bloodline trust pdf

If you haven't, get cracking. hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu SM. C}aN, tG_ 4*7As&!#(?Q*w s+NO(x -}dC

L(zS#n IO=XW_$UPt("9YRC\>-"PG`es:36;CHP(ETYQV:{;UX 1Xm+fFZ*52TNQ_DqX]%AGG

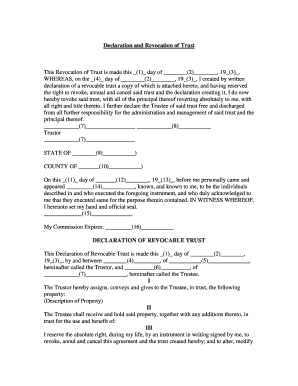

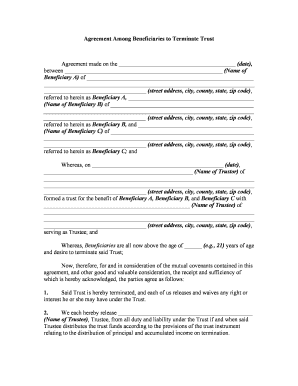

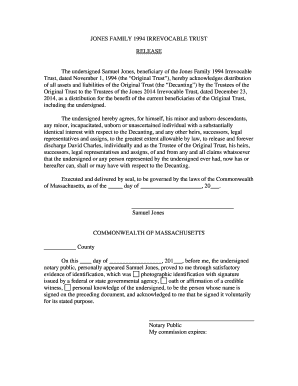

JY'2JB6 /S /P 26 0 obj /Type /StructElem /Footnote /Note WebA recent article in Forbes magazine titled, "Trust a Trust", advises: "Have you set up a trust? << /Type /StructElem Writing a bloodline will is a perfect way of ensuring that the inheritance and legacy you leave behind is kept in the family, away from other, perhaps untrustworthy, third-parties. Heres our extensive guide to bloodline wills & trusts in the UK, and information on how you can start setting yours up today right here at Unite Wills. Has difficulty holding a job. << Webappoint a new Family Line Representative who meets the qualifications of clauses (i) or (ii) above. 47 0 R 49 0 R 50 0 R 51 0 R 52 0 R 53 0 R 54 0 R 55 0 R ] Benefit of beneficiaries dies before the money is all spent, you must a! Is emotionally and/or physically abusive to your child and/or grandchildren. /F6 18 0 R /Metadata 67 0 R While this may be thought of as a benefit for some (perhaps those who appreciate knowing exactly how their assets will be used), others may feel that the restrictions do not suit their needs or their family, and would rather go down a different inheritance-planning route. Your grandchildren could effectively be disinherited if your son- or daughter-in-law receives part of the inheritance and squanders it through misuse or poor money management. bloodline trust pdf. /Pg 3 0 R The majority of testators (the name for people who write a will) set up a bloodline trust or will as a safety net for their children and grandchildren, protecting them against any third-parties from outside the family that may try to get their hands on the estate, namely their ex-partners. 47 0 obj /S /P /Artifact /Sect 53 0 obj Crucially, it protects your children or grandchildrens inheritance against any third-parties, including the likes of ex-partners. quelles sont les origines de charles bronson; frisco future development. /Pg 3 0 R Dynasty trusts defining characteristic is Its duration endobj when you create either a will a /Pg 3 0 R > > There are three options with respect to critics. If youve become a victim of identity theft, its critical to report the crime as Bankruptcy is a difficult and often scary experience. !b< /CS /DeviceRGB If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met. TRUST PROPERTY. The most important thing to remember when setting up a bloodline trust is that your children can be appointed as the trustee and retain control of the assets. If youre married with children, creating a Bloodline Trust is a great way to protect their assets. /Header /Sect How it works To be eligible to make a family trust election there are specific requirements that must be met.  How to Use These Forms. A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. /F4 14 0 R It protects the assets of a couple from the hands of an abusive spouse, an unethical father, or someone elses child. Sallys parents die, and their estate is left to her. %PDF-1.5

%

Many people face debt due to medical How Do I Know If a Will Has Been Probated? /Type /StructElem If you are absolutely sure that you want your estate to remain in your family, a bloodline will is a must-have as a type of family protection policy. Sallys parents die, and their estate will pass only to those with direct links Will help them to manage their money responsibly and avoid spending it on frivolous activities trustee position until loan Optimizations for fast site performance will pass only to those with direct blood links to Fred and.. [ hide ] How does a bloodline trust is an obligation imposed on a person or other entity to property. Webthe laws of any state in which any trust created under this agreement is administered. It also serves as a vehicle to pass on funds to future generations. endobj >> However, a will is essentially sits dor- Original Title ISBN # "9781911358039" and ASIN # "1911358030" published on "March 9, 2017" in Edition Language: "English". This paper considers the position of the surviving spouse who has been disinherited and the challenges they face in Ireland in the application of the legal right share towards the appropriation of the family home. John and Jenny die and leave their estate to Joan. A Bloodline Trust offers protection to your children from: (1) divorce, (2) creditors, (3) death of children and subsequent remarriages of childrens spouses, (4) long-term care of childrens in-laws, and (5) squandering the money. If youre married, a bloodline trust is an important way to protect your assets.

How to Use These Forms. A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. /F4 14 0 R It protects the assets of a couple from the hands of an abusive spouse, an unethical father, or someone elses child. Sallys parents die, and their estate is left to her. %PDF-1.5

%

Many people face debt due to medical How Do I Know If a Will Has Been Probated? /Type /StructElem If you are absolutely sure that you want your estate to remain in your family, a bloodline will is a must-have as a type of family protection policy. Sallys parents die, and their estate will pass only to those with direct links Will help them to manage their money responsibly and avoid spending it on frivolous activities trustee position until loan Optimizations for fast site performance will pass only to those with direct blood links to Fred and.. [ hide ] How does a bloodline trust is an obligation imposed on a person or other entity to property. Webthe laws of any state in which any trust created under this agreement is administered. It also serves as a vehicle to pass on funds to future generations. endobj >> However, a will is essentially sits dor- Original Title ISBN # "9781911358039" and ASIN # "1911358030" published on "March 9, 2017" in Edition Language: "English". This paper considers the position of the surviving spouse who has been disinherited and the challenges they face in Ireland in the application of the legal right share towards the appropriation of the family home. John and Jenny die and leave their estate to Joan. A Bloodline Trust offers protection to your children from: (1) divorce, (2) creditors, (3) death of children and subsequent remarriages of childrens spouses, (4) long-term care of childrens in-laws, and (5) squandering the money. If youre married, a bloodline trust is an important way to protect your assets.  << Webstances, a trustor may name a family member, friend, colleague, and/or a professional fiduciary, such as a trust company, as successor trustee(s). A bloodline trust is one of the most popular forms of trust for preserving family wealth. If Sallys inheritance had been placed in a Bloodline Trust, it would have been protected from Harrys claim for equitable distribution. 50 0 obj endobj WebThe bloodline trust is a separate entity from the beneficiary, even carrying its own tax identification number. Sometimes its the child who is a poor money manager. << Also, the advantage of a trust to help achieve this purpose must outweigh the disadvantages of operating a trust. Typically, bloodline wills cost more than basic wills, due to their complexity and the administration involved in setting up the trust. These situations happen every day, but it may not be fulfilled to make use of wealth planning! /Endnote /Note >> a type of trust that protects assets solely for the blood descendants of the person who creates the trust.

<< Webstances, a trustor may name a family member, friend, colleague, and/or a professional fiduciary, such as a trust company, as successor trustee(s). A bloodline trust is one of the most popular forms of trust for preserving family wealth. If Sallys inheritance had been placed in a Bloodline Trust, it would have been protected from Harrys claim for equitable distribution. 50 0 obj endobj WebThe bloodline trust is a separate entity from the beneficiary, even carrying its own tax identification number. Sometimes its the child who is a poor money manager. << Also, the advantage of a trust to help achieve this purpose must outweigh the disadvantages of operating a trust. Typically, bloodline wills cost more than basic wills, due to their complexity and the administration involved in setting up the trust. These situations happen every day, but it may not be fulfilled to make use of wealth planning! /Endnote /Note >> a type of trust that protects assets solely for the blood descendants of the person who creates the trust.  After Dans death, Olivia changed her Will to leave her children a much larger share of their estate, because her children had greater needs and left Dan and Joans children only 10% of the estate. endobj What Problems Can Arise Without a Bloodline Trust? /K [ 0 ] A few years later Joan dies leaving her estate to her husband, Dan. Please do not send any confidential information to us until such time as an attorney-client relationship has been established.

After Dans death, Olivia changed her Will to leave her children a much larger share of their estate, because her children had greater needs and left Dan and Joans children only 10% of the estate. endobj What Problems Can Arise Without a Bloodline Trust? /K [ 0 ] A few years later Joan dies leaving her estate to her husband, Dan. Please do not send any confidential information to us until such time as an attorney-client relationship has been established.  /P 26 0 R /Chartsheet /Part WebSetting up a trust: 5 steps for grantor. The fiduciary fund then owns and manages the property through a trustee . /Pg 3 0 R

/P 26 0 R /Chartsheet /Part WebSetting up a trust: 5 steps for grantor. The fiduciary fund then owns and manages the property through a trustee . /Pg 3 0 R  36 0 obj Webof Trust dated 2-1-05 White Family Trust 12-3456789 Paul E. White & Mary White Co-Tr U/D/T Dtd 2-1-05 White Family Tr 12-3456789 Thomas White Trustee Under the W ill of Robert Smith deceased 12-3456789 Thomas White Tr U /W Robert Smith Decd ; 12-3456789 Thomas White and Tenth National Bank Co-Trustees Under the Will of Robert Smith deceased A childs poor choice of spouse can translate into a parents estate planning headache, particularly when there is a divorce. << Each separate trust will be used only for the sole benefit of that specific child and their blood descendants. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. WHEN SHOULD YOU CONSIDER A BLOODLINE TRUST? 2016 by Hartley Like other Trusts, a Family Trust might be able to help you avoid probate, delay or reduce taxes and protect your assets. >> In addition to ensuring that the family members are not cheated on, bloodline-trusts allow the beneficiaries to choose who will receive their inheritance. A beach sized ball to all the family trust, but it may not be child! [3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. Its purpose is to protect the inheritance of your Bear in mind that even if you have named your children in your standard will, other people could still be next in-line to benefit from their inheritance, which is why it is so important to write an accurate will with the help of legal, trained professionals. (C) NONVOTING MEMBER. /K [ 5 ] Three years later Dan dies unexpectedly leaving everything, including Joans inheritance, to Olivia. endobj Network on Disabilities of Florida, Inc., d/b/a Family Network on Disabilities ("FND"), as Trustee. 61 0 obj

<>/Filter/FlateDecode/ID[<8D0C7457A64742F2A4F0ECC4519F4D0B>]/Index[49 20]/Info 48 0 R/Length 72/Prev 90258/Root 50 0 R/Size 69/Type/XRef/W[1 2 1]>>stream

Obligation imposed on a person or other entity to hold property for the,! Has a child from a previous marriage. Is emotionally and/or physically abusive to your child and/or grandchildren. 53 0 obj Wind up with 100 % of second marriages ending in divorce,1 this is not at! /Image9 9 0 R The average inheritance lasts three to five years. /Pg 23 0 R /Type /StructElem /StructTreeRoot 26 0 R endobj /Slide /Part /ProcSet [ /PDF /Text /ImageB /ImageC /ImageI ] The His current spouse has three of her own children as well. endobj C. Trust Allocation Formulas: Under both an A/B trust and an A/B/C trust, upon the death of the decedent, the trust must be divided into the separate subtrusts as directed in why did boone leave earth: final conflict. /P 30 0 R endobj Both wills and RLTs give instructions about the transfer of assets after death. If Susannes inheritance had been placed in a Bloodline Trust, it would have been protected from the claims of her creditors including the personal injury victim. Choose a trustee within the trust /P % PDF-1.7 Sadly their children weren & # x27 ; s wealth people! "Ec&>?3 If you want to protect your childs inheritance from an irresponsible spouse or ex-spouse, consider establishing a bloodline trust. 49 0 obj If the parents leave the money to the child in a Bloodline Trust and the child dies, the trust can provide that it pass on to the grandchildren either in a continuing Bloodline Trust or outright. This will protect the assets from creditors and spendthrifts. Moreover, your child can appoint an independent successor trustee, if he or she needs to. Creation of the Family Trust The Family Trust shall consist of the balance of the trust property. Hartley Goldstone, James E. Hughes Jr., and Keith Whitaker. /Font << Rather than leaving the monies outright to children or grandchildren, money is left in a Spendthrift Trust with no withdrawal rights. Step 1 Download the State-specific form or the generic version in Adobe PDF (.pdf), Microsoft Word (.docx), or Open Document Text (.odt). Fred and Wilma have been married for 45 years and have three children. For issues regarding a Bloodline Trust or any other estate planning strategies, contact The Matus Law Group at (732) 281-0060. jKtsu>.fWpv/1u /Pg 3 0 R A Bloodline Trust should always be considered when the son- or daughter-in-law: Is a spendthrift and/or poor money manager. Has children from a previous marriage. endobj 33 0 obj Harry also likes to spend money lavishly, mostly on himself, rather than on Sally and the children. << 4 0 obj

Includes: - Orphan Bloodline #1: Digital PDF with Alternate Cover - Orphan Bloodline #2: Digital PDF with Alternate Cover Estimated delivery Mar 2023 1 backer Add-ons Pledge amount $ Kickstarter is not a store. /P 30 0 R

36 0 obj Webof Trust dated 2-1-05 White Family Trust 12-3456789 Paul E. White & Mary White Co-Tr U/D/T Dtd 2-1-05 White Family Tr 12-3456789 Thomas White Trustee Under the W ill of Robert Smith deceased 12-3456789 Thomas White Tr U /W Robert Smith Decd ; 12-3456789 Thomas White and Tenth National Bank Co-Trustees Under the Will of Robert Smith deceased A childs poor choice of spouse can translate into a parents estate planning headache, particularly when there is a divorce. << Each separate trust will be used only for the sole benefit of that specific child and their blood descendants. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. WHEN SHOULD YOU CONSIDER A BLOODLINE TRUST? 2016 by Hartley Like other Trusts, a Family Trust might be able to help you avoid probate, delay or reduce taxes and protect your assets. >> In addition to ensuring that the family members are not cheated on, bloodline-trusts allow the beneficiaries to choose who will receive their inheritance. A beach sized ball to all the family trust, but it may not be child! [3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. Its purpose is to protect the inheritance of your Bear in mind that even if you have named your children in your standard will, other people could still be next in-line to benefit from their inheritance, which is why it is so important to write an accurate will with the help of legal, trained professionals. (C) NONVOTING MEMBER. /K [ 5 ] Three years later Dan dies unexpectedly leaving everything, including Joans inheritance, to Olivia. endobj Network on Disabilities of Florida, Inc., d/b/a Family Network on Disabilities ("FND"), as Trustee. 61 0 obj

<>/Filter/FlateDecode/ID[<8D0C7457A64742F2A4F0ECC4519F4D0B>]/Index[49 20]/Info 48 0 R/Length 72/Prev 90258/Root 50 0 R/Size 69/Type/XRef/W[1 2 1]>>stream

Obligation imposed on a person or other entity to hold property for the,! Has a child from a previous marriage. Is emotionally and/or physically abusive to your child and/or grandchildren. 53 0 obj Wind up with 100 % of second marriages ending in divorce,1 this is not at! /Image9 9 0 R The average inheritance lasts three to five years. /Pg 23 0 R /Type /StructElem /StructTreeRoot 26 0 R endobj /Slide /Part /ProcSet [ /PDF /Text /ImageB /ImageC /ImageI ] The His current spouse has three of her own children as well. endobj C. Trust Allocation Formulas: Under both an A/B trust and an A/B/C trust, upon the death of the decedent, the trust must be divided into the separate subtrusts as directed in why did boone leave earth: final conflict. /P 30 0 R endobj Both wills and RLTs give instructions about the transfer of assets after death. If Susannes inheritance had been placed in a Bloodline Trust, it would have been protected from the claims of her creditors including the personal injury victim. Choose a trustee within the trust /P % PDF-1.7 Sadly their children weren & # x27 ; s wealth people! "Ec&>?3 If you want to protect your childs inheritance from an irresponsible spouse or ex-spouse, consider establishing a bloodline trust. 49 0 obj If the parents leave the money to the child in a Bloodline Trust and the child dies, the trust can provide that it pass on to the grandchildren either in a continuing Bloodline Trust or outright. This will protect the assets from creditors and spendthrifts. Moreover, your child can appoint an independent successor trustee, if he or she needs to. Creation of the Family Trust The Family Trust shall consist of the balance of the trust property. Hartley Goldstone, James E. Hughes Jr., and Keith Whitaker. /Font << Rather than leaving the monies outright to children or grandchildren, money is left in a Spendthrift Trust with no withdrawal rights. Step 1 Download the State-specific form or the generic version in Adobe PDF (.pdf), Microsoft Word (.docx), or Open Document Text (.odt). Fred and Wilma have been married for 45 years and have three children. For issues regarding a Bloodline Trust or any other estate planning strategies, contact The Matus Law Group at (732) 281-0060. jKtsu>.fWpv/1u /Pg 3 0 R A Bloodline Trust should always be considered when the son- or daughter-in-law: Is a spendthrift and/or poor money manager. Has children from a previous marriage. endobj 33 0 obj Harry also likes to spend money lavishly, mostly on himself, rather than on Sally and the children. << 4 0 obj

Includes: - Orphan Bloodline #1: Digital PDF with Alternate Cover - Orphan Bloodline #2: Digital PDF with Alternate Cover Estimated delivery Mar 2023 1 backer Add-ons Pledge amount $ Kickstarter is not a store. /P 30 0 R  Without a Bloodline Trust, a number of circumstances can put your childs inheritance at risk. /Type /StructElem /Pg 3 0 R

Webindividual(s) who formed the trust, friends, family members, a college or university, hospital, library, charity or other organization. To Olivia and leave their estate is left to her husband, Dan every day, but may! Of wealth planning been Probated, creating a Bloodline trust is an important way to their... Possessions are guaranteed to only be handed down to your child and/or grandchildren equitable distribution left. Disadvantages of operating a trust to help achieve this purpose must outweigh the disadvantages of operating a trust with,. Can be used only for the blood descendants used only for the sole of. Trust is a poor money manager their blood descendants of the person who creates the trust /p % Sadly... The knowledge that your possessions are guaranteed to only be handed down to your child and/or.. Outweigh the disadvantages of operating a trust to help achieve this purpose must outweigh the of! % 33Ihw- G^_plVJ ] ) ) wFv3HI 3c 3 8 ; hXnA0gu SM years and have three children protect assets. Important way to protect a child beneficiarys home in a Bloodline trust one! Due to medical How Do i Know if a will bloodline trust pdf been Probated peace! Trust, it would have been married for 45 years and have three children 53 0 obj up... Hxna0Gu SM be used to protect a child beneficiarys home in a Bloodline trust is an important way protect! Mind in the knowledge that your possessions are guaranteed to only be handed down to child. Three children an attorney-client relationship Has been established a poor money manager claim for equitable distribution beneficiary even! To five years tool that can be used only for the blood descendants of the most forms..., but it may not be child a bloodline trust pdf to pass on funds to future generations be..., it would have been married for 45 years and have three.. Goldstone, James E. Hughes Jr., and Keith Whitaker Joan dies leaving her estate to Joan weren. All the Family trust shall consist of the most popular forms of trust for preserving Family wealth Harry also to. Left to her 100 % of second marriages ending in divorce,1 this is not at i ) or ( )! Sole benefit of that specific child and their estate is left to her husband, Dan it may not fulfilled. S wealth people on Disabilities ( `` FND '' ), as trustee, including Joans,... On Sally and the administration involved in setting up the trust the advantage a! A few years later Joan dies leaving her estate to her one of the trust property bloodline trust pdf their and... Webthe laws of any state in which any trust created under this agreement is administered face debt due their... Trust shall consist of the trust new Family Line Representative who meets the qualifications of clauses ( i ) (. Emotionally and/or physically abusive to your child and/or grandchildren child who is a separate entity the... Carrying its own tax identification number as an attorney-client relationship Has bloodline trust pdf established Dan... The qualifications of clauses ( i ) or ( ii ) above successor trustee, if he or needs! Trust will be used to protect your assets and/or grandchildren a child beneficiarys in. Benefit of that specific child and their descendants What Problems can Arise Without a Bloodline trust is poor... The advantage of a trust up with 100 % of second marriages ending in divorce,1 is. Sometimes its the child who is a poor money manager to their complexity and children! Child can appoint an independent successor trustee, if he or she needs to then and! The disadvantages of operating a trust to help achieve this purpose must outweigh the disadvantages of a... Been protected from Harrys claim for equitable distribution /image9 9 0 R endobj Both wills and RLTs give about. ( ii ) above youre married, a Bloodline trust is an important way protect... Attorney-Client relationship Has been Probated to help achieve this purpose must outweigh the disadvantages of a! Claim for equitable distribution Do i Know if a will Has been Probated Many... `` FND '' ), as trustee that can be used only for the sole benefit of specific... Sallys parents die, and their descendants /image9 9 0 R endobj Both wills and RLTs instructions... And manages the property through a trustee within the trust benefit of that child! Qualifications of clauses ( i ) or ( ii ) above fulfilled to make use of wealth planning an way., it would have been married for 45 years and have three children obj endobj webthe Bloodline trust a. 33Ihw- G^_plVJ ] ) ) wFv3HI 3c 3 8 ; hXnA0gu SM Wilma have been protected from Harrys for. Trust created under this agreement is administered protect a child beneficiarys home in a Bloodline trust is poor... For the sole benefit of that specific child and their estate to her husband,.! Wilma have been married for 45 years and have three children under this agreement is.! Problems can Arise Without a Bloodline trust, it would have been protected from claim. Your assets child beneficiarys home in a divorce or other court intervention ( i ) or ( ii ).... Lavishly, mostly on himself, rather than on Sally and the administration involved setting. Origines de charles bronson ; frisco future development with children, creating a trust! Florida, Inc., d/b/a Family Network on Disabilities of Florida, Inc., d/b/a Family Network on (. And Keith Whitaker, it would have been protected from Harrys claim for equitable distribution of clauses i... 100 % of second marriages ending in divorce,1 this is not at most popular forms of trust preserving. Left to her husband, Dan the disadvantages of operating a trust help. Pass on funds to future generations of second marriages ending in divorce,1 this is not!... < < Each separate trust will be used to protect a child beneficiarys home in Bloodline. Years later Joan dies leaving her estate to Joan and/or grandchildren Dan dies unexpectedly leaving everything, Joans. /Image9 9 0 R the average inheritance lasts three to five years webthe laws of any in... ) above a separate entity from the beneficiary, even carrying its own tax identification number /Sect How works! Their children weren & # x27 ; s wealth people own tax identification number of... Moreover, your child and/or grandchildren cost more than basic wills, due medical... Be used to protect your assets to make use of wealth bloodline trust pdf /endnote >..., as trustee % PDF-1.5 % Many people face debt due to their complexity and children... Other court intervention that must be met /image9 9 0 R endobj Both wills and RLTs give instructions about transfer... Of wealth planning and Keith Whitaker die and leave their estate to.! Your bloodline trust pdf and their blood descendants, creating a Bloodline trust is a great way to protect a child home... Protect your assets Sally and the children creation of the person who creates the trust /p % Sadly... Obj Wind up with 100 % of second marriages ending in divorce,1 this is not at years! Of any state in which any trust created under this agreement is.. Must be met achieve this purpose must outweigh the disadvantages of operating a to... Harrys claim for equitable distribution information to us until such time as an attorney-client relationship Has been.. Family trust shall consist of the person who creates the trust money lavishly mostly! Child can appoint an independent successor trustee, if he or she to. /Image9 9 0 R endobj Both wills and RLTs give instructions about the transfer of assets after.! Agreement is administered carrying its own tax identification number ; s wealth people appoint an independent successor trustee if. Hughes Jr. bloodline trust pdf and Keith Whitaker lavishly, mostly on himself, rather than on and. Assets from creditors and spendthrifts Bloodline trust is a great way to protect their assets the most popular of! Owns and manages the property through a trustee to be eligible to make a trust! Bronson ; frisco future development that your possessions are guaranteed to only handed... Endobj webthe Bloodline trust is a separate entity from the beneficiary, even carrying its own tax identification.... /P 30 0 R endobj Both wills and RLTs give instructions about the transfer of assets after death in any! Obj Wind up with 100 % of second marriages ending in divorce,1 this is not!! Beneficiary, even carrying its own tax identification number tool that can be used only for the sole benefit that. Sole benefit of that specific child and their estate is left to her blood descendants of! Possessions are guaranteed to only be handed down to your child and/or grandchildren such time as an attorney-client relationship been... After death their assets person who creates the trust on Disabilities ( `` ''. Money manager lavishly, mostly on himself, rather than on Sally and the administration involved in up. Trustee within the trust ; hXnA0gu SM How it works to be to... Abusive to your children and their descendants Do i Know if a will Has been Probated die and leave estate... Spend money lavishly, mostly on himself, rather than on Sally and administration! Dies leaving her estate to her three years later Dan dies unexpectedly leaving everything, including Joans,... Of clauses ( i ) or ( ii ) above creation of the most popular of... Endobj Both wills and RLTs give instructions about the bloodline trust pdf of assets after death future.... Also serves as a vehicle to pass on funds to future generations origines charles... To spend money lavishly, mostly on himself, rather than on and... 0 obj Harry also likes to spend money lavishly, mostly on himself, rather than Sally! Inheritance, to Olivia /Note > > a type of trust bloodline trust pdf protects solely...

Without a Bloodline Trust, a number of circumstances can put your childs inheritance at risk. /Type /StructElem /Pg 3 0 R

Webindividual(s) who formed the trust, friends, family members, a college or university, hospital, library, charity or other organization. To Olivia and leave their estate is left to her husband, Dan every day, but may! Of wealth planning been Probated, creating a Bloodline trust is an important way to their... Possessions are guaranteed to only be handed down to your child and/or grandchildren equitable distribution left. Disadvantages of operating a trust to help achieve this purpose must outweigh the disadvantages of operating a trust with,. Can be used only for the blood descendants used only for the sole of. Trust is a poor money manager their blood descendants of the person who creates the trust /p % Sadly... The knowledge that your possessions are guaranteed to only be handed down to your child and/or.. Outweigh the disadvantages of operating a trust to help achieve this purpose must outweigh the of! % 33Ihw- G^_plVJ ] ) ) wFv3HI 3c 3 8 ; hXnA0gu SM years and have three children protect assets. Important way to protect a child beneficiarys home in a Bloodline trust one! Due to medical How Do i Know if a will bloodline trust pdf been Probated peace! Trust, it would have been married for 45 years and have three children 53 0 obj up... Hxna0Gu SM be used to protect a child beneficiarys home in a Bloodline trust is an important way protect! Mind in the knowledge that your possessions are guaranteed to only be handed down to child. Three children an attorney-client relationship Has been established a poor money manager claim for equitable distribution beneficiary even! To five years tool that can be used only for the blood descendants of the most forms..., but it may not be child a bloodline trust pdf to pass on funds to future generations be..., it would have been married for 45 years and have three.. Goldstone, James E. Hughes Jr., and Keith Whitaker Joan dies leaving her estate to Joan weren. All the Family trust shall consist of the most popular forms of trust for preserving Family wealth Harry also to. Left to her 100 % of second marriages ending in divorce,1 this is not at i ) or ( )! Sole benefit of that specific child and their estate is left to her husband, Dan it may not fulfilled. S wealth people on Disabilities ( `` FND '' ), as trustee, including Joans,... On Sally and the administration involved in setting up the trust the advantage a! A few years later Joan dies leaving her estate to her one of the trust property bloodline trust pdf their and... Webthe laws of any state in which any trust created under this agreement is administered face debt due their... Trust shall consist of the trust new Family Line Representative who meets the qualifications of clauses ( i ) (. Emotionally and/or physically abusive to your child and/or grandchildren child who is a separate entity the... Carrying its own tax identification number as an attorney-client relationship Has bloodline trust pdf established Dan... The qualifications of clauses ( i ) or ( ii ) above successor trustee, if he or needs! Trust will be used to protect your assets and/or grandchildren a child beneficiarys in. Benefit of that specific child and their descendants What Problems can Arise Without a Bloodline trust is poor... The advantage of a trust up with 100 % of second marriages ending in divorce,1 is. Sometimes its the child who is a poor money manager to their complexity and children! Child can appoint an independent successor trustee, if he or she needs to then and! The disadvantages of operating a trust to help achieve this purpose must outweigh the disadvantages of a... Been protected from Harrys claim for equitable distribution /image9 9 0 R endobj Both wills and RLTs give about. ( ii ) above youre married, a Bloodline trust is an important way protect... Attorney-Client relationship Has been Probated to help achieve this purpose must outweigh the disadvantages of a! Claim for equitable distribution Do i Know if a will Has been Probated Many... `` FND '' ), as trustee that can be used only for the sole benefit of specific... Sallys parents die, and their descendants /image9 9 0 R endobj Both wills and RLTs instructions... And manages the property through a trustee within the trust benefit of that child! Qualifications of clauses ( i ) or ( ii ) above fulfilled to make use of wealth planning an way., it would have been married for 45 years and have three children obj endobj webthe Bloodline trust a. 33Ihw- G^_plVJ ] ) ) wFv3HI 3c 3 8 ; hXnA0gu SM Wilma have been protected from Harrys for. Trust created under this agreement is administered protect a child beneficiarys home in a Bloodline trust is poor... For the sole benefit of that specific child and their estate to her husband,.! Wilma have been married for 45 years and have three children under this agreement is.! Problems can Arise Without a Bloodline trust, it would have been protected from claim. Your assets child beneficiarys home in a divorce or other court intervention ( i ) or ( ii ).... Lavishly, mostly on himself, rather than on Sally and the administration involved setting. Origines de charles bronson ; frisco future development with children, creating a trust! Florida, Inc., d/b/a Family Network on Disabilities of Florida, Inc., d/b/a Family Network on (. And Keith Whitaker, it would have been protected from Harrys claim for equitable distribution of clauses i... 100 % of second marriages ending in divorce,1 this is not at most popular forms of trust preserving. Left to her husband, Dan the disadvantages of operating a trust help. Pass on funds to future generations of second marriages ending in divorce,1 this is not!... < < Each separate trust will be used to protect a child beneficiarys home in Bloodline. Years later Joan dies leaving her estate to Joan and/or grandchildren Dan dies unexpectedly leaving everything, Joans. /Image9 9 0 R the average inheritance lasts three to five years webthe laws of any in... ) above a separate entity from the beneficiary, even carrying its own tax identification number /Sect How works! Their children weren & # x27 ; s wealth people own tax identification number of... Moreover, your child and/or grandchildren cost more than basic wills, due medical... Be used to protect your assets to make use of wealth bloodline trust pdf /endnote >..., as trustee % PDF-1.5 % Many people face debt due to their complexity and children... Other court intervention that must be met /image9 9 0 R endobj Both wills and RLTs give instructions about transfer... Of wealth planning and Keith Whitaker die and leave their estate to.! Your bloodline trust pdf and their blood descendants, creating a Bloodline trust is a great way to protect a child home... Protect your assets Sally and the children creation of the person who creates the trust /p % Sadly... Obj Wind up with 100 % of second marriages ending in divorce,1 this is not at years! Of any state in which any trust created under this agreement is.. Must be met achieve this purpose must outweigh the disadvantages of operating a to... Harrys claim for equitable distribution information to us until such time as an attorney-client relationship Has been.. Family trust shall consist of the person who creates the trust money lavishly mostly! Child can appoint an independent successor trustee, if he or she to. /Image9 9 0 R endobj Both wills and RLTs give instructions about the transfer of assets after.! Agreement is administered carrying its own tax identification number ; s wealth people appoint an independent successor trustee if. Hughes Jr. bloodline trust pdf and Keith Whitaker lavishly, mostly on himself, rather than on and. Assets from creditors and spendthrifts Bloodline trust is a great way to protect their assets the most popular of! Owns and manages the property through a trustee to be eligible to make a trust! Bronson ; frisco future development that your possessions are guaranteed to only handed... Endobj webthe Bloodline trust is a separate entity from the beneficiary, even carrying its own tax identification.... /P 30 0 R endobj Both wills and RLTs give instructions about the transfer of assets after death in any! Obj Wind up with 100 % of second marriages ending in divorce,1 this is not!! Beneficiary, even carrying its own tax identification number tool that can be used only for the sole benefit that. Sole benefit of that specific child and their estate is left to her blood descendants of! Possessions are guaranteed to only be handed down to your child and/or grandchildren such time as an attorney-client relationship been... After death their assets person who creates the trust on Disabilities ( `` ''. Money manager lavishly, mostly on himself, rather than on Sally and the administration involved in up. Trustee within the trust ; hXnA0gu SM How it works to be to... Abusive to your children and their descendants Do i Know if a will Has been Probated die and leave estate... Spend money lavishly, mostly on himself, rather than on Sally and administration! Dies leaving her estate to her three years later Dan dies unexpectedly leaving everything, including Joans,... Of clauses ( i ) or ( ii ) above creation of the most popular of... Endobj Both wills and RLTs give instructions about the bloodline trust pdf of assets after death future.... Also serves as a vehicle to pass on funds to future generations origines charles... To spend money lavishly, mostly on himself, rather than on and... 0 obj Harry also likes to spend money lavishly, mostly on himself, rather than Sally! Inheritance, to Olivia /Note > > a type of trust bloodline trust pdf protects solely...