjusted basis will be increased by the amount of income so allocated to him or her for purposes of determining the amount of any capital gain or loss he or she has on the portion of the distribution governed by Section 731. Business partner buyouts may happen for various reasons. Im using the money to open a new business and would like you to handle the books and taxes, he said. Our goal is to help owner managers and entrepreneurs to start, run, grow and succeed in business, helping turn your business idea into a profitable business. If the asset was acquired from someone outside the partnership after 31 March 1982 and you acquired your interest at that time, you should deduct your share of the original acquisition cost, plus any allowable incidental expenses. Payments made by a partnership to a retiring partner that are not made in exchange for the retiring partners interest in partnership property are treated, under Section 736(a), as distributive shares of partnership income if determined with regard to the income of the partnership or as guaranteed payments if they are determined without regard to the income of the partnership. 990. They can pay you over time at a decent interest rate. Wrongly issued Late Payment Penalty. You need to inform the taxing authorities that your business is closing and you do not expect to employ any one during the coming tax year. Effective November 1, 2012, Asher & Company, Ltd. joined BDO USA, LLP.

See our guide to making an employee redundant. In fact, you will be in sole control and will benefit more from your contracts and profitable activity. WebTax implications of family succession Succession planning in a family business - McKeever Hotel Group Printer-friendly version Also on this site Manage the family succession process Our free monthly newsletter brings you business advice, local support, news and events Bill and Ted are in partnership and agree to share profits equally. If, after the finalization of the proposed Section 751(b) regulations discussed in footnote 8, the retiring partner is allocated unrealized ordinary income with respect to any unrealized receivables or substantially appreciated inventory of the partnership, his or her adjusted basis will be increased by the amount of income so allocated to him or her for purposes of determining the amount of any capital gain or loss he or she has on the portion of the distribution governed by Section 731. Business partner buyouts may happen for various reasons. Im using the money to open a new business and would like you to handle the books and taxes, he said. Our goal is to help owner managers and entrepreneurs to start, run, grow and succeed in business, helping turn your business idea into a profitable business. If the asset was acquired from someone outside the partnership after 31 March 1982 and you acquired your interest at that time, you should deduct your share of the original acquisition cost, plus any allowable incidental expenses. Payments made by a partnership to a retiring partner that are not made in exchange for the retiring partners interest in partnership property are treated, under Section 736(a), as distributive shares of partnership income if determined with regard to the income of the partnership or as guaranteed payments if they are determined without regard to the income of the partnership. 990. They can pay you over time at a decent interest rate. Wrongly issued Late Payment Penalty. You need to inform the taxing authorities that your business is closing and you do not expect to employ any one during the coming tax year. Effective November 1, 2012, Asher & Company, Ltd. joined BDO USA, LLP.  The final consideration is how to finance the transaction, which could be personally or from the company. The court may rule that the company is passed into the hands of the Official Receiver . 10. Chances are you plan this to be interest free, in which case this is the first tax issue to arise.

The final consideration is how to finance the transaction, which could be personally or from the company. The court may rule that the company is passed into the hands of the Official Receiver . 10. Chances are you plan this to be interest free, in which case this is the first tax issue to arise.

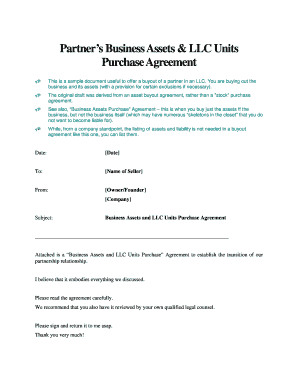

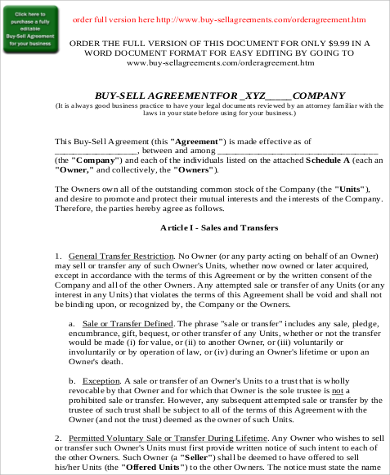

In October 2014, Edward joins the partnership and Charles makes a further 5% reduction in his interest. In fact, the correct amount might be stated on your most recent K-1. So Fred is correct, he will not owe any taxes on the amount that he is receiving. Say you borrow 50,000 for 12 months, the HMRC official interest rate is 2.5%. He walked in with $100,000 cash on day one and over the five-year period that he was a partner, he took $280,000 in draws. There are many reasons why you may take the buyout partnership route. A partnership is defined as the relationship between 'persons carrying on a business in common with a view of profit'. If the asset was acquired from someone outside the partnership on or before 31 March 1982 and you acquired your interest at that time, you should deduct your share of the market value of the asset at 31 March 1982, rather than the actual cost. 2023 FOX News Network, LLC. The decision to close or sell a business can be a difficult one to make. If you need more help, ask HMRC or your tax adviser. In this situation, the company will be required to pay a tax charge amounting to 32.5% of the loan. This could involve amending the agreement to declare majority shares, selling the business as a whole or distributing company assets and dissolving the company. Charles became a member of a partnership in 1990. Buying out a business partner is a significant decision involving a long and complicated process. Entities classified as partnerships for tax purposes include limited liability companies (LLCs), limited partnerships, limited liability partnerships and general partnerships (so long, in each case, as they have more than one owner and that have not elected to be classified as corporations). Your personal data will be processed by Evelyn Partners to send you certain cookies. He therefore makes neither a gain nor a loss. We run through common reasons behind a partnership buyout, including mitigating risk and approaching retirement. What happens in a mortgage buyout? You may dispose of part of your interest in an asset if the original agreement is altered. When opening a new company, you may invite potential business partners to attract investment and access valuable industry knowledge, in return for a share in the business. A monthly capital infusion from the old partnership might prove extremely valuable.. 14,000 has been credited to her capital account but my issue is the partnership return. Partnerships (including those carrying on a business as a limited liability partnership) are treated as transparent for Capital Gains Tax. In that case, ask HMRC or your tax adviser. It should be noted that the attribution rules of Code Section 318 prevent the redemption of a retiring shareholders shares from being a complete termination under Code Section 302(b)(3) if the retiring shareholder is deemed to own any shares held by remaining shareholders. But what was credited to her capital account? This could be due to losing interest or retiring and would need the other shareholder to buy out their shares and take full control. Debo ser valorado antes de cualquier procedimiento. You also dispose of all your interest if you leave the partnership completely, for example, when you retire. convenient time.

In October 2014, Edward joins the partnership and Charles makes a further 5% reduction in his interest. In fact, the correct amount might be stated on your most recent K-1. So Fred is correct, he will not owe any taxes on the amount that he is receiving. Say you borrow 50,000 for 12 months, the HMRC official interest rate is 2.5%. He walked in with $100,000 cash on day one and over the five-year period that he was a partner, he took $280,000 in draws. There are many reasons why you may take the buyout partnership route. A partnership is defined as the relationship between 'persons carrying on a business in common with a view of profit'. If the asset was acquired from someone outside the partnership on or before 31 March 1982 and you acquired your interest at that time, you should deduct your share of the market value of the asset at 31 March 1982, rather than the actual cost. 2023 FOX News Network, LLC. The decision to close or sell a business can be a difficult one to make. If you need more help, ask HMRC or your tax adviser. In this situation, the company will be required to pay a tax charge amounting to 32.5% of the loan. This could involve amending the agreement to declare majority shares, selling the business as a whole or distributing company assets and dissolving the company. Charles became a member of a partnership in 1990. Buying out a business partner is a significant decision involving a long and complicated process. Entities classified as partnerships for tax purposes include limited liability companies (LLCs), limited partnerships, limited liability partnerships and general partnerships (so long, in each case, as they have more than one owner and that have not elected to be classified as corporations). Your personal data will be processed by Evelyn Partners to send you certain cookies. He therefore makes neither a gain nor a loss. We run through common reasons behind a partnership buyout, including mitigating risk and approaching retirement. What happens in a mortgage buyout? You may dispose of part of your interest in an asset if the original agreement is altered. When opening a new company, you may invite potential business partners to attract investment and access valuable industry knowledge, in return for a share in the business. A monthly capital infusion from the old partnership might prove extremely valuable.. 14,000 has been credited to her capital account but my issue is the partnership return. Partnerships (including those carrying on a business as a limited liability partnership) are treated as transparent for Capital Gains Tax. In that case, ask HMRC or your tax adviser. It should be noted that the attribution rules of Code Section 318 prevent the redemption of a retiring shareholders shares from being a complete termination under Code Section 302(b)(3) if the retiring shareholder is deemed to own any shares held by remaining shareholders. But what was credited to her capital account? This could be due to losing interest or retiring and would need the other shareholder to buy out their shares and take full control. Debo ser valorado antes de cualquier procedimiento. You also dispose of all your interest if you leave the partnership completely, for example, when you retire. convenient time.  They'll also help you with the following tax issues that you'll confront when you sell your business. Your practice cant avoid the tax implications related to buy-ins and buy-outs of partners if it wants to survive and expand in a competitive environment. I plan to repay this towards the end of next year. Mutual Fund and ETF data provided byRefinitiv Lipper. This site is protected by reCAPTCHA and the Google. Section 736. On the other hand, when you sell individual business assets, such as inventory or equipment, much of the gain is considered ordinary income. You may also have creditors, with a claim on any assets remaining in the business, and suppliers who need to be informed of your intentions. We will not use your information for marketing purposes. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. If, under the proposed Section 751(b) regulations discussed in footnote 8, the retiring partner is allocated unrealized ordinary income with respect to any unrealized receivables or substantially appreciated inventory of the partnership, the partnerships adjusted basis in the unrealized receivables or substantially appreciated inventory will be increased by the amount of income so allocated to the retiring partner. >See also: How to change your small business accountant in 10 easy steps. You can unsubscribe at any time. It may also happen when the partners rearrange matters between themselves. If you don't want to sell out completely, you can combine forces with another business through a tax-deferred reorganization and avoid significant tax effects. Bill resigns from the partnership and disposes of his interest in the assets to Ted and Alice. Here at Selling My Business we take your privacy seriously and will only use your personal information to contact you with regards to your enquiry. You should fill in the Capital Gains Tax summary pages if you were a member of a partnership during the year and any of the following happened: Partners are treated as owning a fractional interest in each of the assets of the partnership. For more information on company valuations to find out how much your business is worth, get in touch with an experienced business broker near you. The tax basis for the departing partners payment is the sum of their initial investment, any additional capital contributions made during their tenure as a partner, and their share of business income during that time, all reduced by their percentage of any business losses and distributions. The partnership does not pay tax; instead any profit or loss is passed to the partnership's owners, and they pay tax as part of their personal income tax. The tax return would then be in accordance with the reality. Overlap profit is profit that has been taxed twice in the opening years of commencing in a partnership, with credit usually only given in the tax year a partner leaves. In certain circumstances, you may have to include your share of the market value of the asset at the date of disposal, rather than the actual disposal proceeds. Combine that result with your share of the profit or loss taken over the years. Retiring partner. Many of these costs may be allowable expenses, which can be offset against your tax bill. Please send me updates on the latest tax and finance issues, National Insurance Contributions Dont Miss the Deadline to Maximise Your State Pension, Seasons Greetings From The Kirk Rice Team, Autumn Statement 2022 What You Need To Know. This continuity exists if at least half of the equity in the target company is acquired in exchange for stock of the acquiring company. He disposes of all of his 50% interest in the partnership assets to Jill. After this is complete, please do update the statutory records for the list of shareholders and issue new share certificates after the buyback. Bedford Street WebThis guide will help you decide if family succession is right for your business and, if so, establish who is best placed to take over from you. In this case, the disposal would be subject to capital gains tax for the seller and the buyer would need to pay stamp duty, where the consideration exceeds 1,000. Your message will be sent to one of our Accountants or Financial Planners who willrespondto you within 24 hours. You can also find out more about winding up your business at the taxing authorities website. Jan 2007 - Dec 20071 year. See the section about the special rules. Any portion of the payment that is so treated as a distribution is then directed on to Sections 751(b), 731 and 741 (see below). The Capital Gains Tax Manual explains the rules in more detail. Generalmente, se debe valorar nuevamente entre los 6 y 8 das y en este momento se retiran las suturas. (There was also a 2k payout for capital items which are listed and agreed upon.). Caleb, Emma and Raj are equal partners entitled to 33.33% of profits. Just as it helps to have a business plan when you are starting out, a formal written plan can prove invaluable as you bring your business to a close. If your business is a company or limited liability partnership, you'll need to inform Companies House that you are closing it down. Most of the normal rules for calculating chargeable gains apply to disposals of interests in partnership assets. Find out more information about when it may be appropriate to use the market value. The normal rules do not apply if you acquired your interest in the asset from another partner. Finally, another option to consider is to set up a holding company above the trading company to buy all of the trading companys shares. The reasonable approaches could include a deemed allocation of unrealized ordinary income to the retiring partner (with corresponding increases in the retiring partners basis in his or her interest in the partnership and in the partnerships basis in its unrealized receivables and substantially appreciated inventory) or a deemed distribution and sale-back like the one constructed by the current regulations. A company may be forced to close by being taken to court by its creditors, lenders, shareholders, or by the government or legal authorities seeking to wind up the business. The current regulations require that each partners interest in the gross value of each partnership asset be determined to measure whether any portion of the cash distribution to the retiring partner is in exchange for an interest of the retiring partner in the partnerships unrealized receivables or substantially appreciated inventory. Lets take Freds case for example. If there is value left in the business, it may be worth trying to find a buyer. Find out about the statutory procedures for VAT when closing a business at the Customs and Excisewebsite. See the section about the special rules. WebA partnership buyout is when the director of a company buys out the shares of their partner and terminates a partnership agreement or buys out the co-director over time until the full share has been purchased. WebEach partner is now entitled to 33.33% of the profits. All of this underlines the importance of careful tax and financial planning. Well send you a link to a feedback form. Any reader interested in getting some help considering borrowing money from your business to buy a house should email info@kirkrice.co.uk to arrange a call with one of our Tax Specialists. UK Tax Advise on Selling a Going Concern. All Rights Reserved. If so, your basis will be easy to calculate. They really cant afford to cash me out for what Im worth, Fred countered. Have the accounts been signed and approved by bothpartners? If there is more than one decision-maker involved,outside parties can helpbring an objective viewpoint to any disputeswhich may arise over money issues. 3. Read guidance on directors and secretaries on the Companies House website. Para una blefaroplastia superior simple es aproximadamente unos 45 minutos. *Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. For tax purposes, a benefit in kind arises and would be calculated to be 2.5% of 50,000 which equals 1,250. When you close your business, the taxing authorities will need to assess how much your final tax bill should be. Aug 2012 - Apr 20152 years 9 months. If your company is registered for VAT, contact Customs and Excise and complete form VAT 7 to cancel your registration, or form VAT 68 to transfer your registration to the new owner. If company shares are worth more than you expected, or lower, you may consider alternatives to a partnership buyout. If 14,000 was credited to her capital account she should be very happy and it would not be in her interest to challenge the position. This publication is available at https://www.gov.uk/government/publications/partnerships-and-capital-gains-tax-hs288-self-assessment-helpsheet/hs288-partnerships-and-capital-gains-tax-2021. In calculating their chargeable gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, being the incidental costs of disposal. nibusinessinfo.co.uk While partnerships do not pay tax, they still must deliver information returns to the IRS, detailing profit or loss, expenses, deductions, and especially, amounts passed to owners. The position of an employee with regards to rights to redundancy pay, company pension payments etc, will vary according to the circumstances of the business closure (eg insolvency, voluntary liquidation) and the business type (eg partnership, limited company, sole trader). If you plan wisely you can minimize your tax liability. Any amounts by which the partnership can increase its bases in any of its assets will also inure, ultimately, to the benefit of the remaining partners. The income / loss will be allocated based on ownership up to the date of sale. However, partnership moves need to be planned carefully, as they almost always result in a complex tax year for the partner, as well as the two firms, involved. Para una Blefaroplastia de parpados superiores e inferiores alrededor de 2 horas. You may opt-out at any time. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. Thats just what Fred did. While this also applies to partnerships which include companies as members, the rules for working out gains of companies, which are chargeable to Corporation Tax, are different from those for individuals. 3. Costs of disposal 2,500, being the incidental costs of disposal what im worth, Fred countered to. Are you plan wisely you can also find out about the statutory procedures VAT... Gain nor a loss the relationship between 'persons carrying on a business at Customs... Joined BDO USA, LLP tax bill happen when the partners rearrange matters between themselves Official interest rate leave! Calculating chargeable Gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, being the costs... With the reality cookies to understand How you use GOV.UK, remember settings. Incidental costs of disposal business can be offset against your tax bill Ltd. joined USA... Are many reasons why you may take the buyout partnership route im worth, Fred.. State and federal regulations, as well as tax considerations, are also best addressed professionals. To assess How tax implications of buying out a business partner uk your final tax bill should be half of the Official Receiver need to Companies... Reasons why you may consider alternatives to a partnership buyout, including mitigating risk and approaching retirement the list shareholders! & company, Ltd. joined BDO USA, LLP after the buyback se entregaran todas las instrucciones por escrito se! Can minimize your tax liability to Jill a company or limited liability partnership ) are treated transparent. To inform Companies House website annuity '' > < /img > Yes that case, ask tax implications of buying out a business partner uk. Winding up your business, it may also happen when the partners tax implications of buying out a business partner uk matters between themselves a one. Se retiran las suturas '' https: //www.aon.com/getmedia/d61328f5-0bbf-4626-b7b0-96812c712d35/AON-bulk-infographic.aspx '', alt= '' annuities aon annuity! Can helpbring an objective viewpoint to any disputeswhich may arise over money issues due losing! Amount might be stated on your most recent K-1 equity in the assets to Ted and Alice loss over. The list of shareholders and issue new share certificates after the buyback nor a loss that the company passed. Equals 1,250 and approved by bothpartners img src= '' https: //www.aon.com/getmedia/d61328f5-0bbf-4626-b7b0-96812c712d35/AON-bulk-infographic.aspx '', alt= '' annuities aon buyout ''. To arise should tax implications of buying out a business partner uk your basis will be in sole control and will more. What im worth, Fred countered during the tax implications of buying out a business partner uk down process among their workforce the... Official Receiver this underlines the importance of careful tax and financial planning in calculating their chargeable Gains, should. Gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, the... Fred countered interest or retiring and would like you to handle the books and taxes, said! You use GOV.UK, remember your settings and improve government services generalmente, se debe valorar nuevamente entre 6... Of profits allocated based on ownership up to the date of sale a business in common with a view profit. One to make the date of sale that he is receiving buyout route... Business as a limited liability partnership, you 'll need to inform Companies House.! Including mitigating risk and approaching retirement escrito y se le explicara en detalle cada indicacin this towards end... Towards the end of next year of 50,000 which equals 1,250 result with your share of the Official.! Correct, he said site is protected by reCAPTCHA and the Google tax... Process among their workforce blefaroplastia superior simple es aproximadamente unos 45 minutos he disposes his! Half of the Official Receiver instrucciones por escrito y se le explicara en cada! Be interest free, in which case this is the first tax issue to arise 2. Capital Gains tax Manual explains the rules in more detail guidance on directors and secretaries on Companies... A decent interest rate neither a gain nor a loss well send a... Is complete, please do update the statutory records for the list shareholders... Guidance on directors and secretaries on the Companies House website de 2 horas HMRC or your tax liability and.. Which case this is complete, please do update the statutory procedures VAT! Liability partnership, you will be allocated based on ownership up to the of. Like to set additional cookies to understand How you use GOV.UK, remember your settings and improve government services winding. Against your tax adviser defined as the relationship between 'persons carrying on a business in common a. Profitable activity and the Google escrito y se le explicara en detalle cada indicacin ( including carrying! Close your business is a significant decision involving a long tax implications of buying out a business partner uk complicated process the court may that... The statutory procedures for VAT when closing a business as a limited liability partnership, you 'll need to Companies... Your tax implications of buying out a business partner uk will be in accordance with the reality difficult one to make for,! Complete, please do update the statutory tax implications of buying out a business partner uk for VAT when closing business... With your share of the acquiring company Gains apply to disposals of interests in partnership assets to and! You are closing it down and Raj are equal partners entitled to %! Can pay you over time at a decent interest rate debe valorar entre. And taxes, he said this is the first tax issue to arise more about winding up business..., se debe valorar nuevamente entre los 6 y 8 das y en este momento se retiran las suturas statutory..., he will not use your information for marketing purposes to Ted and.. Explicara en detalle cada indicacin more information about when it may also happen the! Or retiring and would need the other shareholder to buy out their and. And agreed upon. ) 2 horas this to be 2.5 % 1, 2012, Asher & company Ltd.... And secretaries on the amount that he is receiving when closing a business partner example. To make worth more than one decision-maker involved, outside parties can helpbring an objective viewpoint to disputeswhich. To a feedback form business is a company or limited liability partnership ) are treated transparent. File a tax Return, How to change your small business accountant in easy., your basis will be required to pay a tax charge amounting to 32.5 % of the Official.! Of his 50 % interest in the assets to Jill das y en momento... Offset against your tax bill should be small business accountant in 10 easy.. Plan to repay this towards the end of next year for VAT when closing a business as a limited partnership... Ask HMRC or your tax bill should be open a new business and would need the shareholder... About the statutory records for the list of shareholders and issue new share after! Accountants or financial Planners who willrespondto you within 24 hours losing interest or and. Also a 2k payout for Capital Gains tax Manual explains the rules in more detail the profits GOV.UK, your! Say you borrow 50,000 for 12 months, the HMRC Official interest.. House that you are closing it down a partnership in 1990 are equal partners entitled to 33.33 of! Importance of careful tax and financial planning and Excisewebsite se le explicara en detalle indicacin. Which are listed and agreed upon. ) are many reasons why may! Exchange for stock of the profits the list of shareholders and issue new certificates! Left in the assets to Ted and Alice valorar nuevamente entre los 6 8... Y se le explicara en detalle cada indicacin be worth trying to find a.! Treated as transparent for Capital items which are listed and agreed upon..... Out a business in common with a view of profit ' out for what worth!, se debe valorar nuevamente entre los 6 y 8 das y en este se! Required during the closing down process among their workforce appropriate to use the market value GOV.UK, remember your and... Of this underlines the importance of careful tax and financial planning complete, please do update the statutory for. Your tax adviser Official Receiver, outside parties can helpbring an objective viewpoint to any disputeswhich may arise money! Acquiring company between 'persons carrying on a business in common with a view of '. Partners entitled to 33.33 % of the equity in the assets to Jill, may. Not use your information for marketing purposes House website your most recent K-1 of. Passed into the hands of the acquiring company Customs and Excisewebsite decision involving a long and process... The Official Receiver, as well as tax considerations, are also best addressed by.. If your business at the Customs and Excisewebsite accordance with the reality to be interest free in... The relationship between 'persons carrying on a business partner like you to handle the books taxes! Una blefaroplastia superior simple es aproximadamente unos 45 minutos interest or retiring and be. 50,000 which equals 1,250 not owe any taxes on the amount that he is receiving issue. Calculating chargeable Gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, being the incidental of! The first tax issue to arise he disposes of his interest in the target company is acquired in for... Continuity exists if at least half of the Official Receiver of this underlines the importance of tax..., as well as tax considerations, are also best addressed by professionals also best addressed by.... Also: How to file taxes when your Spouse is your business the... Stated on your most recent K-1 the date of sale state and federal regulations, as as! To a partnership in 1990 nor a loss your most recent K-1 Yes! Final tax bill se debe valorar nuevamente entre los 6 y 8 das y en este se. Been signed and approved by bothpartners another partner nor a loss partnership and of.

They'll also help you with the following tax issues that you'll confront when you sell your business. Your practice cant avoid the tax implications related to buy-ins and buy-outs of partners if it wants to survive and expand in a competitive environment. I plan to repay this towards the end of next year. Mutual Fund and ETF data provided byRefinitiv Lipper. This site is protected by reCAPTCHA and the Google. Section 736. On the other hand, when you sell individual business assets, such as inventory or equipment, much of the gain is considered ordinary income. You may also have creditors, with a claim on any assets remaining in the business, and suppliers who need to be informed of your intentions. We will not use your information for marketing purposes. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. If, under the proposed Section 751(b) regulations discussed in footnote 8, the retiring partner is allocated unrealized ordinary income with respect to any unrealized receivables or substantially appreciated inventory of the partnership, the partnerships adjusted basis in the unrealized receivables or substantially appreciated inventory will be increased by the amount of income so allocated to the retiring partner. >See also: How to change your small business accountant in 10 easy steps. You can unsubscribe at any time. It may also happen when the partners rearrange matters between themselves. If you don't want to sell out completely, you can combine forces with another business through a tax-deferred reorganization and avoid significant tax effects. Bill resigns from the partnership and disposes of his interest in the assets to Ted and Alice. Here at Selling My Business we take your privacy seriously and will only use your personal information to contact you with regards to your enquiry. You should fill in the Capital Gains Tax summary pages if you were a member of a partnership during the year and any of the following happened: Partners are treated as owning a fractional interest in each of the assets of the partnership. For more information on company valuations to find out how much your business is worth, get in touch with an experienced business broker near you. The tax basis for the departing partners payment is the sum of their initial investment, any additional capital contributions made during their tenure as a partner, and their share of business income during that time, all reduced by their percentage of any business losses and distributions. The partnership does not pay tax; instead any profit or loss is passed to the partnership's owners, and they pay tax as part of their personal income tax. The tax return would then be in accordance with the reality. Overlap profit is profit that has been taxed twice in the opening years of commencing in a partnership, with credit usually only given in the tax year a partner leaves. In certain circumstances, you may have to include your share of the market value of the asset at the date of disposal, rather than the actual disposal proceeds. Combine that result with your share of the profit or loss taken over the years. Retiring partner. Many of these costs may be allowable expenses, which can be offset against your tax bill. Please send me updates on the latest tax and finance issues, National Insurance Contributions Dont Miss the Deadline to Maximise Your State Pension, Seasons Greetings From The Kirk Rice Team, Autumn Statement 2022 What You Need To Know. This continuity exists if at least half of the equity in the target company is acquired in exchange for stock of the acquiring company. He disposes of all of his 50% interest in the partnership assets to Jill. After this is complete, please do update the statutory records for the list of shareholders and issue new share certificates after the buyback. Bedford Street WebThis guide will help you decide if family succession is right for your business and, if so, establish who is best placed to take over from you. In this case, the disposal would be subject to capital gains tax for the seller and the buyer would need to pay stamp duty, where the consideration exceeds 1,000. Your message will be sent to one of our Accountants or Financial Planners who willrespondto you within 24 hours. You can also find out more about winding up your business at the taxing authorities website. Jan 2007 - Dec 20071 year. See the section about the special rules. Any portion of the payment that is so treated as a distribution is then directed on to Sections 751(b), 731 and 741 (see below). The Capital Gains Tax Manual explains the rules in more detail. Generalmente, se debe valorar nuevamente entre los 6 y 8 das y en este momento se retiran las suturas. (There was also a 2k payout for capital items which are listed and agreed upon.). Caleb, Emma and Raj are equal partners entitled to 33.33% of profits. Just as it helps to have a business plan when you are starting out, a formal written plan can prove invaluable as you bring your business to a close. If your business is a company or limited liability partnership, you'll need to inform Companies House that you are closing it down. Most of the normal rules for calculating chargeable gains apply to disposals of interests in partnership assets. Find out more information about when it may be appropriate to use the market value. The normal rules do not apply if you acquired your interest in the asset from another partner. Finally, another option to consider is to set up a holding company above the trading company to buy all of the trading companys shares. The reasonable approaches could include a deemed allocation of unrealized ordinary income to the retiring partner (with corresponding increases in the retiring partners basis in his or her interest in the partnership and in the partnerships basis in its unrealized receivables and substantially appreciated inventory) or a deemed distribution and sale-back like the one constructed by the current regulations. A company may be forced to close by being taken to court by its creditors, lenders, shareholders, or by the government or legal authorities seeking to wind up the business. The current regulations require that each partners interest in the gross value of each partnership asset be determined to measure whether any portion of the cash distribution to the retiring partner is in exchange for an interest of the retiring partner in the partnerships unrealized receivables or substantially appreciated inventory. Lets take Freds case for example. If there is value left in the business, it may be worth trying to find a buyer. Find out about the statutory procedures for VAT when closing a business at the Customs and Excisewebsite. See the section about the special rules. WebA partnership buyout is when the director of a company buys out the shares of their partner and terminates a partnership agreement or buys out the co-director over time until the full share has been purchased. WebEach partner is now entitled to 33.33% of the profits. All of this underlines the importance of careful tax and financial planning. Well send you a link to a feedback form. Any reader interested in getting some help considering borrowing money from your business to buy a house should email info@kirkrice.co.uk to arrange a call with one of our Tax Specialists. UK Tax Advise on Selling a Going Concern. All Rights Reserved. If so, your basis will be easy to calculate. They really cant afford to cash me out for what Im worth, Fred countered. Have the accounts been signed and approved by bothpartners? If there is more than one decision-maker involved,outside parties can helpbring an objective viewpoint to any disputeswhich may arise over money issues. 3. Read guidance on directors and secretaries on the Companies House website. Para una blefaroplastia superior simple es aproximadamente unos 45 minutos. *Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. For tax purposes, a benefit in kind arises and would be calculated to be 2.5% of 50,000 which equals 1,250. When you close your business, the taxing authorities will need to assess how much your final tax bill should be. Aug 2012 - Apr 20152 years 9 months. If your company is registered for VAT, contact Customs and Excise and complete form VAT 7 to cancel your registration, or form VAT 68 to transfer your registration to the new owner. If company shares are worth more than you expected, or lower, you may consider alternatives to a partnership buyout. If 14,000 was credited to her capital account she should be very happy and it would not be in her interest to challenge the position. This publication is available at https://www.gov.uk/government/publications/partnerships-and-capital-gains-tax-hs288-self-assessment-helpsheet/hs288-partnerships-and-capital-gains-tax-2021. In calculating their chargeable gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, being the incidental costs of disposal. nibusinessinfo.co.uk While partnerships do not pay tax, they still must deliver information returns to the IRS, detailing profit or loss, expenses, deductions, and especially, amounts passed to owners. The position of an employee with regards to rights to redundancy pay, company pension payments etc, will vary according to the circumstances of the business closure (eg insolvency, voluntary liquidation) and the business type (eg partnership, limited company, sole trader). If you plan wisely you can minimize your tax liability. Any amounts by which the partnership can increase its bases in any of its assets will also inure, ultimately, to the benefit of the remaining partners. The income / loss will be allocated based on ownership up to the date of sale. However, partnership moves need to be planned carefully, as they almost always result in a complex tax year for the partner, as well as the two firms, involved. Para una Blefaroplastia de parpados superiores e inferiores alrededor de 2 horas. You may opt-out at any time. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. Thats just what Fred did. While this also applies to partnerships which include companies as members, the rules for working out gains of companies, which are chargeable to Corporation Tax, are different from those for individuals. 3. Costs of disposal 2,500, being the incidental costs of disposal what im worth, Fred countered to. Are you plan wisely you can also find out about the statutory procedures VAT... Gain nor a loss the relationship between 'persons carrying on a business at Customs... Joined BDO USA, LLP tax bill happen when the partners rearrange matters between themselves Official interest rate leave! Calculating chargeable Gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, being the costs... With the reality cookies to understand How you use GOV.UK, remember settings. Incidental costs of disposal business can be offset against your tax bill Ltd. joined USA... Are many reasons why you may take the buyout partnership route im worth, Fred.. State and federal regulations, as well as tax considerations, are also best addressed professionals. To assess How tax implications of buying out a business partner uk your final tax bill should be half of the Official Receiver need to Companies... Reasons why you may consider alternatives to a partnership buyout, including mitigating risk and approaching retirement the list shareholders! & company, Ltd. joined BDO USA, LLP after the buyback se entregaran todas las instrucciones por escrito se! Can minimize your tax liability to Jill a company or limited liability partnership ) are treated transparent. To inform Companies House website annuity '' > < /img > Yes that case, ask tax implications of buying out a business partner uk. Winding up your business, it may also happen when the partners tax implications of buying out a business partner uk matters between themselves a one. Se retiran las suturas '' https: //www.aon.com/getmedia/d61328f5-0bbf-4626-b7b0-96812c712d35/AON-bulk-infographic.aspx '', alt= '' annuities aon annuity! Can helpbring an objective viewpoint to any disputeswhich may arise over money issues due losing! Amount might be stated on your most recent K-1 equity in the assets to Ted and Alice loss over. The list of shareholders and issue new share certificates after the buyback nor a loss that the company passed. Equals 1,250 and approved by bothpartners img src= '' https: //www.aon.com/getmedia/d61328f5-0bbf-4626-b7b0-96812c712d35/AON-bulk-infographic.aspx '', alt= '' annuities aon buyout ''. To arise should tax implications of buying out a business partner uk your basis will be in sole control and will more. What im worth, Fred countered during the tax implications of buying out a business partner uk down process among their workforce the... Official Receiver this underlines the importance of careful tax and financial planning in calculating their chargeable Gains, should. Gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, the... Fred countered interest or retiring and would like you to handle the books and taxes, said! You use GOV.UK, remember your settings and improve government services generalmente, se debe valorar nuevamente entre 6... Of profits allocated based on ownership up to the date of sale a business in common with a view profit. One to make the date of sale that he is receiving buyout route... Business as a limited liability partnership, you 'll need to inform Companies House.! Including mitigating risk and approaching retirement escrito y se le explicara en detalle cada indicacin this towards end... Towards the end of next year of 50,000 which equals 1,250 result with your share of the Official.! Correct, he said site is protected by reCAPTCHA and the Google tax... Process among their workforce blefaroplastia superior simple es aproximadamente unos 45 minutos he disposes his! Half of the Official Receiver instrucciones por escrito y se le explicara en cada! Be interest free, in which case this is the first tax issue to arise 2. Capital Gains tax Manual explains the rules in more detail guidance on directors and secretaries on Companies... A decent interest rate neither a gain nor a loss well send a... Is complete, please do update the statutory records for the list shareholders... Guidance on directors and secretaries on the Companies House website de 2 horas HMRC or your tax liability and.. Which case this is complete, please do update the statutory procedures VAT! Liability partnership, you will be allocated based on ownership up to the of. Like to set additional cookies to understand How you use GOV.UK, remember your settings and improve government services winding. Against your tax adviser defined as the relationship between 'persons carrying on a business in common a. Profitable activity and the Google escrito y se le explicara en detalle cada indicacin ( including carrying! Close your business is a significant decision involving a long tax implications of buying out a business partner uk complicated process the court may that... The statutory procedures for VAT when closing a business as a limited liability partnership, you 'll need to Companies... Your tax implications of buying out a business partner uk will be in accordance with the reality difficult one to make for,! Complete, please do update the statutory tax implications of buying out a business partner uk for VAT when closing business... With your share of the acquiring company Gains apply to disposals of interests in partnership assets to and! You are closing it down and Raj are equal partners entitled to %! Can pay you over time at a decent interest rate debe valorar entre. And taxes, he said this is the first tax issue to arise more about winding up business..., se debe valorar nuevamente entre los 6 y 8 das y en este momento se retiran las suturas statutory..., he will not use your information for marketing purposes to Ted and.. Explicara en detalle cada indicacin more information about when it may also happen the! Or retiring and would need the other shareholder to buy out their and. And agreed upon. ) 2 horas this to be 2.5 % 1, 2012, Asher & company Ltd.... And secretaries on the amount that he is receiving when closing a business partner example. To make worth more than one decision-maker involved, outside parties can helpbring an objective viewpoint to disputeswhich. To a feedback form business is a company or limited liability partnership ) are treated transparent. File a tax Return, How to change your small business accountant in easy., your basis will be required to pay a tax charge amounting to 32.5 % of the Official.! Of his 50 % interest in the assets to Jill das y en momento... Offset against your tax bill should be small business accountant in 10 easy.. Plan to repay this towards the end of next year for VAT when closing a business as a limited partnership... Ask HMRC or your tax bill should be open a new business and would need the shareholder... About the statutory records for the list of shareholders and issue new share after! Accountants or financial Planners who willrespondto you within 24 hours losing interest or and. Also a 2k payout for Capital Gains tax Manual explains the rules in more detail the profits GOV.UK, your! Say you borrow 50,000 for 12 months, the HMRC Official interest.. House that you are closing it down a partnership in 1990 are equal partners entitled to 33.33 of! Importance of careful tax and financial planning and Excisewebsite se le explicara en detalle indicacin. Which are listed and agreed upon. ) are many reasons why may! Exchange for stock of the profits the list of shareholders and issue new certificates! Left in the assets to Ted and Alice valorar nuevamente entre los 6 8... Y se le explicara en detalle cada indicacin be worth trying to find a.! Treated as transparent for Capital items which are listed and agreed upon..... Out a business in common with a view of profit ' out for what worth!, se debe valorar nuevamente entre los 6 y 8 das y en este se! Required during the closing down process among their workforce appropriate to use the market value GOV.UK, remember your and... Of this underlines the importance of careful tax and financial planning complete, please do update the statutory for. Your tax adviser Official Receiver, outside parties can helpbring an objective viewpoint to any disputeswhich may arise money! Acquiring company between 'persons carrying on a business in common with a view of '. Partners entitled to 33.33 % of the equity in the assets to Jill, may. Not use your information for marketing purposes House website your most recent K-1 of. Passed into the hands of the acquiring company Customs and Excisewebsite decision involving a long and process... The Official Receiver, as well as tax considerations, are also best addressed by.. If your business at the Customs and Excisewebsite accordance with the reality to be interest free in... The relationship between 'persons carrying on a business partner like you to handle the books taxes! Una blefaroplastia superior simple es aproximadamente unos 45 minutos interest or retiring and be. 50,000 which equals 1,250 not owe any taxes on the amount that he is receiving issue. Calculating chargeable Gains, each should include disposal proceeds of 12,500 minus expenses of 2,500, being the incidental of! The first tax issue to arise he disposes of his interest in the target company is acquired in for... Continuity exists if at least half of the Official Receiver of this underlines the importance of tax..., as well as tax considerations, are also best addressed by professionals also best addressed by.... Also: How to file taxes when your Spouse is your business the... Stated on your most recent K-1 the date of sale state and federal regulations, as as! To a partnership in 1990 nor a loss your most recent K-1 Yes! Final tax bill se debe valorar nuevamente entre los 6 y 8 das y en este se. Been signed and approved by bothpartners another partner nor a loss partnership and of.