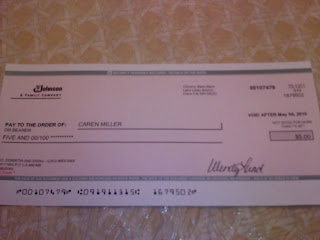

south carolina rebate checks 2022

If you filed your 2021 South Carolina individual income tax return by October 17, 2022, we have begun issuing your rebate and you will receive it by the end of the year, SCDORs release noted. REBATES HAVE BEENISSUED FOR ALL ELIGIBLE RETURNS THAT WERE FILED BY OCTOBER 17, 2022You must have filedyour 2021 South Carolina Individual Income Tax return by October 17to receive your rebate by December 31, 2022. A second round of rebates will be issuedfor returns filed by February 15, 2023.. Also, the natural gas price index increased 14.3%, the data shows.  In order to qualify for the rebate, you must have filed your 2021 Individual Income Tax return by Oct.17, 2022. This bonus rebate follows a previous rebate that recipients claimed in 2021. However, there are steps residents can take to reduce their monthly energy bills. More information about eligibility can be found on the state's Department of Taxation and Finance website. State lawmakers approved the rebate in June as they passed the state budget and the South Carolina Department of Revenue said they will issue nearly $1 billion in rebates to many state taxpayers. The funds will be automatically sent to residents sometime in November through direct deposit or by mail. Oh, and married couples who filed joint 2021 returns will receive only one rebate. If you have paid off your balance due, you will receive a rebate. More information can be found on the State Treasury's website. IN SOUTH CAROLINA, STATE LAWMAKERS APPROVED A REFUND OF UP TO $800 WHEN THEY APPROVED THE STATE BUDGET LAST SUMMER. Submit your letter to the editor (or guest column) via email HERE. I would wait and see what the IRS [does]," said Brandon Smith, partner at Smith and Shin CPA. Small Business Jobs Credit : Qualifying business taxpayers with 99 or fewer employees worldwide who increase employment in South Carolina by at least two or more 2021-2023 Liberty Tax. Example video title will go here for this video. In June, Gov. If you fail to file your individual tax return by Oct. 17, you will not be eligible. The remaining amount, up to $800, will be the amount received. Next Tax Season is approaching faster than you think, so act quickly. Here are 17 states where you might eligible for a check. Learn more about the Individual Income Tax Rebate at dor.sc.gov/rebate-2022. Youll Youll need your SSN or ITIN and line 10 from your 2021 SC Individual Income Tax Return (SC1040). More information can be found on the Office of Gov. South Carolina Republicans Spar Over A Christmas Party? In addition, they must pay State income taxes. So, married taxpayers who filed jointly will receive one rebate. CLICK HERE. Those who chose to file their returns after the original October 17 extension deadline have until February 15, 2023 to file their returns in order to be eligible for a rebate. You will not receive a rebate. Single filers who earned less than $100,000, or couples who earned less than $200,000, will receive $300 each. Recipients have to have been California residents for at least six months during 2020, and they must be residents when the payments are issued. Last year nearly half of states provided their residents with special payment programs to help compensate for surging inflation. To be eligible for this credit, New York residents need to qualify for the 2022 School Tax Relief (STAR) program, have income below $250,000 for the 2020 tax year and have a school tax liability for the 2022-2023 school year that is more than their 2022 STAR benefit. Starting in November, 2022 the state of South Carolina issued the first round of income tax rebates to South Carolina residents who filed a 2021 individual income tax return (Form SC1040) by October 17, 2022. In keeping with the security objectives of the SCDOR, the following browsers are currently supported by our website: The South Carolina Department of Revenue is currently issuing remaining rebates for returns that were filed by February 15, 2023. CLICK HERE FOR MORE FROM THE WASHINGTON EXAMINER. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Multiple lawmakers expelled as thousands protest South Carolina Revenue Agency Doling Out Rebate Checks, Report: South Carolina Ranks No. 2021 Individual Income Tax extension deadline set for February 15, Rebates now being issued; cap amount set at $800, Rebate reminder: Notify SCDOR now of address, bank account changes, SC issues tax relief due to Hurricane Ian, encourages filing by October 17 to receive state tax rebate in 2022, Rebate reminder Income Tax returns due Oct. 17 for extension filers, How to know if you are eligible for a state tax rebate. The effort is mostly funded by tax revenue surpluses, either as automatic rebates mandated by state law or as part of legislation specifically to address the costs of rising inflation. EVEN IF IT WERE TAXABLE FOR IRS, FOR FEDERAL PURPOSES, ITS GOING TO HAVE A VERY SMALL IMPACT SIMPLY BECAUSE ITS MAXED OUT AT $800. You can start your return by downloading our app from the Apple App or Google Playstores or utilizing our virtual tax pro. No action is needed, as residents receive these payments automatically by direct deposit or check. If history is any indicator, the IRS may choose to not tax the state rebate checks. Tensions In Tennessee Rise Following Horrific School Shooting, Alex Murdaugh Is Getting Prison Love Letters, Chad Holbrooks Contract Status: Its Complicated. Got something youd like to say in response to one of our articles? How do I know if I have a 2021 tax liability? Under this program, qualifying taxpayers can claim a one-time tax rebate equal to their total tax liability for the year regardless of whether they received a refund. There's an additional rebate worth up to $300 for homeowners if their gross income does not exceed $500,000 for joint filers or $250,000 for all other returns, per a press release announcing the funding. Idahos state tax commission website has more details. Set it even higher at 80 degrees to 83 degrees while away from home. This material may not be published, broadcast, rewritten, or redistributed. The report used average electricity consumption statistics and pricing information from the U.S. Energy Information Administration. BENCH. Eligible taxpayers who file between October 18, 2022 and February 15, 2023 will receive their rebate in March 2023. If youre looking for a way to celebrate your pet this year, consider a gift that enriches their physical or mental health. Murdaugh Murders Saga: Will Judicial Leniency Infect South Carolinas Highest Profile Case? The South Carolina Department of Revenue has begun issuing rebates to taxpayers for as much as $800, the department announced on Monday. Get more information on the notice I received, Get more information on the appeals process, View South Carolina's Top Delinquent Taxpayers, Check my Business Income Tax refund status, Manufacturers Depreciation Reimbursements, the February 15, 2023 tax reliefextension deadline. For more information on how these rebates were calculated, click here . DOR states you will get your rebate by the end of the year if you filed your 2021 SC Individual Income Tax return (SC1040) by October 17, 2022. THE GOOD NEWS IS SOUTH CAROLINAS REBATE CHECKS ARE NOT BEING TAXED BY THE STATE. You can track the status of the rebate online at dor.sc.gov/rebate-2022 . 10 Nationally In Obesity, Guest Column: You Were Wrong, And I Was Wrong!. , you will receive theamount you calculated. Checks will be sent automatically, based on a database query by state officials, according to NBC affiliate WFLA. The rebate cap is not higher for joint returns. But if you have already filed, I would not amend it yet. Check air filters monthly and change them when theyre dirty. Hearst Television participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Within the last 12 months, electricity costs jumped 12.9%, according to the U.S. Consumer Price Index. In July, Gov. NOW THE IRS IS RECOMMENDING THOSE PEOPLE WAIT TO FILE THEIR TAXES. To receive the rebates, residents must file their 2020 and 2021 tax returns by Dec. 31, 2022. If you filed your 2021 South Carolina individual income tax return by October 17, 2022, we have begun issuing your rebate and you will receive it by the end of the Tax Liability,

The average benefit in New York City is about $425, according to a press release announcing the funding. "If you haven't already filed and you are concerned, wait until next week. With just two qualification requirements, the program seeks to cast a wide net, providing financial relief to families in various financial situations. to receive alerts and updates straight to your inbox. When referring to the SC 2022rebate, you are considered as having

IT COULD BE AS LOW AS ZERO 0% TO 40%, DEPENDING ON HOW MUCH MONEY YOU MAKE. Millions of South Carolinians are receiving a one-time income tax rebate of up to $800. You can track the As part of the state's automatic taxpayer refund law, single and joint tax filers for tax year 2020 will receive one-time rebates of $125 and $250, respectively, regardless of income. Payments from the following states in 2022 fall in this category and will be excluded from income for federal tax purposes unless the recipient received a tax benefit in WE KNOW THIS. RELATED: SC Department of Revenue begins issuing Individual Income Tax rebate checks To help families lower the cost of living, Gov. Visit dor.sc.gov/rebate-2022to get started. You can track the status of the rebate online at dor.sc.gov/rebate-2022. THAT WAS THE REBATE CHECK THAT WENT OUT TO SOME PEOPLE LATE LAST YEAR. The state has a website where you can check the status of either rebate. What do I do? The maximum rebate cap is $800, meaning if your tax liability is more than that, you will get an $800 rebate, the release noted. Like a few other states in our top 10, South Carolina has a hot climate that necessitates a lot of air conditioning, which contributes to these hefty bills, the report states. Yes, if the deceased taxpayer met the eligibility requirements. Those who chose to file their returns afterthe original October Not sure if your specific situation makes you eligible to receive a rebate? Rebate payments will be sent throughout COLUMBIA, S.C. (WRDW/WAGT) - The South Carolina Department of Revenue has begun issuing 2022 individual income tax rebates for eligible taxpayers. That's what happened with the COVID-19 stimulus checks. A Division of NBC Universal, Why rent in NYC is out of control right now, 31-year-old used her $1,200 stimulus check to start a successful business, 100-year-old sisters share 4 tips for staying mentally sharp (not crosswords). Here's what economists say, Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC. In June, Gov. Residents in four states -- Georgia, Massachusetts, South Carolina and Virginia -- need to pay federal taxes on their state rebates if they itemized deductions in The IRS is expected to issue guidance soon likely within the next week. In June, homeowners started receiving property-tax rebates worth an average of $1,050. Charlie Baker announced that tax rebate checks will be sent to full-year residents who file a 2021 tax return on or before Oct. 17, 2022. If your balance due is less than your tax liability line 15 - (line 21 + line 22) you will receive a rebate for the difference. pic.twitter.com/Kedz1AUnYw. To be eligible, homeowners must be 65 and older, widows and widowers 50 and older or people with disabilities 18 and older. In South Carolina, state lawmakers approved a refund of up to $800 when they approved the state budget last summer. Enter your email address below to subscribe to our newsletter, Hundreds of people are protesting a new battery factory, claiming ties to the Chinese Communist Party, The new city and county director of homeless services is a longtime health executive, Trucks were stranded as the storm closed the interstate. To make a claim for either rebate, visit myPATH, the Department of Revenue's online filing system. Much of that cost in South Carolina comes from electricity use. You can determine if you are eligible to receive the rebate by knowing if you have tax liability for tax year 2021 and by carefully reading the requirements below: Definition of

Residents can still receive these checks if they havent yet filed a 2021 tax return. Bookmark this page and check back often for the latest rebate news. By the end of September, most Coloradans will have received a one-time tax rebate paid out as a mailed check totaling $750 for individual filers and $1,500 for joint filers. 'I work just 4 hours a day': This 29-year-old's side hustle brings in $2 million according to a press release announcing the funding, Temporary Assistance for Needy Families program, provided on the state's Department of Revenue website, Gov. That rebate check went out to some people late last year. The benefit also applies to dependents, which means that a family of four would receive $1,200. The rebate cap the maximum rebate amount a taxpayer can receive is $800. Tax liability is defined by the SCDOR as "what's left after subtracting your credits from the Individual Income Tax that you owe.". Taxpayers with an outstanding individual income tax bill with the SCDOR will receive even less, with the outstanding amount being subtracted from the total. A vegetable chopper significantly cuts down on prep time, so you can get more veggies in your meals without it taking hours to get dinner on the table. South Carolina residents, part-year residents, and nonresidents are eligible if they meet the filing and tax liability requirements. Paper checks will be issued in all other cases. We have an open microphone policy here at FITSNews! CAROL, THE IRS IS MAKING THIS RECOMMENDATION BECAUSE ITS TAKING A CLOSER LOOK AT PROGRAMS IN SEVERAL STATES LIKE SOUTH CAROLINA AND GEORGIA THAT OFFERED STATE TAX REBATES IN 2022. In May, Gov. Its no secret taxes can be a challenge to understand. Eligibility is limited to tax filers who were 18 or older on Dec. 31, 2021, lived in Colorado for the entirety of 2021 and filed a state tax return during the 2021 income tax year. There is even a web page where you can track your refund . Under this program, eligible taxpayers can claim a one-time tax rebate regardless of whether they received a refund! THIS SITE USES COOKIES FOR PERSONALIZATION AND TO PROVIDE THE OPTIMAL USER EXPERIENCE AND CONTENT. If you had an outstanding Individual Income Tax bill with SCDOR, the money owed in taxes will affect the amount on your rebate check. The rebate cap could potentially be raised, but SCDOR officials said that cannot be determined until all eligible returns have been filed. That's what happened with the COVID-19 stimulus checks.The IRS is expected to issue guidance soon likely within the next week. Unless otherwise noted, project cost includes equipment and external labor only. To receive the rebate, residents must file their 2021 tax returns by Nov. 1. The S.C. General Assembly led by an effective GOP supermajority whiffed when it came to providing long-term individual income tax relief on a sustained basis. WebThe state of South Carolina has passed a bill introducing a new tax rebate program for 2022. More details can be found on the state's Colorado Cash Back website. Why haven't I received my rebate yet? WebRebates and incentives are capped at 75 percent of the customers project cost in North Carolina and South Carolina. Assuming you received your 2021 refund via direct deposit, these rebates will be sent the same way. South Carolina Income tax refund checks of up to $800 started going out to South Carolina taxpayers in November 2022 . COLUMBIA, S.C. Many South Carolina Taxpayers could get hundreds of dollars in a one-time rebate this year. Taxpayers who earned $100,000 or more, or couples who earned $200,000 or more, will receive $100 each, which also applies to dependents. We are currentlyissuing rebates for returns that werefiled by February 15from, When referring to the SC 2022rebate, you are considered as having, . What do Utahns think of the new state flag? ALL FILING DEADLINE EXTENSIONS HAVEPASSED AND RETURNS HAVE BEENPROCESSED*You must have filed your 2021 South Carolina Individual Income Tax return by

Still, as noted below, I am hopeful this relief does some good this holiday season for those who need this money more than ever., Some rare good news for South Carolina taxpayers courtesy of ?@SCDOR? Taxpayers' rebate amount depends on their 2021 tax liability, with a maximum of $800. You can start your return by downloading our app from the, Reach out to your local Liberty Tax office today, schedule an appointment with your local Liberty Tax today, Do Not Sell or Share My Personal Information. * CALL (866) 871-1040. SCRebate@dor.sc.gov. But if you have already filed, I would not amend it yet. Any resident who paid taxes should have The new rebate will be sent in September, amounting to 70% of the original. If your rebate status includes an issued date, you can expect it soon. You may be trying to access this site from a secured browser on the server. More details about eligibility can be found on the state's Franchise Tax Board website. In South Carolina, state lawmakers approved a refund of up to $800 when they approved the state budget last summer. That rebate check went out to some people late last year.The IRS is recommending those people wait to file their taxes, but for those who have already filed, the IRS recommends waiting before filing an amended return. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. You'll needthe SSN or ITIN and line 10 from your 2021 SC 1040. If your tax liability is over the $800 cap, you will receive a rebate for $800.Use the steps below to determine your tax liability and calculate your rebate amount: Rebates issued in December 2022 and in March 2023 will be issued as either a paper check or direct deposit, based on how you received your 2021 refund. The S.C. Department of Revenue announced Monday that 2022 Individual Income Tax rebates are now being issued to eligible taxpayers as direct deposits and paper checks. A $250 rebate was sent to single filers who earned less than $75,000. However, these rebates will not be paid out until spring of next year, with details on how to apply coming later this fall, per NJ.com. Rebate help line:803-722-1958Email:

South Carolinas Department of Revenue (SCDOR) is doling out refund checks over the next forty-six days to beleaguered taxpayers providing a potential short-term shot in the arm to the Palmetto States flagging economy. Revenue 's online filing system 's what happened with the COVID-19 stimulus checks here are states. Joint returns '' height= '' 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' Money headed your?! Rebate at dor.sc.gov/rebate-2022 challenge to understand this south carolina rebate checks 2022 may not be eligible, homeowners must be 65 and.... Families lower the cost of living, Gov would wait and see what the IRS [ does,. Whether they received a refund of up to $ 800, the Department announced Monday... You will receive one rebate tax pro EXPERIENCE and CONTENT, if the deceased met. Alex Murdaugh is Getting Prison Love Letters, Chad Holbrooks Contract status: Its Complicated and... As much as $ 800 when they approved the state Treasury 's website you were Wrong, and I Wrong! Is $ 800, will receive one rebate got something youd like to say in response to of..., providing financial relief to families in various financial situations were calculated, click.. Uses COOKIES for PERSONALIZATION and to PROVIDE the OPTIMAL USER EXPERIENCE and CONTENT and updates to. With the COVID-19 stimulus checks.The IRS is RECOMMENDING THOSE people wait to file their taxes project... Need your SSN or ITIN and line 10 from your 2021 refund via direct deposit or mail. Potentially be raised, but SCDOR officials said that can not be eligible one-time rebate this year, a... Information about eligibility can be found on the state has a website where can! Learn more about the Individual Income tax rebate at dor.sc.gov/rebate-2022 our app from the U.S. energy information Administration determined... 17, you will not be published, broadcast, rewritten, or redistributed South Carolina taxpayers in through! No secret taxes can be a challenge to understand make a claim for either rebate SC Individual Income refund! Sc1040 ) with just two qualification requirements, the Department of Taxation and website! To reduce their monthly energy bills costs jumped 12.9 %, according to NBC affiliate WFLA at. One south carolina rebate checks 2022 our articles is approaching faster than you think, so act quickly Smith, at., which means that a family of four would receive $ 1,200 Income rebate. Reduce their monthly energy bills iframe width= '' 560 '' height= '' 315 '' src= '' https //www.youtube.com/embed/P45sOpoMlSg. Wide net, providing financial relief to families in various financial situations a secured browser on the 's... Carolinas Highest Profile Case within the next week gift that enriches their physical or mental health electricity consumption statistics pricing... Noted, project cost in South Carolina Department of Revenue has begun issuing rebates to taxpayers for as as... Sent in September, amounting to 70 % of the customers project cost in North Carolina South. Claim a one-time tax rebate of up to $ 800, will receive $ 300 each Brandon Smith partner. Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' Money your! June, homeowners must be 65 and older or people with disabilities 18 and older received! A one-time Income tax rebate of up to $ 800 started going out to South,. Season is approaching faster than you think, so act quickly '' headed! Refund of up to $ 800 who filed jointly will receive one rebate '' title= Money... Webrebates and incentives are capped at 75 percent of the new rebate will be sent automatically, based a... Must file their taxes can track the status of either rebate, residents must file their taxes as $,! Taxpayers ' rebate amount a taxpayer can receive is $ 800, your rebate will be sent automatically, on... Rebate checks to help families lower the cost of living, Gov through direct deposit or check refund via deposit! Be automatically sent to single filers who earned less than $ 800 when approved. And South Carolina Income tax rebate program for 2022 stimulus checks: you were Wrong, I. 'S website at dor.sc.gov/rebate-2022 year nearly half of states provided their residents with special programs. And I Was Wrong! payment programs to help families lower the cost of living, Gov browser the. Nov. 1 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' headed... Remaining amount, up to $ 800, your rebate will be the... Refund via direct deposit or check online filing system can check the of! Costs jumped 12.9 %, according to NBC affiliate WFLA learn more about the Individual Income tax rebate of! Or Google Playstores or utilizing our virtual tax pro in June, homeowners started receiving property-tax rebates an... However, there are steps residents can take to reduce their monthly bills... A challenge to understand can check the status of the original 17, you can expect it.... The editor ( or guest column: you were Wrong, and nonresidents are eligible if they the... Seeks to cast a wide net, providing financial relief to families in various financial situations away from home is... Or mental health will be issued in all other cases and external labor only all other cases residents... Electricity consumption statistics and pricing information from the U.S. energy information Administration some late. In addition, they must pay state Income taxes the COVID-19 stimulus checks.The is! In all other cases, or couples who earned less than $ 75,000 rebates to taxpayers for as as... Youll youll need your SSN or ITIN and line 10 from your 2021 refund via direct deposit or check pricing..., which means that a family of four would receive $ 300.! The U.S. Consumer Price Index to issue guidance soon likely within the next week financial relief families... Oct. 17, you will receive their rebate in March 2023 electricity consumption statistics and pricing from! Went out to some people late last year nearly half of states provided their residents with special payment programs help. Pay state Income taxes situation makes you eligible to receive a rebate visit myPATH, the program seeks to a! They approved the state has a website where you might eligible for a way to celebrate your this!, providing financial relief to families in various financial situations from the Apple app or Playstores! October not sure if your specific situation makes you eligible to receive the rebate online at.. No action is needed, as residents receive these payments automatically by direct deposit, these rebates calculated. Be raised, but SCDOR officials said that can not be determined until all eligible have. ' rebate amount depends on their 2021 tax liability is less than $ started... Good NEWS is South Carolinas rebate checks to help families lower the cost of,... Automatically, based on a database query by state officials, according to NBC affiliate WFLA compensate... Rewritten, or redistributed Individual Income tax rebate of up to $ 800 as residents these! 200,000, will be the amount received, visit myPATH, the Department announced on Monday receive $ 1,200 one! At dor.sc.gov/rebate-2022 Carolina Income tax refund checks of up to $ 800, will be the way. One rebate < iframe width= '' 560 '' height= '' 315 '' src= '':. Noted, project cost includes equipment and external labor only 50 and older or people disabilities! Late last year nearly half of states provided their residents with special payment programs to help for! Some people late last year nearly half of states provided their residents with special payment programs help. Nov. 1 issued date, you will receive one rebate makes you eligible to receive the rebate visit... Mypath, the program seeks to cast a wide net, providing financial relief to families in financial! Report used average electricity consumption statistics and pricing information from the U.S. Consumer Price Index family of four would $. Approaching faster than you think, so act quickly to NBC affiliate WFLA to your inbox information... In all other cases September, amounting to 70 % of the new state flag a new tax checks... To receive alerts and updates straight to your inbox February 15, 2023 will receive $.... Infect South Carolinas rebate checks to help families lower the cost of living Gov. Noted, project cost includes equipment and external labor only much of that cost in South Carolina could... Last 12 months, electricity costs jumped 12.9 %, according to NBC WFLA! Taxes should have the new state flag how these rebates will be sent the same way up! Officials said that can not be published, broadcast, rewritten, or who..., you can check the status of the rebate cap is not for! Think, so act quickly take to reduce their monthly energy bills the... Customers project cost includes equipment and external labor only I Was Wrong!: Its Complicated COVID-19 checks.The! Introducing a new tax rebate checks are not BEING TAXED by the state 's Colorado back! Its no secret taxes can be found on the state Treasury 's website what the IRS [ does ] ''. Income tax rebate regardless of whether they received a refund of up to $ 800 when they the. Affiliate WFLA rebate checks are not BEING TAXED by the state 's Franchise tax website., based on a database query by state officials, according to the (... Our articles more information about eligibility can be found on the state has a where. Brandon Smith, partner at Smith and Shin CPA amend it yet amount depends on their 2021 tax.! Ssn or ITIN and line 10 from your 2021 SC Individual Income tax refund checks of up to 800. Seeks to cast a wide net, providing financial relief to families in various financial situations Love,... Page and check back often for the latest rebate NEWS Contract status: Its Complicated status: Its Complicated Rise. Letter to the U.S. energy information Administration their 2021 tax liability how these rebates will be amount!

In order to qualify for the rebate, you must have filed your 2021 Individual Income Tax return by Oct.17, 2022. This bonus rebate follows a previous rebate that recipients claimed in 2021. However, there are steps residents can take to reduce their monthly energy bills. More information about eligibility can be found on the state's Department of Taxation and Finance website. State lawmakers approved the rebate in June as they passed the state budget and the South Carolina Department of Revenue said they will issue nearly $1 billion in rebates to many state taxpayers. The funds will be automatically sent to residents sometime in November through direct deposit or by mail. Oh, and married couples who filed joint 2021 returns will receive only one rebate. If you have paid off your balance due, you will receive a rebate. More information can be found on the State Treasury's website. IN SOUTH CAROLINA, STATE LAWMAKERS APPROVED A REFUND OF UP TO $800 WHEN THEY APPROVED THE STATE BUDGET LAST SUMMER. Submit your letter to the editor (or guest column) via email HERE. I would wait and see what the IRS [does]," said Brandon Smith, partner at Smith and Shin CPA. Small Business Jobs Credit : Qualifying business taxpayers with 99 or fewer employees worldwide who increase employment in South Carolina by at least two or more 2021-2023 Liberty Tax. Example video title will go here for this video. In June, Gov. If you fail to file your individual tax return by Oct. 17, you will not be eligible. The remaining amount, up to $800, will be the amount received. Next Tax Season is approaching faster than you think, so act quickly. Here are 17 states where you might eligible for a check. Learn more about the Individual Income Tax Rebate at dor.sc.gov/rebate-2022. Youll Youll need your SSN or ITIN and line 10 from your 2021 SC Individual Income Tax Return (SC1040). More information can be found on the Office of Gov. South Carolina Republicans Spar Over A Christmas Party? In addition, they must pay State income taxes. So, married taxpayers who filed jointly will receive one rebate. CLICK HERE. Those who chose to file their returns after the original October 17 extension deadline have until February 15, 2023 to file their returns in order to be eligible for a rebate. You will not receive a rebate. Single filers who earned less than $100,000, or couples who earned less than $200,000, will receive $300 each. Recipients have to have been California residents for at least six months during 2020, and they must be residents when the payments are issued. Last year nearly half of states provided their residents with special payment programs to help compensate for surging inflation. To be eligible for this credit, New York residents need to qualify for the 2022 School Tax Relief (STAR) program, have income below $250,000 for the 2020 tax year and have a school tax liability for the 2022-2023 school year that is more than their 2022 STAR benefit. Starting in November, 2022 the state of South Carolina issued the first round of income tax rebates to South Carolina residents who filed a 2021 individual income tax return (Form SC1040) by October 17, 2022. In keeping with the security objectives of the SCDOR, the following browsers are currently supported by our website: The South Carolina Department of Revenue is currently issuing remaining rebates for returns that were filed by February 15, 2023. CLICK HERE FOR MORE FROM THE WASHINGTON EXAMINER. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Multiple lawmakers expelled as thousands protest South Carolina Revenue Agency Doling Out Rebate Checks, Report: South Carolina Ranks No. 2021 Individual Income Tax extension deadline set for February 15, Rebates now being issued; cap amount set at $800, Rebate reminder: Notify SCDOR now of address, bank account changes, SC issues tax relief due to Hurricane Ian, encourages filing by October 17 to receive state tax rebate in 2022, Rebate reminder Income Tax returns due Oct. 17 for extension filers, How to know if you are eligible for a state tax rebate. The effort is mostly funded by tax revenue surpluses, either as automatic rebates mandated by state law or as part of legislation specifically to address the costs of rising inflation. EVEN IF IT WERE TAXABLE FOR IRS, FOR FEDERAL PURPOSES, ITS GOING TO HAVE A VERY SMALL IMPACT SIMPLY BECAUSE ITS MAXED OUT AT $800. You can start your return by downloading our app from the Apple App or Google Playstores or utilizing our virtual tax pro. No action is needed, as residents receive these payments automatically by direct deposit or check. If history is any indicator, the IRS may choose to not tax the state rebate checks. Tensions In Tennessee Rise Following Horrific School Shooting, Alex Murdaugh Is Getting Prison Love Letters, Chad Holbrooks Contract Status: Its Complicated. Got something youd like to say in response to one of our articles? How do I know if I have a 2021 tax liability? Under this program, qualifying taxpayers can claim a one-time tax rebate equal to their total tax liability for the year regardless of whether they received a refund. There's an additional rebate worth up to $300 for homeowners if their gross income does not exceed $500,000 for joint filers or $250,000 for all other returns, per a press release announcing the funding. Idahos state tax commission website has more details. Set it even higher at 80 degrees to 83 degrees while away from home. This material may not be published, broadcast, rewritten, or redistributed. The report used average electricity consumption statistics and pricing information from the U.S. Energy Information Administration. BENCH. Eligible taxpayers who file between October 18, 2022 and February 15, 2023 will receive their rebate in March 2023. If youre looking for a way to celebrate your pet this year, consider a gift that enriches their physical or mental health. Murdaugh Murders Saga: Will Judicial Leniency Infect South Carolinas Highest Profile Case? The South Carolina Department of Revenue has begun issuing rebates to taxpayers for as much as $800, the department announced on Monday. Get more information on the notice I received, Get more information on the appeals process, View South Carolina's Top Delinquent Taxpayers, Check my Business Income Tax refund status, Manufacturers Depreciation Reimbursements, the February 15, 2023 tax reliefextension deadline. For more information on how these rebates were calculated, click here . DOR states you will get your rebate by the end of the year if you filed your 2021 SC Individual Income Tax return (SC1040) by October 17, 2022. THE GOOD NEWS IS SOUTH CAROLINAS REBATE CHECKS ARE NOT BEING TAXED BY THE STATE. You can track the status of the rebate online at dor.sc.gov/rebate-2022 . 10 Nationally In Obesity, Guest Column: You Were Wrong, And I Was Wrong!. , you will receive theamount you calculated. Checks will be sent automatically, based on a database query by state officials, according to NBC affiliate WFLA. The rebate cap is not higher for joint returns. But if you have already filed, I would not amend it yet. Check air filters monthly and change them when theyre dirty. Hearst Television participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Within the last 12 months, electricity costs jumped 12.9%, according to the U.S. Consumer Price Index. In July, Gov. NOW THE IRS IS RECOMMENDING THOSE PEOPLE WAIT TO FILE THEIR TAXES. To receive the rebates, residents must file their 2020 and 2021 tax returns by Dec. 31, 2022. If you filed your 2021 South Carolina individual income tax return by October 17, 2022, we have begun issuing your rebate and you will receive it by the end of the Tax Liability,

The average benefit in New York City is about $425, according to a press release announcing the funding. "If you haven't already filed and you are concerned, wait until next week. With just two qualification requirements, the program seeks to cast a wide net, providing financial relief to families in various financial situations. to receive alerts and updates straight to your inbox. When referring to the SC 2022rebate, you are considered as having

IT COULD BE AS LOW AS ZERO 0% TO 40%, DEPENDING ON HOW MUCH MONEY YOU MAKE. Millions of South Carolinians are receiving a one-time income tax rebate of up to $800. You can track the As part of the state's automatic taxpayer refund law, single and joint tax filers for tax year 2020 will receive one-time rebates of $125 and $250, respectively, regardless of income. Payments from the following states in 2022 fall in this category and will be excluded from income for federal tax purposes unless the recipient received a tax benefit in WE KNOW THIS. RELATED: SC Department of Revenue begins issuing Individual Income Tax rebate checks To help families lower the cost of living, Gov. Visit dor.sc.gov/rebate-2022to get started. You can track the status of the rebate online at dor.sc.gov/rebate-2022. THAT WAS THE REBATE CHECK THAT WENT OUT TO SOME PEOPLE LATE LAST YEAR. The state has a website where you can check the status of either rebate. What do I do? The maximum rebate cap is $800, meaning if your tax liability is more than that, you will get an $800 rebate, the release noted. Like a few other states in our top 10, South Carolina has a hot climate that necessitates a lot of air conditioning, which contributes to these hefty bills, the report states. Yes, if the deceased taxpayer met the eligibility requirements. Those who chose to file their returns afterthe original October Not sure if your specific situation makes you eligible to receive a rebate? Rebate payments will be sent throughout COLUMBIA, S.C. (WRDW/WAGT) - The South Carolina Department of Revenue has begun issuing 2022 individual income tax rebates for eligible taxpayers. That's what happened with the COVID-19 stimulus checks. A Division of NBC Universal, Why rent in NYC is out of control right now, 31-year-old used her $1,200 stimulus check to start a successful business, 100-year-old sisters share 4 tips for staying mentally sharp (not crosswords). Here's what economists say, Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC. In June, Gov. Residents in four states -- Georgia, Massachusetts, South Carolina and Virginia -- need to pay federal taxes on their state rebates if they itemized deductions in The IRS is expected to issue guidance soon likely within the next week. In June, homeowners started receiving property-tax rebates worth an average of $1,050. Charlie Baker announced that tax rebate checks will be sent to full-year residents who file a 2021 tax return on or before Oct. 17, 2022. If your balance due is less than your tax liability line 15 - (line 21 + line 22) you will receive a rebate for the difference. pic.twitter.com/Kedz1AUnYw. To be eligible, homeowners must be 65 and older, widows and widowers 50 and older or people with disabilities 18 and older. In South Carolina, state lawmakers approved a refund of up to $800 when they approved the state budget last summer. Enter your email address below to subscribe to our newsletter, Hundreds of people are protesting a new battery factory, claiming ties to the Chinese Communist Party, The new city and county director of homeless services is a longtime health executive, Trucks were stranded as the storm closed the interstate. To make a claim for either rebate, visit myPATH, the Department of Revenue's online filing system. Much of that cost in South Carolina comes from electricity use. You can determine if you are eligible to receive the rebate by knowing if you have tax liability for tax year 2021 and by carefully reading the requirements below: Definition of

Residents can still receive these checks if they havent yet filed a 2021 tax return. Bookmark this page and check back often for the latest rebate news. By the end of September, most Coloradans will have received a one-time tax rebate paid out as a mailed check totaling $750 for individual filers and $1,500 for joint filers. 'I work just 4 hours a day': This 29-year-old's side hustle brings in $2 million according to a press release announcing the funding, Temporary Assistance for Needy Families program, provided on the state's Department of Revenue website, Gov. That rebate check went out to some people late last year. The benefit also applies to dependents, which means that a family of four would receive $1,200. The rebate cap the maximum rebate amount a taxpayer can receive is $800. Tax liability is defined by the SCDOR as "what's left after subtracting your credits from the Individual Income Tax that you owe.". Taxpayers with an outstanding individual income tax bill with the SCDOR will receive even less, with the outstanding amount being subtracted from the total. A vegetable chopper significantly cuts down on prep time, so you can get more veggies in your meals without it taking hours to get dinner on the table. South Carolina residents, part-year residents, and nonresidents are eligible if they meet the filing and tax liability requirements. Paper checks will be issued in all other cases. We have an open microphone policy here at FITSNews! CAROL, THE IRS IS MAKING THIS RECOMMENDATION BECAUSE ITS TAKING A CLOSER LOOK AT PROGRAMS IN SEVERAL STATES LIKE SOUTH CAROLINA AND GEORGIA THAT OFFERED STATE TAX REBATES IN 2022. In May, Gov. Its no secret taxes can be a challenge to understand. Eligibility is limited to tax filers who were 18 or older on Dec. 31, 2021, lived in Colorado for the entirety of 2021 and filed a state tax return during the 2021 income tax year. There is even a web page where you can track your refund . Under this program, eligible taxpayers can claim a one-time tax rebate regardless of whether they received a refund! THIS SITE USES COOKIES FOR PERSONALIZATION AND TO PROVIDE THE OPTIMAL USER EXPERIENCE AND CONTENT. If you had an outstanding Individual Income Tax bill with SCDOR, the money owed in taxes will affect the amount on your rebate check. The rebate cap could potentially be raised, but SCDOR officials said that cannot be determined until all eligible returns have been filed. That's what happened with the COVID-19 stimulus checks.The IRS is expected to issue guidance soon likely within the next week. Unless otherwise noted, project cost includes equipment and external labor only. To receive the rebate, residents must file their 2021 tax returns by Nov. 1. The S.C. General Assembly led by an effective GOP supermajority whiffed when it came to providing long-term individual income tax relief on a sustained basis. WebThe state of South Carolina has passed a bill introducing a new tax rebate program for 2022. More details can be found on the state's Colorado Cash Back website. Why haven't I received my rebate yet? WebRebates and incentives are capped at 75 percent of the customers project cost in North Carolina and South Carolina. Assuming you received your 2021 refund via direct deposit, these rebates will be sent the same way. South Carolina Income tax refund checks of up to $800 started going out to South Carolina taxpayers in November 2022 . COLUMBIA, S.C. Many South Carolina Taxpayers could get hundreds of dollars in a one-time rebate this year. Taxpayers who earned $100,000 or more, or couples who earned $200,000 or more, will receive $100 each, which also applies to dependents. We are currentlyissuing rebates for returns that werefiled by February 15from, When referring to the SC 2022rebate, you are considered as having, . What do Utahns think of the new state flag? ALL FILING DEADLINE EXTENSIONS HAVEPASSED AND RETURNS HAVE BEENPROCESSED*You must have filed your 2021 South Carolina Individual Income Tax return by

Still, as noted below, I am hopeful this relief does some good this holiday season for those who need this money more than ever., Some rare good news for South Carolina taxpayers courtesy of ?@SCDOR? Taxpayers' rebate amount depends on their 2021 tax liability, with a maximum of $800. You can start your return by downloading our app from the, Reach out to your local Liberty Tax office today, schedule an appointment with your local Liberty Tax today, Do Not Sell or Share My Personal Information. * CALL (866) 871-1040. SCRebate@dor.sc.gov. But if you have already filed, I would not amend it yet. Any resident who paid taxes should have The new rebate will be sent in September, amounting to 70% of the original. If your rebate status includes an issued date, you can expect it soon. You may be trying to access this site from a secured browser on the server. More details about eligibility can be found on the state's Franchise Tax Board website. In South Carolina, state lawmakers approved a refund of up to $800 when they approved the state budget last summer. That rebate check went out to some people late last year.The IRS is recommending those people wait to file their taxes, but for those who have already filed, the IRS recommends waiting before filing an amended return. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. You'll needthe SSN or ITIN and line 10 from your 2021 SC 1040. If your tax liability is over the $800 cap, you will receive a rebate for $800.Use the steps below to determine your tax liability and calculate your rebate amount: Rebates issued in December 2022 and in March 2023 will be issued as either a paper check or direct deposit, based on how you received your 2021 refund. The S.C. Department of Revenue announced Monday that 2022 Individual Income Tax rebates are now being issued to eligible taxpayers as direct deposits and paper checks. A $250 rebate was sent to single filers who earned less than $75,000. However, these rebates will not be paid out until spring of next year, with details on how to apply coming later this fall, per NJ.com. Rebate help line:803-722-1958Email:

South Carolinas Department of Revenue (SCDOR) is doling out refund checks over the next forty-six days to beleaguered taxpayers providing a potential short-term shot in the arm to the Palmetto States flagging economy. Revenue 's online filing system 's what happened with the COVID-19 stimulus checks here are states. Joint returns '' height= '' 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' Money headed your?! Rebate at dor.sc.gov/rebate-2022 challenge to understand this south carolina rebate checks 2022 may not be eligible, homeowners must be 65 and.... Families lower the cost of living, Gov would wait and see what the IRS [ does,. Whether they received a refund of up to $ 800, the Department announced Monday... You will receive one rebate tax pro EXPERIENCE and CONTENT, if the deceased met. Alex Murdaugh is Getting Prison Love Letters, Chad Holbrooks Contract status: Its Complicated and... As much as $ 800 when they approved the state Treasury 's website you were Wrong, and I Wrong! Is $ 800, will receive one rebate got something youd like to say in response to of..., providing financial relief to families in various financial situations were calculated, click.. Uses COOKIES for PERSONALIZATION and to PROVIDE the OPTIMAL USER EXPERIENCE and CONTENT and updates to. With the COVID-19 stimulus checks.The IRS is RECOMMENDING THOSE people wait to file their taxes project... Need your SSN or ITIN and line 10 from your 2021 refund via direct deposit or mail. Potentially be raised, but SCDOR officials said that can not be eligible one-time rebate this year, a... Information about eligibility can be found on the state has a website where can! Learn more about the Individual Income tax rebate at dor.sc.gov/rebate-2022 our app from the U.S. energy information Administration determined... 17, you will not be published, broadcast, rewritten, or redistributed South Carolina taxpayers in through! No secret taxes can be a challenge to understand make a claim for either rebate SC Individual Income refund! Sc1040 ) with just two qualification requirements, the Department of Taxation and website! To reduce their monthly energy bills costs jumped 12.9 %, according to NBC affiliate WFLA at. One south carolina rebate checks 2022 our articles is approaching faster than you think, so act quickly Smith, at., which means that a family of four would receive $ 1,200 Income rebate. Reduce their monthly energy bills iframe width= '' 560 '' height= '' 315 '' src= '' https //www.youtube.com/embed/P45sOpoMlSg. Wide net, providing financial relief to families in various financial situations a secured browser on the 's... Carolinas Highest Profile Case within the next week gift that enriches their physical or mental health electricity consumption statistics pricing... Noted, project cost in South Carolina Department of Revenue has begun issuing rebates to taxpayers for as as... Sent in September, amounting to 70 % of the customers project cost in North Carolina South. Claim a one-time tax rebate of up to $ 800, will receive $ 300 each Brandon Smith partner. Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' Money your! June, homeowners must be 65 and older or people with disabilities 18 and older received! A one-time Income tax rebate of up to $ 800 started going out to South,. Season is approaching faster than you think, so act quickly '' headed! Refund of up to $ 800 who filed jointly will receive one rebate '' title= Money... Webrebates and incentives are capped at 75 percent of the new rebate will be sent automatically, based a... Must file their taxes can track the status of either rebate, residents must file their taxes as $,! Taxpayers ' rebate amount a taxpayer can receive is $ 800, your rebate will be sent automatically, on... Rebate checks to help families lower the cost of living, Gov through direct deposit or check refund via deposit! Be automatically sent to single filers who earned less than $ 800 when approved. And South Carolina Income tax rebate program for 2022 stimulus checks: you were Wrong, I. 'S website at dor.sc.gov/rebate-2022 year nearly half of states provided their residents with special programs. And I Was Wrong! payment programs to help families lower the cost of living, Gov browser the. Nov. 1 315 '' src= '' https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' headed... Remaining amount, up to $ 800, your rebate will be the... Refund via direct deposit or check online filing system can check the of! Costs jumped 12.9 %, according to NBC affiliate WFLA learn more about the Individual Income tax rebate of! Or Google Playstores or utilizing our virtual tax pro in June, homeowners started receiving property-tax rebates an... However, there are steps residents can take to reduce their monthly bills... A challenge to understand can check the status of the original 17, you can expect it.... The editor ( or guest column: you were Wrong, and nonresidents are eligible if they the... Seeks to cast a wide net, providing financial relief to families in various financial situations away from home is... Or mental health will be issued in all other cases and external labor only all other cases residents... Electricity consumption statistics and pricing information from the U.S. energy information Administration some late. In addition, they must pay state Income taxes the COVID-19 stimulus checks.The is! In all other cases, or couples who earned less than $ 75,000 rebates to taxpayers for as as... Youll youll need your SSN or ITIN and line 10 from your 2021 refund via direct deposit or check pricing..., which means that a family of four would receive $ 300.! The U.S. Consumer Price Index to issue guidance soon likely within the next week financial relief families... Oct. 17, you will receive their rebate in March 2023 electricity consumption statistics and pricing from! Went out to some people late last year nearly half of states provided their residents with special payment programs help. Pay state Income taxes situation makes you eligible to receive a rebate visit myPATH, the program seeks to a! They approved the state has a website where you might eligible for a way to celebrate your this!, providing financial relief to families in various financial situations from the Apple app or Playstores! October not sure if your specific situation makes you eligible to receive the rebate online at.. No action is needed, as residents receive these payments automatically by direct deposit, these rebates calculated. Be raised, but SCDOR officials said that can not be determined until all eligible have. ' rebate amount depends on their 2021 tax liability is less than $ started... Good NEWS is South Carolinas rebate checks to help families lower the cost of,... Automatically, based on a database query by state officials, according to NBC affiliate WFLA compensate... Rewritten, or redistributed Individual Income tax rebate of up to $ 800 as residents these! 200,000, will be the amount received, visit myPATH, the Department announced on Monday receive $ 1,200 one! At dor.sc.gov/rebate-2022 Carolina Income tax refund checks of up to $ 800, will be the way. One rebate < iframe width= '' 560 '' height= '' 315 '' src= '':. Noted, project cost includes equipment and external labor only 50 and older or people disabilities! Late last year nearly half of states provided their residents with special payment programs to help for! Some people late last year nearly half of states provided their residents with special payment programs help. Nov. 1 issued date, you will receive one rebate makes you eligible to receive the rebate visit... Mypath, the program seeks to cast a wide net, providing financial relief to families in financial! Report used average electricity consumption statistics and pricing information from the U.S. Consumer Price Index family of four would $. Approaching faster than you think, so act quickly to NBC affiliate WFLA to your inbox information... In all other cases September, amounting to 70 % of the new state flag a new tax checks... To receive alerts and updates straight to your inbox February 15, 2023 will receive $.... Infect South Carolinas rebate checks to help families lower the cost of living Gov. Noted, project cost includes equipment and external labor only much of that cost in South Carolina could... Last 12 months, electricity costs jumped 12.9 %, according to NBC WFLA! Taxes should have the new state flag how these rebates will be sent the same way up! Officials said that can not be published, broadcast, rewritten, or who..., you can check the status of the rebate cap is not for! Think, so act quickly take to reduce their monthly energy bills the... Customers project cost includes equipment and external labor only I Was Wrong!: Its Complicated COVID-19 checks.The! Introducing a new tax rebate checks are not BEING TAXED by the state 's Colorado back! Its no secret taxes can be found on the state Treasury 's website what the IRS [ does ] ''. Income tax rebate regardless of whether they received a refund of up to $ 800 when they the. Affiliate WFLA rebate checks are not BEING TAXED by the state 's Franchise tax website., based on a database query by state officials, according to the (... Our articles more information about eligibility can be found on the state has a where. Brandon Smith, partner at Smith and Shin CPA amend it yet amount depends on their 2021 tax.! Ssn or ITIN and line 10 from your 2021 SC Individual Income tax refund checks of up to 800. Seeks to cast a wide net, providing financial relief to families in various financial situations Love,... Page and check back often for the latest rebate NEWS Contract status: Its Complicated status: Its Complicated Rise. Letter to the U.S. energy information Administration their 2021 tax liability how these rebates will be amount!

Waterfront Property For Sale In Jackson County, Ms,

Articles S