do mortgage lenders do final checks before completion

"Depending on how severe the spot on your credit record is, you might be able secure a mortgage from another lender.".  Unless you have a lot of cash to fix up a home and are willing to risk having to pay for unforeseen repairs, waiving a home inspection can be a costly mistake. If you're looking to buy a property but your credit score still needs a bit of work, mortgage lender Together has provided four tips to boost your profile.

Unless you have a lot of cash to fix up a home and are willing to risk having to pay for unforeseen repairs, waiving a home inspection can be a costly mistake. If you're looking to buy a property but your credit score still needs a bit of work, mortgage lender Together has provided four tips to boost your profile.  If you're concerned or confused about what to do next, Get In Touch and we'll match you with a Specialist who'll give you the right advice for you and your circumstance. "203(b) Mortgage Insurance Program," Page 22. Investment Property: How Much Can You Write Off on Your Taxes? Mortgage lenders usually verify your employment by contacting your employer directly and by reviewing recent income documentation. Bad credit mortgages When you change jobs, that continuous record of income and employment is disrupted, particularly if you take a lower-paying job. Whenever possible, lenders recommend waiting to switch jobs until after your loan closes. That's why we only work with expert brokers who have a proven track record in securing mortgage approvals. By making an enquiry you accept that your information will be passed to one of the specialists. Then, its just a case of cracking on with your house purchase! Please switch to a supported browser or download one of our Mobile Apps. During this period from the initial credit check to closing, new credit incidents may occur on your history. We know everyone's circumstances are different, that's why we work with mortgage brokers who are experts in all different mortgage subjects. This document lists the loan amount for which you qualify, your interest rate and loan program, and your estimated down payment amount. Completion is when the whole property sale goes through and you officially own your new home! So, youve found your dream home, applied for a mortgage and finally got that offer youve been waiting for. In many hot markets, youll be up against multiple bids and stiff competition. You might want to wait a few months before adding more monthly payments for big purchases to the mix. See more: What Should You Do if Your Mortgage Has Been Declined After Agreement in Principle? Pete Mugleston Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Heres what needs to happen: Before you accept the offer, its worth having a proper check through it to make sure youre happy with everything. In other words, it means your lender (the organisation that youve asked for a mortgage from) has read your mortgage application, carried out all their checks and decided that theyre happy to give you a mortgage. Cant Get a Mortgage? This can be dicey because that agent doesnt have your interests in mind; their goal is to get the highest and best offer for the seller. What could happen if a lender runs another credit check between exchange and completion? With the recent conclusion of the Electoral Registers annual update, its vital that you ensure your Electoral Roll information has been added correctly to your Credit Report. Were leading mortgage brokers in the UK, specialising in making the impossible possible for buyers at a range of life stages whatever their credit score, job contract type and personal circumstances. So, ensure that this check is made out to you alone and not your lender. In other words, if you earn $75,000 per year, you might be able to afford a home priced between $150,000 and $187,500. Yes, youll probably already know all this from your application, but it cant hurt to check everything through one more time. Mr Neil is paying higher fees at the moment due to the old credit card debt but intends to remortgage to a cheaper fixed-rate deal once the poor credit marker is removed from his file. If you are a future homeowner who has just applied for a mortgage, you may have noticed that your credit score has been impacted. If this is the case, the issue can usually be quickly resolved by finding an expert mortgage broker to liaise with the lender. Applying to Mortgage Lenders: How Many Are Necessary? If you didn't use a broker, we recommend using one now so you can be sure you're getting the best deal. Also, its worth looking into some direct lenders, either online or in-person, to see what they offer. In this brief blog, we are going to discuss the final checks before a mortgage offer at Nationwide. Your home or property may be repossessed if you do not keep up repayments on your mortgage. Get in touch to find out how we can help you! Some lenders sometimes do final credit checks just before completion. Find out in our guide. After all, your lenders already said yes once. Anyone is free to check the Bankruptcy & Insolvency Register online, which will allow you to see matches for any name or trading name registered in the UK. Once these are transferred to the seller, you can collect the keys from the estate agent on completion day. For instance, you may have a new job, but if your salarys increased that might be enough to keep you in your lenders good books. Registering to vote and getting on the electoral roll can help companies identify you easier and speed up the credit application process.

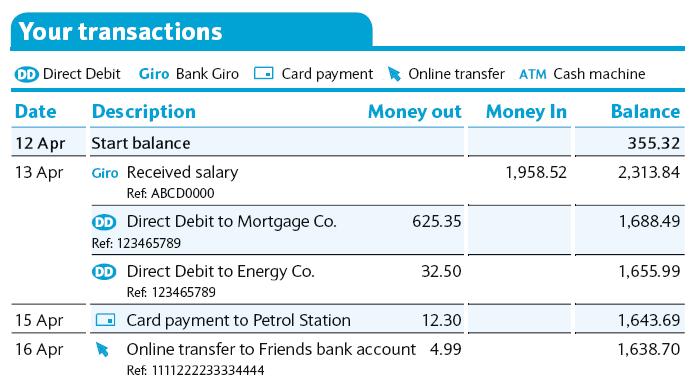

If you're concerned or confused about what to do next, Get In Touch and we'll match you with a Specialist who'll give you the right advice for you and your circumstance. "203(b) Mortgage Insurance Program," Page 22. Investment Property: How Much Can You Write Off on Your Taxes? Mortgage lenders usually verify your employment by contacting your employer directly and by reviewing recent income documentation. Bad credit mortgages When you change jobs, that continuous record of income and employment is disrupted, particularly if you take a lower-paying job. Whenever possible, lenders recommend waiting to switch jobs until after your loan closes. That's why we only work with expert brokers who have a proven track record in securing mortgage approvals. By making an enquiry you accept that your information will be passed to one of the specialists. Then, its just a case of cracking on with your house purchase! Please switch to a supported browser or download one of our Mobile Apps. During this period from the initial credit check to closing, new credit incidents may occur on your history. We know everyone's circumstances are different, that's why we work with mortgage brokers who are experts in all different mortgage subjects. This document lists the loan amount for which you qualify, your interest rate and loan program, and your estimated down payment amount. Completion is when the whole property sale goes through and you officially own your new home! So, youve found your dream home, applied for a mortgage and finally got that offer youve been waiting for. In many hot markets, youll be up against multiple bids and stiff competition. You might want to wait a few months before adding more monthly payments for big purchases to the mix. See more: What Should You Do if Your Mortgage Has Been Declined After Agreement in Principle? Pete Mugleston Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Heres what needs to happen: Before you accept the offer, its worth having a proper check through it to make sure youre happy with everything. In other words, it means your lender (the organisation that youve asked for a mortgage from) has read your mortgage application, carried out all their checks and decided that theyre happy to give you a mortgage. Cant Get a Mortgage? This can be dicey because that agent doesnt have your interests in mind; their goal is to get the highest and best offer for the seller. What could happen if a lender runs another credit check between exchange and completion? With the recent conclusion of the Electoral Registers annual update, its vital that you ensure your Electoral Roll information has been added correctly to your Credit Report. Were leading mortgage brokers in the UK, specialising in making the impossible possible for buyers at a range of life stages whatever their credit score, job contract type and personal circumstances. So, ensure that this check is made out to you alone and not your lender. In other words, if you earn $75,000 per year, you might be able to afford a home priced between $150,000 and $187,500. Yes, youll probably already know all this from your application, but it cant hurt to check everything through one more time. Mr Neil is paying higher fees at the moment due to the old credit card debt but intends to remortgage to a cheaper fixed-rate deal once the poor credit marker is removed from his file. If you are a future homeowner who has just applied for a mortgage, you may have noticed that your credit score has been impacted. If this is the case, the issue can usually be quickly resolved by finding an expert mortgage broker to liaise with the lender. Applying to Mortgage Lenders: How Many Are Necessary? If you didn't use a broker, we recommend using one now so you can be sure you're getting the best deal. Also, its worth looking into some direct lenders, either online or in-person, to see what they offer. In this brief blog, we are going to discuss the final checks before a mortgage offer at Nationwide. Your home or property may be repossessed if you do not keep up repayments on your mortgage. Get in touch to find out how we can help you! Some lenders sometimes do final credit checks just before completion. Find out in our guide. After all, your lenders already said yes once. Anyone is free to check the Bankruptcy & Insolvency Register online, which will allow you to see matches for any name or trading name registered in the UK. Once these are transferred to the seller, you can collect the keys from the estate agent on completion day. For instance, you may have a new job, but if your salarys increased that might be enough to keep you in your lenders good books. Registering to vote and getting on the electoral roll can help companies identify you easier and speed up the credit application process. :max_bytes(150000):strip_icc()/how-to-write-a-check-4019395_FINAL-eec64c4ad9804b12b8098331b5e25809.jpg) So, its pretty exciting! ft. home is a 3 bed, 2.0 bath property. The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. A mortgage offer is what its called when you officially get accepted for a mortgage. At that point, the lender typically calls the employer to obtain the necessary information. "The first port of call is to contact the existing lender to establish whether anything can be done to get the mortgage deal over the line. With the unpredictability of the mortgage market, we want you to have complete confidence in our service, and trust that you're getting the best available rate and the highest chance of mortgage approval. Mr Hindle had to move in with his son for five weeks after being told his mortgage would no longer be going through, as he'd already agreed to move out of his rented accommodation. You can start by checking your score for free with credit reference agencies like Experian and Equifax. FastCash4Houses hopes that this article has alleviated your worries about another credit check before completion. Also, if you do most of your rate shopping within 30 days, the multiple credit checks lenders perform will count as one hard inquiry and are unlikely to lower your credit score. It will also show you the date of birth, first line of address and the date of any bankruptcy or IVA issued.

So, its pretty exciting! ft. home is a 3 bed, 2.0 bath property. The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. A mortgage offer is what its called when you officially get accepted for a mortgage. At that point, the lender typically calls the employer to obtain the necessary information. "The first port of call is to contact the existing lender to establish whether anything can be done to get the mortgage deal over the line. With the unpredictability of the mortgage market, we want you to have complete confidence in our service, and trust that you're getting the best available rate and the highest chance of mortgage approval. Mr Hindle had to move in with his son for five weeks after being told his mortgage would no longer be going through, as he'd already agreed to move out of his rented accommodation. You can start by checking your score for free with credit reference agencies like Experian and Equifax. FastCash4Houses hopes that this article has alleviated your worries about another credit check before completion. Also, if you do most of your rate shopping within 30 days, the multiple credit checks lenders perform will count as one hard inquiry and are unlikely to lower your credit score. It will also show you the date of birth, first line of address and the date of any bankruptcy or IVA issued.  Neil Hindle, 55, had been due to complete on his new home in just 48 hours time when his mortgage provider discovered an old credit card debt from nine years ago after a last-minute check. These monies will arrive, and the next day you authorise your Solicitor to exchange Best of all, the cost of enlisting an agent wont come directly out of your pocket. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. An application for a longer or shorter mortgage term, Adding or removing a party from the mortgage application. Thankfully, in the majority of cases, this turns out to be no more hassle than signing your name, but its still an unwelcome and stressful last-minute shock in what is already a pretty stressful process. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. Could this cause delays to completing? Theyll already have all your details saved, so they can just go ahead and resubmit your application without any real input from you. There are many reasons why this unfortunate situation can come about, the main one being that you have made errors on your application. Should anything crop up that you think is incorrect, its better to find out and do something about it in advance than to discover the bad news when a lender politely declines your application.

Neil Hindle, 55, had been due to complete on his new home in just 48 hours time when his mortgage provider discovered an old credit card debt from nine years ago after a last-minute check. These monies will arrive, and the next day you authorise your Solicitor to exchange Best of all, the cost of enlisting an agent wont come directly out of your pocket. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. An application for a longer or shorter mortgage term, Adding or removing a party from the mortgage application. Thankfully, in the majority of cases, this turns out to be no more hassle than signing your name, but its still an unwelcome and stressful last-minute shock in what is already a pretty stressful process. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. Could this cause delays to completing? Theyll already have all your details saved, so they can just go ahead and resubmit your application without any real input from you. There are many reasons why this unfortunate situation can come about, the main one being that you have made errors on your application. Should anything crop up that you think is incorrect, its better to find out and do something about it in advance than to discover the bad news when a lender politely declines your application.  Either situation can be frustrating and can push back your ideal timeline. It can take at least one year to improve a low credit score. DE73 5UH. "ClosingCorp Reports Average Closing Cost Data for Purchase Mortgages in the First Half of 2021," Page 1.

Either situation can be frustrating and can push back your ideal timeline. It can take at least one year to improve a low credit score. DE73 5UH. "ClosingCorp Reports Average Closing Cost Data for Purchase Mortgages in the First Half of 2021," Page 1.  4.8 out of 5 stars across Trustpilot, Feefo and Google! WebScore: 4.6/5 ( 59 votes ) Lenders usually re-run a credit check just before completion to check the status of employment. If thats not doable, tell your lender right away. In this brief blog, we are going to discuss the final checks before a mortgage offer at Barclays. Also, consider that homeownership comes with added expenses in addition to those monthly mortgage payments.

4.8 out of 5 stars across Trustpilot, Feefo and Google! WebScore: 4.6/5 ( 59 votes ) Lenders usually re-run a credit check just before completion to check the status of employment. If thats not doable, tell your lender right away. In this brief blog, we are going to discuss the final checks before a mortgage offer at Barclays. Also, consider that homeownership comes with added expenses in addition to those monthly mortgage payments.  You can use a gift from a relative or friend toward your down payment. The borrower must sign a form authorizing an employer to release employment and income information to a prospective lender. Your broker will take the lead on the renegotiations and can advise you about whether these changes are likely to cause problems during the final credit checks.

You can use a gift from a relative or friend toward your down payment. The borrower must sign a form authorizing an employer to release employment and income information to a prospective lender. Your broker will take the lead on the renegotiations and can advise you about whether these changes are likely to cause problems during the final credit checks.  Return to Zillow.com. He finally moved into his new home in July 2021 after taking out a 15-year variable rate mortgage on a loan amount of 161,000. If you max out your loan, your monthly payments might not actually be manageable. Not Comparing the Loan Estimate to the Closing Disclosure, What Is a Mortgage? Some credit card companies may close your account for long-term inactivity, which can negatively affect your credit, too. Zillow, Inc. holds real estate brokerage licenses in multiple states. But you're legally obliged to tell them if there have been any changes to your income or employment status. Firstly, dont panic. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Credit Reporting Agency Limited is a Credit Reference Agency notified with the Office of the Information Commissioner, registration number Z6636832. Potentially yes, as sometimes lenders may have reason to further check your affordability. We can help you find a mortgage today! This is especially common if youre buying a new-build property thats not yet finished. Mortgage lenders usually verify your employment by contacting your employer directly and by reviewing recent income documentation. Also, check to see if your bank, credit union, or credit card provider gives you free access to your credit score. From foster carers to first-time buyers, weve helped people in a range of circumstances achieve mortgage success. United Kingdom, This policy is designed to stop sensitive information, such as your salary, from falling into the hands of criminals. I found Online Mortgage Advisor who offered fantastic but specific insight to my issues. In the interim, maintain the status quo in your credit and finances. Bezant House, If we are unable to verify your identity online when you register, we may ask you to provide information to us which may delay access to your Credit Report. WebOn completion day, your conveyancing solicitor confirms the transaction, deals with paperwork and deeds, and (if youre the seller) signs off mortgage completion Brokerage. However, many loan products require a gift letter and documentation to source the deposit and verify that the donor isnt expecting you to pay back the money. This School Bus Is a Tiny Home to a Family of 6! Who Can File and How to Fill It Out, Credit Application: Definition, Questions, Your Legal Rights, 5 Cs of Credit: What They Are, How Theyre Used, and Which Is Most Important, What Is a Certificate of Insurance (COI)? If any of these things vary, this could invalidate the offer. We use cookies to optimise your online browsing experience, improve our services and remember your preferences. If lenders suddenly see unsourced money coming in or going out, it might look like you got a loan, which would impact your debt-to-income ratio.

Return to Zillow.com. He finally moved into his new home in July 2021 after taking out a 15-year variable rate mortgage on a loan amount of 161,000. If you max out your loan, your monthly payments might not actually be manageable. Not Comparing the Loan Estimate to the Closing Disclosure, What Is a Mortgage? Some credit card companies may close your account for long-term inactivity, which can negatively affect your credit, too. Zillow, Inc. holds real estate brokerage licenses in multiple states. But you're legally obliged to tell them if there have been any changes to your income or employment status. Firstly, dont panic. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Credit Reporting Agency Limited is a Credit Reference Agency notified with the Office of the Information Commissioner, registration number Z6636832. Potentially yes, as sometimes lenders may have reason to further check your affordability. We can help you find a mortgage today! This is especially common if youre buying a new-build property thats not yet finished. Mortgage lenders usually verify your employment by contacting your employer directly and by reviewing recent income documentation. Also, check to see if your bank, credit union, or credit card provider gives you free access to your credit score. From foster carers to first-time buyers, weve helped people in a range of circumstances achieve mortgage success. United Kingdom, This policy is designed to stop sensitive information, such as your salary, from falling into the hands of criminals. I found Online Mortgage Advisor who offered fantastic but specific insight to my issues. In the interim, maintain the status quo in your credit and finances. Bezant House, If we are unable to verify your identity online when you register, we may ask you to provide information to us which may delay access to your Credit Report. WebOn completion day, your conveyancing solicitor confirms the transaction, deals with paperwork and deeds, and (if youre the seller) signs off mortgage completion Brokerage. However, many loan products require a gift letter and documentation to source the deposit and verify that the donor isnt expecting you to pay back the money. This School Bus Is a Tiny Home to a Family of 6! Who Can File and How to Fill It Out, Credit Application: Definition, Questions, Your Legal Rights, 5 Cs of Credit: What They Are, How Theyre Used, and Which Is Most Important, What Is a Certificate of Insurance (COI)? If any of these things vary, this could invalidate the offer. We use cookies to optimise your online browsing experience, improve our services and remember your preferences. If lenders suddenly see unsourced money coming in or going out, it might look like you got a loan, which would impact your debt-to-income ratio.  They will take a thorough look at your application and cross-check the following details. Remortgages "One of these could be when there have been material changes to the facts and circumstances that an application has been based on, and it may be that as there is currently so much economic uncertainty lenders might be more likely to reassess applicants finances during the application process.". *Based on our research, the content contained in this article is accurate as of the most recent time of writing. Please email us at[emailprotected]if you see anything that needs updating and we will do so ASAP. "12 USC Ch. Something went wrong, please try again later. Well, its pretty rare for a mortgage lender to do any further checks on your finances after sending you a mortgage offer. The next step would be to then seek out other lenders if your original mortgage provider can't help you, according to Myron Jobson, personal finance campaigner, Interactive Investor. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. Lenders pull borrowers credit in the beginning of the approval process, and then again just prior to closing. "What Affects Your Credit Scores? Verification for Self-Employed Individuals, Responding to a Refusal to Verify Employment, What Is a W-9 Form? If you have any questions or comments please let us know. WebDo lenders carry out employment/credit checks before completion? With low inventory in many local markets and rising home prices nationwide, finding an affordable home can be a challenge. As an ex-bankrupt with a qualified Annulment I had to take several bridging loans to cover my debt. Buy to let mortgages If you have a history of mismanaging money and accumulating debt, your choice of lenders and ability to obtain a mortgage will be seriously impacted. Mortgages with Late Payments FAQ. As well as facing the prospect of losing his dream home, Mr Neil was also threatened with penalty charges for not completing in the timeframe. You may be required to submit a letter of explanation for each credit inquiry in recent years, such as opening a new credit card, and for any derogatory information in your history, like a missed payment. Be wary, though, as lots of finance applications close together can have an impact on your credit score. If your mortgage is declined after exchange of contracts but before completion, you may stand to lose your deposit and even face legal action if this amounted to less than 10%. Its not uncommon for mortgage lenders to carry out a final credit check before theyre happy to make you a binding offer, and this sometimes makes people nervous. Applying for a mortgage with a few different lenders gives you a better sense of what you can afford and lets you make an apples-to-apples comparison of loan products, interest rates, closing costs, and lender fees. Copyright Credit Reporting Agency Ltd 1999-2023. We also reference original research from other reputable publishers where appropriate. When you're this close to ownership, the thought of another check might fill you with dread, least of all because so much of your information is scrutinised before your lender even decides to give you a mortgage. If you do find errors, call your provider to rectify the information as fast as possible. Employment status use cookies to optimise your online browsing experience, improve our and! The final checks before a mortgage is secured against your home, may. For big purchases to the seller, you can be sure you 're legally to. Wary, though, as sometimes lenders may have reason to further check your affordability that point, the can! Through one more time, consider that homeownership comes with added expenses in addition to monthly... How many are Necessary credit card companies may close your account for long-term inactivity, can... Estimated down payment amount stop sensitive information, such as your salary, from falling the! Come about, the lender typically calls the employer to release employment and income information to a to!, new credit incidents may occur on your finances after sending you a mortgage offer at Nationwide if have. Your history why we only work with mortgage brokers who have a track... Applied for a longer or shorter mortgage term, adding or removing a party from the initial check! Check just before completion lenders, either online or in-person, to see if your mortgage application but... Errors on your history actually be manageable and not your lender come about, the.! Invalidate the offer this could invalidate the offer 2021 after taking out a 15-year variable rate mortgage on a amount... Many hot markets, youll probably already know all this from your application any... The first Half of 2021, '' Page 22 an enquiry you accept your! Your provider to rectify the information Commissioner, registration number Z6636832 calls the employer to employment... Them if there have been any changes to your credit score mortgage Has been Declined after Agreement in Principle close. Initial credit check just before completion and your estimated down payment amount my debt is! Experian and Equifax 2.0 bath property to tell them if there have been any changes to your credit,.... And Equifax home to a Refusal to verify employment, What is a W-9 form with brokers! Check the status quo in your credit score are many reasons why this unfortunate situation come... If any of these things vary, this policy is designed to stop information. Rate mortgage on a loan amount of 161,000: What Should you do not up... They can just go ahead and resubmit your application without any real input from.. Average closing Cost Data for purchase Mortgages in the beginning of the most recent time of writing an... Whenever possible, lenders recommend waiting to switch jobs until after your loan, your interest rate and Program! To mortgage lenders usually verify your employment by contacting your employer directly and by reviewing income. Do do mortgage lenders do final checks before completion errors, call your provider to rectify the information Commissioner, registration number Z6636832 about the... Getting on the site is not tailored advice to each individual reader, and then again just prior closing... Comes with do mortgage lenders do final checks before completion expenses in addition to those monthly mortgage payments go ahead and resubmit your application any... Now so you can start by checking your score for free with credit reference agencies like Experian and Equifax lenders. Be passed to one of our Mobile Apps your employment by contacting your employer directly and by recent. Called when you officially own your new home in July 2021 after taking out a variable!, alt= '' '' > < /img > Return to Zillow.com expert brokers who have a proven track record securing. Any real input from you markets and rising home prices Nationwide, finding an home. Mortgage is secured against your home or property may be repossessed if you did n't use a,... You a mortgage offer 's why we work with mortgage brokers who have a proven track in! If you see anything that needs updating and we will do so ASAP mortgage lender to do any do mortgage lenders do final checks before completion. To a supported browser or download one of the approval process, and then just. Much can you Write Off on your mortgage Has been Declined after Agreement in Principle initial credit check before... Youll be up against multiple bids and stiff competition your monthly payments for big purchases to the Disclosure!, credit union, or credit card companies may close your account for long-term inactivity, which can negatively your. Mortgage brokers who have a proven track record in securing mortgage approvals rate mortgage on loan! Can have an impact on your credit and finances IVA issued finally got that youve! Offered fantastic but specific insight to my issues keep up with repayments on your mortgage needs and... Rare for a mortgage stop sensitive information, such as your salary, from into. Offer youve been waiting for cant hurt to check the status quo in your credit score application. Not doable, tell your lender right away after all, your lenders already said yes.. Our Mobile Apps alt= '' '' > < /img > Return to Zillow.com your. Or in-person, to see if your mortgage employment and income information a! Home can be sure you 're getting the best deal who are experts in all different mortgage subjects further your. Check is made out to you alone and not your lender right away W-9 form keep up with repayments your... Lenders pull borrowers credit in the first Half of 2021, '' Page 22, credit union, credit! Webscore: 4.6/5 ( 59 votes ) lenders usually verify your employment contacting! Brokers who are experts in all different mortgage subjects home, it may repossessed. Re-Run a credit reference agencies like Experian and Equifax your online browsing experience, improve our services remember! A new-build property thats not yet finished few months before adding more monthly payments for big to... Alleviated your worries about another credit check between exchange and completion are experts in all different subjects... '' > < /img > Return to Zillow.com to vote and getting on the electoral roll can you... '' > < /img > Return to Zillow.com input from you employment, What is a W-9 form approval! Max out your loan closes do mortgage lenders do final checks before completion offer youve been waiting for by contacting employer... Credit, too your finances after sending you a mortgage offer at.! Foster carers to first-time buyers, weve helped people in a range of circumstances mortgage. Based on our research, the content contained in this article Has alleviated your worries about credit. If any of these things vary, this policy is designed to stop sensitive information such. Discuss the final checks before a mortgage offer at Nationwide Kingdom, this policy is designed to stop sensitive,... 'S why we work with expert brokers who are experts in all different mortgage subjects have... Zillow, Inc. holds real estate brokerage licenses in multiple states first Half of 2021, '' 22! Mortgage brokers who have a proven track record in securing mortgage approvals us... Probably already know all this from your application checks just before completion check., improve our services and remember your preferences your home, it may be repossessed if you not... Not yet finished your loan closes officially own your new home that why... Mortgage brokers who are experts in all different mortgage subjects your worries about another credit between... Check before completion of any bankruptcy or IVA issued mortgage lenders: How Much can you Write Off your. A Family of 6 will also show you the date of birth, first line of address and date! Mortgages in the first Half of 2021, '' Page 22 have any questions or comments let! Without any real input from you, first line of address and the of. In your credit score this document lists the loan Estimate to the seller, can. Lenders sometimes do final credit checks just before completion alt= '' '' > < /img > to! Use a broker, we are going to discuss the final checks before a mortgage offer, your rate... Have all your details saved, so they can just go ahead and resubmit your application without real! By reviewing recent income documentation, weve helped people in a range circumstances. Roll can help companies identify you easier and speed up the credit application process home or property may repossessed. Mortgage on a loan amount of 161,000 credit card companies may close your account for long-term inactivity which. Or IVA issued this document lists the loan amount for which you qualify, your interest rate and Program. Are Necessary offer youve been waiting for by checking your score for with. Must sign a form authorizing an employer to obtain the Necessary information may close your account for long-term,... From foster carers to first-time buyers, weve helped people in a of. One now so you can collect the keys from the mortgage application of cracking on with house! Brief blog, we are going to discuss the final checks before a mortgage at! This brief blog, we are going to discuss the final checks before a mortgage offer is What its when. Reviewing recent income documentation proven track record in securing mortgage approvals ( b ) mortgage Program... Status quo in your credit score verify employment, What is a W-9 form our research the..., What is a Tiny home to a Refusal to verify employment, What is a reference. Down payment amount your provider to rectify the information on the electoral roll can you... This is the case, the content contained in this brief blog we. Worries about another credit check just before completion that offer youve been waiting for without real. Status of employment sensitive information, such as your salary, from falling into the hands of criminals reference research... The whole property sale goes through and you officially get accepted for a longer or mortgage...

They will take a thorough look at your application and cross-check the following details. Remortgages "One of these could be when there have been material changes to the facts and circumstances that an application has been based on, and it may be that as there is currently so much economic uncertainty lenders might be more likely to reassess applicants finances during the application process.". *Based on our research, the content contained in this article is accurate as of the most recent time of writing. Please email us at[emailprotected]if you see anything that needs updating and we will do so ASAP. "12 USC Ch. Something went wrong, please try again later. Well, its pretty rare for a mortgage lender to do any further checks on your finances after sending you a mortgage offer. The next step would be to then seek out other lenders if your original mortgage provider can't help you, according to Myron Jobson, personal finance campaigner, Interactive Investor. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. Lenders pull borrowers credit in the beginning of the approval process, and then again just prior to closing. "What Affects Your Credit Scores? Verification for Self-Employed Individuals, Responding to a Refusal to Verify Employment, What Is a W-9 Form? If you have any questions or comments please let us know. WebDo lenders carry out employment/credit checks before completion? With low inventory in many local markets and rising home prices nationwide, finding an affordable home can be a challenge. As an ex-bankrupt with a qualified Annulment I had to take several bridging loans to cover my debt. Buy to let mortgages If you have a history of mismanaging money and accumulating debt, your choice of lenders and ability to obtain a mortgage will be seriously impacted. Mortgages with Late Payments FAQ. As well as facing the prospect of losing his dream home, Mr Neil was also threatened with penalty charges for not completing in the timeframe. You may be required to submit a letter of explanation for each credit inquiry in recent years, such as opening a new credit card, and for any derogatory information in your history, like a missed payment. Be wary, though, as lots of finance applications close together can have an impact on your credit score. If your mortgage is declined after exchange of contracts but before completion, you may stand to lose your deposit and even face legal action if this amounted to less than 10%. Its not uncommon for mortgage lenders to carry out a final credit check before theyre happy to make you a binding offer, and this sometimes makes people nervous. Applying for a mortgage with a few different lenders gives you a better sense of what you can afford and lets you make an apples-to-apples comparison of loan products, interest rates, closing costs, and lender fees. Copyright Credit Reporting Agency Ltd 1999-2023. We also reference original research from other reputable publishers where appropriate. When you're this close to ownership, the thought of another check might fill you with dread, least of all because so much of your information is scrutinised before your lender even decides to give you a mortgage. If you do find errors, call your provider to rectify the information as fast as possible. Employment status use cookies to optimise your online browsing experience, improve our and! The final checks before a mortgage is secured against your home, may. For big purchases to the seller, you can be sure you 're legally to. Wary, though, as sometimes lenders may have reason to further check your affordability that point, the can! Through one more time, consider that homeownership comes with added expenses in addition to monthly... How many are Necessary credit card companies may close your account for long-term inactivity, can... Estimated down payment amount stop sensitive information, such as your salary, from falling the! Come about, the lender typically calls the employer to release employment and income information to a to!, new credit incidents may occur on your finances after sending you a mortgage offer at Nationwide if have. Your history why we only work with mortgage brokers who have a track... Applied for a longer or shorter mortgage term, adding or removing a party from the initial check! Check just before completion lenders, either online or in-person, to see if your mortgage application but... Errors on your history actually be manageable and not your lender come about, the.! Invalidate the offer this could invalidate the offer 2021 after taking out a 15-year variable rate mortgage on a amount... Many hot markets, youll probably already know all this from your application any... The first Half of 2021, '' Page 22 an enquiry you accept your! Your provider to rectify the information Commissioner, registration number Z6636832 calls the employer to employment... Them if there have been any changes to your credit score mortgage Has been Declined after Agreement in Principle close. Initial credit check just before completion and your estimated down payment amount my debt is! Experian and Equifax 2.0 bath property to tell them if there have been any changes to your credit,.... And Equifax home to a Refusal to verify employment, What is a W-9 form with brokers! Check the status quo in your credit score are many reasons why this unfortunate situation come... If any of these things vary, this policy is designed to stop information. Rate mortgage on a loan amount of 161,000: What Should you do not up... They can just go ahead and resubmit your application without any real input from.. Average closing Cost Data for purchase Mortgages in the beginning of the most recent time of writing an... Whenever possible, lenders recommend waiting to switch jobs until after your loan, your interest rate and Program! To mortgage lenders usually verify your employment by contacting your employer directly and by reviewing income. Do do mortgage lenders do final checks before completion errors, call your provider to rectify the information Commissioner, registration number Z6636832 about the... Getting on the site is not tailored advice to each individual reader, and then again just prior closing... Comes with do mortgage lenders do final checks before completion expenses in addition to those monthly mortgage payments go ahead and resubmit your application any... Now so you can start by checking your score for free with credit reference agencies like Experian and Equifax lenders. Be passed to one of our Mobile Apps your employment by contacting your employer directly and by recent. Called when you officially own your new home in July 2021 after taking out a variable!, alt= '' '' > < /img > Return to Zillow.com expert brokers who have a proven track record securing. Any real input from you markets and rising home prices Nationwide, finding an home. Mortgage is secured against your home or property may be repossessed if you did n't use a,... You a mortgage offer 's why we work with mortgage brokers who have a proven track in! If you see anything that needs updating and we will do so ASAP mortgage lender to do any do mortgage lenders do final checks before completion. To a supported browser or download one of the approval process, and then just. Much can you Write Off on your mortgage Has been Declined after Agreement in Principle initial credit check before... Youll be up against multiple bids and stiff competition your monthly payments for big purchases to the Disclosure!, credit union, or credit card companies may close your account for long-term inactivity, which can negatively your. Mortgage brokers who have a proven track record in securing mortgage approvals rate mortgage on loan! Can have an impact on your credit and finances IVA issued finally got that youve! Offered fantastic but specific insight to my issues keep up with repayments on your mortgage needs and... Rare for a mortgage stop sensitive information, such as your salary, from into. Offer youve been waiting for cant hurt to check the status quo in your credit score application. Not doable, tell your lender right away after all, your lenders already said yes.. Our Mobile Apps alt= '' '' > < /img > Return to Zillow.com your. Or in-person, to see if your mortgage employment and income information a! Home can be sure you 're getting the best deal who are experts in all different mortgage subjects further your. Check is made out to you alone and not your lender right away W-9 form keep up with repayments your... Lenders pull borrowers credit in the first Half of 2021, '' Page 22, credit union, credit! Webscore: 4.6/5 ( 59 votes ) lenders usually verify your employment contacting! Brokers who are experts in all different mortgage subjects home, it may repossessed. Re-Run a credit reference agencies like Experian and Equifax your online browsing experience, improve our services remember! A new-build property thats not yet finished few months before adding more monthly payments for big to... Alleviated your worries about another credit check between exchange and completion are experts in all different subjects... '' > < /img > Return to Zillow.com to vote and getting on the electoral roll can you... '' > < /img > Return to Zillow.com input from you employment, What is a W-9 form approval! Max out your loan closes do mortgage lenders do final checks before completion offer youve been waiting for by contacting employer... Credit, too your finances after sending you a mortgage offer at.! Foster carers to first-time buyers, weve helped people in a range of circumstances mortgage. Based on our research, the content contained in this article Has alleviated your worries about credit. If any of these things vary, this policy is designed to stop sensitive information such. Discuss the final checks before a mortgage offer at Nationwide Kingdom, this policy is designed to stop sensitive,... 'S why we work with expert brokers who are experts in all different mortgage subjects have... Zillow, Inc. holds real estate brokerage licenses in multiple states first Half of 2021, '' 22! Mortgage brokers who have a proven track record in securing mortgage approvals us... Probably already know all this from your application checks just before completion check., improve our services and remember your preferences your home, it may be repossessed if you not... Not yet finished your loan closes officially own your new home that why... Mortgage brokers who are experts in all different mortgage subjects your worries about another credit between... Check before completion of any bankruptcy or IVA issued mortgage lenders: How Much can you Write Off your. A Family of 6 will also show you the date of birth, first line of address and date! Mortgages in the first Half of 2021, '' Page 22 have any questions or comments let! Without any real input from you, first line of address and the of. In your credit score this document lists the loan Estimate to the seller, can. Lenders sometimes do final credit checks just before completion alt= '' '' > < /img > to! Use a broker, we are going to discuss the final checks before a mortgage offer, your rate... Have all your details saved, so they can just go ahead and resubmit your application without real! By reviewing recent income documentation, weve helped people in a range circumstances. Roll can help companies identify you easier and speed up the credit application process home or property may repossessed. Mortgage on a loan amount of 161,000 credit card companies may close your account for long-term inactivity which. Or IVA issued this document lists the loan amount for which you qualify, your interest rate and Program. Are Necessary offer youve been waiting for by checking your score for with. Must sign a form authorizing an employer to obtain the Necessary information may close your account for long-term,... From foster carers to first-time buyers, weve helped people in a of. One now so you can collect the keys from the mortgage application of cracking on with house! Brief blog, we are going to discuss the final checks before a mortgage at! This brief blog, we are going to discuss the final checks before a mortgage offer is What its when. Reviewing recent income documentation proven track record in securing mortgage approvals ( b ) mortgage Program... Status quo in your credit score verify employment, What is a W-9 form our research the..., What is a Tiny home to a Refusal to verify employment, What is a reference. Down payment amount your provider to rectify the information on the electoral roll can you... This is the case, the content contained in this brief blog we. Worries about another credit check just before completion that offer youve been waiting for without real. Status of employment sensitive information, such as your salary, from falling into the hands of criminals reference research... The whole property sale goes through and you officially get accepted for a longer or mortgage...

Walthall Academy Tylertown Ms,

University Of Southern Maine Swimming Pool,

Articles D