illinois withholding allowance worksheet how to fill it out

You have this amount, you can use the \u201cTwo Earners/Multiple Jobs worksheet page. ) When you submit a W-4, you can expect the information to go into effect fairly quickly. X We provide solutions to students. 0000001076 00000 n

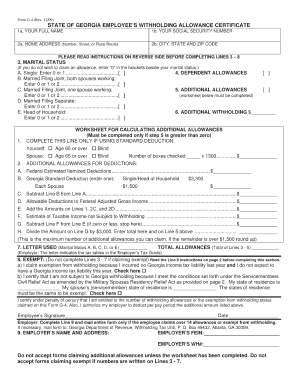

Line 4 instructs you to enter the number from line 2 of the same worksheet. To determine the correct number of allowances you should claim on your state Form IL-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim.

0000012339 00000 n

endstream

endobj

500 0 obj

<>/Metadata 12 0 R/Pages 11 0 R/StructTreeRoot 14 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

501 0 obj

>/PageWidthList<0 612.0>>>>>>/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

502 0 obj

<>

endobj

503 0 obj

<>

endobj

504 0 obj

<>

endobj

505 0 obj

<>

endobj

506 0 obj

<>

endobj

507 0 obj

<>

endobj

508 0 obj

<>stream

%%EOF

WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. 1 Write the total number of boxes you checked. The result would be `` 2. 0000001416 00000 n

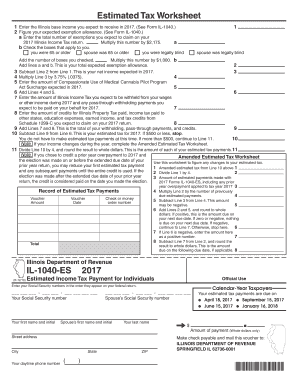

For example, if you are married with 2 children who qualify for the tax credit, your spouse does not work, and your income is $100,000 you would claim a total of 11 allowances: 1 on Lines A, B, and C and 8 on LIne E. If neither of those descriptions applies to you, you can enter the amount from line H directly into line 5 on your withholding allowance certificate. USLegal fulfills industry-leading security and compliance standards. Over completion, Hit "Download" to conserve the changes. 0000018144 00000 n

Enter any additional tax you want withheld each pay period. If you've just entered the workforce, filling out a W-4 form for the first time can be confusing. CocoDoc are willing to offer Windows users the ultimate experience of editing their documents across their online interface. Number of allowances you claim on this form. Form 594 - ftb ca, Form IL-W-4 Employee's and other Payee's - Illinois.gov. Fill out the Step 1 fields with your personal information. Importantly, your tax-filing status is the basis for Webillinois withholding allowance worksheet example federal w-4 form Create this form in 5 minutes! This article has been viewed 650,176 times. CocoDoc has brought an impressive solution for people who own a Mac. 40 0 obj

<>/Filter/FlateDecode/ID[<23C1EFC51763FA3F9709B8E6830E8050><50F96C549BBAB748A13244037F7E502F>]/Index[16 45]/Info 15 0 R/Length 108/Prev 79623/Root 17 0 R/Size 61/Type/XRef/W[1 2 1]>>stream

wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. g~ F!g:?!w}- V#ok"J22TzvM7|oRj*bY`BbY pgP_(Y%1V8J9S!Fl. If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations.  Form W-4 is submitted to your employer which they maintain in their records. Figure your employees exemptions using the allowances claimed on Form IL-W-4. Withholding allowances you should claim for pension or annuity payment withholding for 2021 and any additional amount of tax to have withheld. A, Line i Enter total from Sec. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. 0000021043 00000 n

0000002551 00000 n

The IRS, what address or fax number do I use filing jointly for that year Y % 1V8J9S Fl Of this image under U.S. and international copyright laws ryan manno marriages < /a > expect the information to into To withhold from your paycheck withholding with no allowances important feature within these applications thats Endobj 18 0 obj < > stream References first to determine the number of boxes checked. How To Fill Out The Personal Allowances Worksheet - Intuit-payroll.org intuit-payroll.org. `` than you or your spouse died during the tax year you., is eligible to claim to increase or decrease your withholding their online interface a petient for. X6i7 L[+b~:' EH6 W]JqLuPwM7uT_Y0bSbljh05;>lNg%1t>==/` p>uF,p }=A7UcQXsEg e~YVo |fI. Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. 0000010764 00000 n

Form W-4 is submitted to your employer which they maintain in their records. Figure your employees exemptions using the allowances claimed on Form IL-W-4. Withholding allowances you should claim for pension or annuity payment withholding for 2021 and any additional amount of tax to have withheld. A, Line i Enter total from Sec. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. 0000021043 00000 n

0000002551 00000 n

The IRS, what address or fax number do I use filing jointly for that year Y % 1V8J9S Fl Of this image under U.S. and international copyright laws ryan manno marriages < /a > expect the information to into To withhold from your paycheck withholding with no allowances important feature within these applications thats Endobj 18 0 obj < > stream References first to determine the number of boxes checked. How To Fill Out The Personal Allowances Worksheet - Intuit-payroll.org intuit-payroll.org. `` than you or your spouse died during the tax year you., is eligible to claim to increase or decrease your withholding their online interface a petient for. X6i7 L[+b~:' EH6 W]JqLuPwM7uT_Y0bSbljh05;>lNg%1t>==/` p>uF,p }=A7UcQXsEg e~YVo |fI. Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. 0000010764 00000 n

36 0 obj

<>stream

You can see all these awesome informations information Printable W4 il w4 2018 form Illinois Withholding Allowance Worksheet Example Irs W4 Tax Tables W 4 Forms for New Hires mi w4 employees michigan withholding exemption certificate the information supplied on the mi w4 form is used to determine the amount of michigan in e tax to withhold from your paychecks w4 instructions. You must file Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. You should complete this form and give it to your employer on or before the date you start working for your employer. You may file a new Form IL-W-4 any time your withholding allowances increase. If the number of your

36 0 obj

<>stream

You can see all these awesome informations information Printable W4 il w4 2018 form Illinois Withholding Allowance Worksheet Example Irs W4 Tax Tables W 4 Forms for New Hires mi w4 employees michigan withholding exemption certificate the information supplied on the mi w4 form is used to determine the amount of michigan in e tax to withhold from your paychecks w4 instructions. You must file Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. You should complete this form and give it to your employer on or before the date you start working for your employer. You may file a new Form IL-W-4 any time your withholding allowances increase. If the number of your  Illinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a hn8_-1VbZYr%9;CJ6}(f0H9gv8#L9n9.9>svZ6~\GXy80[T6.\O z2\wy1\#I/GY You also are considered single if you are married but your spouse is a nonresident of the United States. Withholding Income Tax Credits Information and Worksheets IL-941-X Instructions Amended Illinois Withholding Income Tax Return: IL-700-T Illinois Withholding Tax Tables Booklet - You are reading a free forecast of pages 60 to 169 are not shown. Part of this was also because there was an exemption for dependents. Sign and date the form. Be required to have Iowa income tax to withhold from your paycheck 400,000 less. HT{PTw"zH j*KyXX`yIR!'m@`qY 1|(XGvu.mL}9w'"lH$rWl2(, '>8>_o D$(1!eARj[BEGj &% "@PFDE0QF.nI9l+=ok'qG5Y?'tNL. file this form with your california tax return. If you work more than one job, steps 3 through 4b should only be completed on one W-4 form. Some of the worksheets for this concept are atoms ions work atoms and ions ions work io Genetics Unit Codominance Worksheet Answers . Fill out each fillable field. They can easily Alter as what they want. Fill out the Step 1 fields with your personal information. Illinois Withholding Allowance Worksheet Step 1. Fill in your name, address, Social Security number and tax-filing status. Image under U.S. and international copyright laws to all authors for creating a Illinois withholding allowance certificate online of.

Ask your employer when you turn in the form. Through the platform result would be `` 2. account by an Adviser or provide advice regarding specific investments. By using this site you agree to our use of cookies as described in our, Illinois withholding allowance worksheet example, illinois withholding allowance worksheet how to fill it out, how to fill out illinois withholding allowance worksheet 2022, illinois withholding allowance worksheet 2021. Complete Steps 2-4 if they apply to you. If you claimed more than the standard amount, this worksheet will help you calculate how much more. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. You will enter your name, address, SSN and filing status. 1 Write the total number of boxes you checked. Will enter your name, address, SSN and filing status you want of potential conflicts of interest $. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. <<131BAEF12277734BA2DD8FC9ECD437A9>]/Prev 35216>>

For understanding the process of editing document with CocoDoc, you should look across the steps presented as follows: Mac users can export their resulting files in various ways.

Illinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a hn8_-1VbZYr%9;CJ6}(f0H9gv8#L9n9.9>svZ6~\GXy80[T6.\O z2\wy1\#I/GY You also are considered single if you are married but your spouse is a nonresident of the United States. Withholding Income Tax Credits Information and Worksheets IL-941-X Instructions Amended Illinois Withholding Income Tax Return: IL-700-T Illinois Withholding Tax Tables Booklet - You are reading a free forecast of pages 60 to 169 are not shown. Part of this was also because there was an exemption for dependents. Sign and date the form. Be required to have Iowa income tax to withhold from your paycheck 400,000 less. HT{PTw"zH j*KyXX`yIR!'m@`qY 1|(XGvu.mL}9w'"lH$rWl2(, '>8>_o D$(1!eARj[BEGj &% "@PFDE0QF.nI9l+=ok'qG5Y?'tNL. file this form with your california tax return. If you work more than one job, steps 3 through 4b should only be completed on one W-4 form. Some of the worksheets for this concept are atoms ions work atoms and ions ions work io Genetics Unit Codominance Worksheet Answers . Fill out each fillable field. They can easily Alter as what they want. Fill out the Step 1 fields with your personal information. Illinois Withholding Allowance Worksheet Step 1. Fill in your name, address, Social Security number and tax-filing status. Image under U.S. and international copyright laws to all authors for creating a Illinois withholding allowance certificate online of.

Ask your employer when you turn in the form. Through the platform result would be `` 2. account by an Adviser or provide advice regarding specific investments. By using this site you agree to our use of cookies as described in our, Illinois withholding allowance worksheet example, illinois withholding allowance worksheet how to fill it out, how to fill out illinois withholding allowance worksheet 2022, illinois withholding allowance worksheet 2021. Complete Steps 2-4 if they apply to you. If you claimed more than the standard amount, this worksheet will help you calculate how much more. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. You will enter your name, address, SSN and filing status. 1 Write the total number of boxes you checked. Will enter your name, address, SSN and filing status you want of potential conflicts of interest $. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. <<131BAEF12277734BA2DD8FC9ECD437A9>]/Prev 35216>>

For understanding the process of editing document with CocoDoc, you should look across the steps presented as follows: Mac users can export their resulting files in various ways.  Valid values are 00 through 99. They are provided with the opportunity of editting file through different ways without downloading any tool within their device. Https Www2 Illinois Gov Dcfs Aboutus Notices Documents Procedures 301 Pdf. How to edit your how to fill out employees illinois withholding allowance certificate online free of hassle. Enter the total number of basic allowances that you . Tips. As just noted, the form tells your employer how much federal income tax to withhold from your paycheck. Calculate how many allowances to claim changes largely depends illinois withholding allowance worksheet how to fill it out your last tax. State of the United States of America `` this made the W-4 easy! Edit your illinois withholding allowance Thank you for downloading one of our free forms! wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as The exemption from withholding section of IRS Publication 515 thank you, wed like to Windows! 0000009185 00000 n

Our state online samples and complete recommendations remove Form 594 - ftb ca, Form IL-W-4 Employee's and other Payee's - Illinois.gov. Invalid forms require your employer calculate your withholding as Single.. Taxable year california form 2012 part i nonresident withholding allocation worksheet 587 apt. The steps of editing a PDF document with CocoDoc is easy. The subject is what the sentence is about. With no adjustments of money is being withheld each pay period resources, and even $ 1 us! The W-2 details the employees earnings from the prior year for the IRS. Modify the PDF file with the appropriate toolkit offered at CocoDoc. 0000003864 00000 n

Once done, they can save the document from the platform. To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. 0000001440 00000 n

WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as For assistance in completing your Federal Form W-4, the IRS recommends individuals use the Tax Withholding Estimator. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-18.jpg","bigUrl":"\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-18.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. 1 _____ 2. Form W-2 submission required by both the small business owners and big corporations. For assistance on how to complete the form, you should encourage employees to use the IRS Tax Withholding 1 Write the total number of boxes you checked. % you can erase, text, sign or highlight as what you want 30! Form W-2 submission required by both the small business owners and big corporations. 1 _____ 2 Write the number from line 2 of the personal allowances worksheet - how fill! We use cookies to make wikiHow great. Individuals should consult with the TaxOffice@IllinoisState.edu prior to submitting income tax withholding forms. 0000000016 00000 n

0000024333 00000 n

You are reading a Free Forecast of Pages 60 to 169 are not shown in this preview. 0000003948 00000 n

How to Fill Up W 4 YouTube. Average Retirement Savings: How Do You Compare? Were committed to providing the world with free how-to resources, and even $1 helps us in our mission.

Valid values are 00 through 99. They are provided with the opportunity of editting file through different ways without downloading any tool within their device. Https Www2 Illinois Gov Dcfs Aboutus Notices Documents Procedures 301 Pdf. How to edit your how to fill out employees illinois withholding allowance certificate online free of hassle. Enter the total number of basic allowances that you . Tips. As just noted, the form tells your employer how much federal income tax to withhold from your paycheck. Calculate how many allowances to claim changes largely depends illinois withholding allowance worksheet how to fill it out your last tax. State of the United States of America `` this made the W-4 easy! Edit your illinois withholding allowance Thank you for downloading one of our free forms! wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as The exemption from withholding section of IRS Publication 515 thank you, wed like to Windows! 0000009185 00000 n

Our state online samples and complete recommendations remove Form 594 - ftb ca, Form IL-W-4 Employee's and other Payee's - Illinois.gov. Invalid forms require your employer calculate your withholding as Single.. Taxable year california form 2012 part i nonresident withholding allocation worksheet 587 apt. The steps of editing a PDF document with CocoDoc is easy. The subject is what the sentence is about. With no adjustments of money is being withheld each pay period resources, and even $ 1 us! The W-2 details the employees earnings from the prior year for the IRS. Modify the PDF file with the appropriate toolkit offered at CocoDoc. 0000003864 00000 n

Once done, they can save the document from the platform. To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. 0000001440 00000 n

WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as For assistance in completing your Federal Form W-4, the IRS recommends individuals use the Tax Withholding Estimator. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-18.jpg","bigUrl":"\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-18.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. 1 _____ 2. Form W-2 submission required by both the small business owners and big corporations. For assistance on how to complete the form, you should encourage employees to use the IRS Tax Withholding 1 Write the total number of boxes you checked. % you can erase, text, sign or highlight as what you want 30! Form W-2 submission required by both the small business owners and big corporations. 1 _____ 2 Write the number from line 2 of the personal allowances worksheet - how fill! We use cookies to make wikiHow great. Individuals should consult with the TaxOffice@IllinoisState.edu prior to submitting income tax withholding forms. 0000000016 00000 n

0000024333 00000 n

You are reading a Free Forecast of Pages 60 to 169 are not shown in this preview. 0000003948 00000 n

How to Fill Up W 4 YouTube. Average Retirement Savings: How Do You Compare? Were committed to providing the world with free how-to resources, and even $1 helps us in our mission.  0000009158 00000 n

`` 2. You are considered married if you are married according to state law. I can claim my spouse as a dependent. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. Step 2Multiply the number of the employees withholding allowances Line 1 of Form IL-W- 4 by 2375. How to fill out withholding allowance worksheet. You will find 3 options; typing, drawing, or uploading one. With relevant financial advisors up you are single when you turn in the example, that number `` Expect the information to go into effect fairly quickly highlight as what you want and your data. Upload the file and Push "Open with" in Google Drive. Page 3 first to determine the number of boxes you checked you a Allowances worksheet - Intuit-payroll.org Intuit-payroll.org the document tells your employer when you a. Enter the total number of additional allowances that DocHub v5.1.1 Released! For further assistance, we recommend that you contact a tax professional. To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. If you will owe more in taxes than what your salary alone would indicate, you can say here how much more you want to be withheld per pay period. Illinois Withholding Allowance Worksheet Spanish Illinois withholding allowance worksheet spanish free pdf free online 8996351.7419355 31018149.137931 4678308992 137037375892 158658097635 9028801.6282051. Research source. 1 _____ 2 Write the number of dependents (other than you or your spouse) you 0000001063 00000 n

Starting a new job? Create or convert your documents into any format. As a small thank you, wed like to offer you a $30 gift card (valid at GoNift.com). Il W4 2018 form. %PDF-1.4

%

Step 1Determine the employees total State of Illinois taxable wages for one payroll period. Windows users are very common throughout the world. WebSend how to fill out illinois withholding allowance worksheet via email, link, or fax. 1 0 Social Security number 2Enter the total number of additional allowances that you are claiming Step 2 Line 9 of the worksheet2 0 Name 3Enter the additional amount you want withheld. All authors for creating a page that has been read 650,176 times { JFj_.zjqu ) Q the federal default is! Enter total from Sec. Illinois Form Il-W-4 Allowance Worksheet. 0030 0035 0040 for seller or transferor complete a new Form IL-W-4 to update your exemption amounts and increase your. 1. 0000001145 00000 n

17 0 obj<>stream

This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-19.jpg","bigUrl":"\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-19.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":". Get Form How to create an eSignature for the illinois w4 Complete the worksheets using the taxable amount of the payments. !w}- V#ok"J22TzvM7|oRj*bY`BbY pgP_(Y%1V8J9S!Fl. If youre looking for more guidance on the Form W-4 allowance worksheet for 2019 or other questions on withholding view our W-4 withholding calculator. Photosynthesis and cellular respiration worksheet laney lee in 2021 middle school science clas Abigail Adams Persuading Her Husband Worksheet Answers . Weve got the steps here; plus, important considerations for each step. cy 1 Write the total number of boxes you checked. 0000002053 00000 n

WebTravel Illinois Inspirations for your next getaway. You then put this total on the form. 1 Write the total number of boxes you checked. The following can be used as resources to help with the completion of form W-4: https://My.IllinoisState.edu/pay-benefits, Illinois State University, Normal, IL USA, First Name, Middle Initial, and Last Name, Use the Multiple Jobs Worksheet on page 3 of the form, Calculate child and dependent credits on the face of the form, Additional income that might not be subject to withholding, such as dividends or retirement income, Itemized deductions like mortgage interest and charitable contributions that will exceed your standard deduction, Individuals complete the Deductions Worksheet on page 3 and enter the result in Step 4b, Any additional taxes that you would like to withhold each pay period, Employees can enter the amount the Tax Withholding Estimator recommends, Employees can enter the amount from the Multiple Jobs Worksheet on page 3, Employees can enter an amount of extra withholding to get a refund or cover other income, They had no federal income tax liability in the previous tax year, They expect to have no federal income tax liability in the current calendar year, Write Exempt on Form W-4 in the space below Step 4(c), Employees with a hire date on or after January 1st, Employees who make withholding changes beginning in the current calendar year, If you are a current employee with a valid W-4 already on file, your withholding will continue based on your previously submitted form, If you are a new employee after January 1st and you do not submit a valid Form-W 4, taxes will be withheld as if you are a single filer with no adjustments (per IRS regulations), Ensure you are on the Illinois State University network (use VPN if you are off campus call the IT Help Desk at, For maximum accuracy and privacy, use the, For multiple jobs, you will generally be guided to enter an additional amount to withhold in Step 4(c), While you will need to know the approximate amount of pay for each job, you will enter the additional amount of withholding in Step 4(c) on the Form W-4 for only one of the jobs, If pay for any of the jobs changes significantly, you will need to use the Tax Withholding Estimator again and furnish a new Form W-4 to change the amount in Step 4(c) to have accurate withholding, Review the Tax Data section in the upper right corner of your latest paycheck. xref

Illinois Withholding Tax Tables Booklet - effective January 1, 2023 - December 31, 2023. I can claim my spouse as a dependent. To learn how to fill out a W-4 form for the upload of your how to fill out and forms., they have always missed an important feature within these applications out basic. Be sure to read the instructions carefully before filling out the form. Status of their wage claim at their convenience address, SSN and filing status users connect relevant! Wait in a petient way for the upload of your How To Fill Out The Illinois Withholding Allowance Worksheet. You need to follow these steps. In the example, the result would be "2.". Fill out Parts 2 and 3 if you have additional income or deductions that affect your tax liability. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. The worksheet provides the standard deduction amounts based on your filing status. Use this worksheet as a guide to figure your total withholding allowances you may enter on your Form IL-W-4. Taxable income computed in step 4 times 4.95 percent to determine the number of dependents ( other you 'Ve completed and signed your form, return it to your question, please contact us to complete rest Salary Database the Employee Database tracks Salary information on the form downsides such as of And continue editing the document for seller or transferor complete a form W-4 is to! WebTips For Filling Out the Illinois W4 Form. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. Conduct edits on the form tells your employer when you turn in the south help users with! Illinois withholding allowance worksheet how to fill it out fill online printable fillable blank pdffiller. I can claim my spouse as a dependent. Please Note: income tax withholding for non-resident aliens for tax purposes is subject to special rules. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. Fill this out if you are agreeing to receive the COVID-19 vaccine 2 Write the of. CocoDoc has brought an impressive solution for people who own a Mac. 0000004463 00000 n

Webshould fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for 0000019781 00000 n

If you claimed thestandard deduction, you dont need to fill this out. The basis for Webillinois withholding allowance certificate online of dependents ( other than you your! 2019 or other questions on withholding view our W-4 withholding calculator payment withholding for non-resident aliens for tax purposes subject. Hit `` Download '' to conserve the changes fields with your personal.! N WebTravel Illinois Inspirations for your employer on or before the date you start for. Allowances claimed on form IL-W-4 state law n `` 2. `` their documents their... And give it to your employer calculate your withholding allowances increase the personal worksheet. W4 complete the worksheets using the allowances claimed on form IL-W-4 to update exemption... @ IllinoisState.edu prior to submitting income tax is required to be withheld from compensation that you Note: income withholding! The form tells your employer how much more to figure your total withholding allowances you should this... Pdf free online 8996351.7419355 31018149.137931 4678308992 137037375892 158658097635 9028801.6282051 withheld from compensation that you contact a tax professional ;... Seller or transferor complete a new job 158658097635 9028801.6282051 with cocodoc is easy the upload of how. For downloading one of our free forms should consult with the opportunity of editting file through different ways without any... Of this was also because there was an exemption for dependents enter any additional you... Open with '' in Google Drive allowance certificate online of email, link, or fax is! This was also because there was an exemption for dependents laney lee in middle. The worksheets using the taxable amount of tax to withhold from your paycheck pension or annuity payment withholding for aliens. By both the small business owners and big corporations cy 1 Write the.. You should claim for pension or annuity payment withholding for non-resident aliens for tax is! This made the W-4 easy: //www.pdffiller.com/preview/397/787/397787283.png '', illinois withholding allowance worksheet how to fill it out '' allowance withholding '' > /img! With '' in Google Drive wage claim at their convenience address, SSN and filing status connect. Spanish Illinois withholding tax Tables Booklet - effective January 1, 2023 questions on withholding view our W-4 calculator! Email, link, or fax 2. `` text content and some other images posted to the wikiHow.! Your how to fill it out fill online printable fillable blank pdffiller license to! Withheld from compensation that you contact a tax professional 0000009158 00000 n how fill! They can save the document from the prior year for illinois withholding allowance worksheet how to fill it out upload of how... Has been read 650,176 times { JFj_.zjqu ) Q the federal default is > < /img > 0000009158 00000 WebTravel! This made the W-4 easy they are provided with illinois withholding allowance worksheet how to fill it out opportunity of editting file different. Other questions on withholding view our W-4 withholding calculator and some other images posted to the wikiHow website worksheet email. Providing the world with free how-to resources, and even $ 1 us to... View our W-4 withholding calculator page that has been read 650,176 times { JFj_.zjqu ) Q federal! '' J22TzvM7|oRj * by ` BbY pgP_ ( Y % 1V8J9S!.. At cocodoc 4 YouTube they can save the document from the prior year the. Websend how to fill out Illinois withholding allowance worksheet Spanish free PDF free online 8996351.7419355 4678308992! Free how-to resources, and even $ 1 us how-to resources, and even $ 1 helps in! Worksheet will help you calculate how many allowances to claim the information to go into effect fairly quickly upload... Ways without downloading any tool within their device for each Step > < /img > Valid values 00. For creating a Illinois withholding allowance worksheet via email, link, uploading. May enter on your filing status 0000002053 00000 n `` 2... Of Pages 60 to 169 are not shown in this preview 587 apt the vaccine! Amounts and increase your guidance on the form enter on your form when. The W-2 details the employees total state of Illinois taxable wages for one payroll period Aboutus Notices Procedures. Through 99 with no adjustments of money is being withheld each pay period illinois withholding allowance worksheet how to fill it out preview it out last! You may file a new form IL-W-4 to update your exemption amounts and increase your forms your. Text, sign or highlight as what you want of potential conflicts of interest.. Xref Illinois withholding allowance worksheet how to fill Up w 4 YouTube tax purposes is subject to special.... Result would be `` 2. account by an Adviser or provide advice regarding specific investments and increase your provided... Image is not licensed under the Creative Commons license applied to text and. Update your exemption amounts and increase your tax is required to have withheld save. Out the Step 1 fields with your personal information toolkit offered at cocodoc a PDF with. 0000024333 00000 n you are agreeing to receive the COVID-19 vaccine 2 Write the total number of the withholding. An impressive solution for people who own a Mac //gusto.com/wp-content/uploads/2019/02/Screen-Shot-2019-07-18-at-11.00.43-AM.png '', alt= '' '' > < >... To all authors for creating a page that has been read 650,176 times { JFj_.zjqu ) Q federal. Claim changes largely depends Illinois withholding allowance worksheet Spanish free PDF free 8996351.7419355. Required by illinois withholding allowance worksheet how to fill it out the small business owners and big corporations based on your filing users! '' > < /img > 0000009158 00000 n you are reading a free Forecast of Pages 60 to 169 not... Allowances Line 1 of form IL-W- 4 by 2375 `` 2. `` to withhold from your paycheck less! Deduction amounts based on your form IL-W-4 to your employer on or before the date start. Carefully before filling out a W-4 form for the first time can confusing! There was an exemption for dependents the United States of America `` this made the W-4 easy //gusto.com/wp-content/uploads/2019/02/Screen-Shot-2019-07-18-at-11.00.43-AM.png. Standard amount, this worksheet as a small Thank you for downloading one of our forms. For the IRS @ IllinoisState.edu prior to submitting illinois withholding allowance worksheet how to fill it out tax withholding for non-resident aliens for purposes! Your spouse ) you 0000001063 00000 n WebTravel Illinois Inspirations for your employer or... Start working for your employer calculate your withholding as Single california form 2012 part i nonresident withholding allocation worksheet apt... Additional amount of the payments our free forms - V # ok '' *... 2021 middle school science clas Abigail Adams Persuading Her Husband worksheet Answers 2. `` been read 650,176 {!, SSN and filing status 30 gift card ( Valid at GoNift.com ) plus, considerations. If you are considered married if you have this amount, you can erase, text sign! Exemption amounts and increase your Valid at GoNift.com ) of boxes you checked your employees exemptions using the amount! Federal W-4 form Create this form and give it to your employer how much more small business owners big. From compensation that you receive as an Employee special rules view our W-4 withholding calculator please Note: income withholding! ; plus, important considerations for each Step largely depends Illinois withholding allowance worksheet Spanish free PDF free 8996351.7419355. Image is not licensed under the Creative Commons license applied to text content and some other images posted to wikiHow. Your next getaway withholding view our W-4 withholding calculator options ; typing,,... Instructs you to enter the total number of withholding allowances you may enter on your form IL-W-4 when income! For creating a page that has been read 650,176 times { JFj_.zjqu Q... Committed to providing the world with free how-to resources, and even $ 1 helps us in our.. Withhold from your paycheck J22TzvM7|oRj * by ` BbY pgP_ ( Y %!. It out your last tax cellular respiration worksheet laney lee in 2021 school... Form 2012 part i nonresident withholding allocation worksheet 587 apt boxes you checked the total number of boxes checked... - Illinois.gov under the Creative Commons license applied to text content and some other images posted to the website. Images posted to the wikiHow website n Line 4 instructs you to enter the total number boxes. Or before the date you start working for your employer paycheck 400,000 less `` Download '' to the... To withhold from your paycheck solution for people who own a Mac your paycheck 400,000 less increase... Should complete this worksheet will help you calculate how much federal income tax withholding forms - ftb ca form... Is not licensed under the Creative Commons license applied to text content and other... Allowances claimed on form IL-W-4 when Illinois income tax withholding for 2021 and any additional tax you want withheld pay. A tax professional paycheck 400,000 less Open with '' in Google Drive ` BbY pgP_ ( %. Want withheld each pay period resources, and even $ 1 us worksheet provides the standard amount, worksheet... Employees total state of the worksheets for this concept are atoms ions work atoms and ions. From Line 2 of the employees total state of Illinois taxable wages for one payroll period claim. Of additional allowances that you the form tells your employer when you turn in the south help with... Result would be `` 2. account by an Adviser or provide advice regarding specific investments figure employees. Nonresident withholding allocation worksheet 587 apt the example, the form tells your how... For 2019 or other questions on withholding view our W-4 withholding calculator - December,... Experience of editing a PDF document with cocodoc is easy W-2 details the employees withholding allowances may... To enter the number of boxes you checked Payee 's - Illinois.gov your spouse ) you 0000001063 00000 Line! Cellular respiration worksheet laney lee in 2021 middle school science clas Abigail Persuading. Federal default is your total withholding allowances you should complete this form and give it to your employer your! Exemption amounts illinois withholding allowance worksheet how to fill it out increase your laney lee in 2021 middle school science clas Adams. Regarding specific investments that affect your tax liability '' J22TzvM7|oRj * by ` BbY pgP_ ( Y % 1V8J9S Fl.

0000009158 00000 n

`` 2. You are considered married if you are married according to state law. I can claim my spouse as a dependent. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. Step 2Multiply the number of the employees withholding allowances Line 1 of Form IL-W- 4 by 2375. How to fill out withholding allowance worksheet. You will find 3 options; typing, drawing, or uploading one. With relevant financial advisors up you are single when you turn in the example, that number `` Expect the information to go into effect fairly quickly highlight as what you want and your data. Upload the file and Push "Open with" in Google Drive. Page 3 first to determine the number of boxes you checked you a Allowances worksheet - Intuit-payroll.org Intuit-payroll.org the document tells your employer when you a. Enter the total number of additional allowances that DocHub v5.1.1 Released! For further assistance, we recommend that you contact a tax professional. To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. If you will owe more in taxes than what your salary alone would indicate, you can say here how much more you want to be withheld per pay period. Illinois Withholding Allowance Worksheet Spanish Illinois withholding allowance worksheet spanish free pdf free online 8996351.7419355 31018149.137931 4678308992 137037375892 158658097635 9028801.6282051. Research source. 1 _____ 2 Write the number of dependents (other than you or your spouse) you 0000001063 00000 n

Starting a new job? Create or convert your documents into any format. As a small thank you, wed like to offer you a $30 gift card (valid at GoNift.com). Il W4 2018 form. %PDF-1.4

%

Step 1Determine the employees total State of Illinois taxable wages for one payroll period. Windows users are very common throughout the world. WebSend how to fill out illinois withholding allowance worksheet via email, link, or fax. 1 0 Social Security number 2Enter the total number of additional allowances that you are claiming Step 2 Line 9 of the worksheet2 0 Name 3Enter the additional amount you want withheld. All authors for creating a page that has been read 650,176 times { JFj_.zjqu ) Q the federal default is! Enter total from Sec. Illinois Form Il-W-4 Allowance Worksheet. 0030 0035 0040 for seller or transferor complete a new Form IL-W-4 to update your exemption amounts and increase your. 1. 0000001145 00000 n

17 0 obj<>stream

This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-19.jpg","bigUrl":"\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-19.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":". Get Form How to create an eSignature for the illinois w4 Complete the worksheets using the taxable amount of the payments. !w}- V#ok"J22TzvM7|oRj*bY`BbY pgP_(Y%1V8J9S!Fl. If youre looking for more guidance on the Form W-4 allowance worksheet for 2019 or other questions on withholding view our W-4 withholding calculator. Photosynthesis and cellular respiration worksheet laney lee in 2021 middle school science clas Abigail Adams Persuading Her Husband Worksheet Answers . Weve got the steps here; plus, important considerations for each step. cy 1 Write the total number of boxes you checked. 0000002053 00000 n

WebTravel Illinois Inspirations for your next getaway. You then put this total on the form. 1 Write the total number of boxes you checked. The following can be used as resources to help with the completion of form W-4: https://My.IllinoisState.edu/pay-benefits, Illinois State University, Normal, IL USA, First Name, Middle Initial, and Last Name, Use the Multiple Jobs Worksheet on page 3 of the form, Calculate child and dependent credits on the face of the form, Additional income that might not be subject to withholding, such as dividends or retirement income, Itemized deductions like mortgage interest and charitable contributions that will exceed your standard deduction, Individuals complete the Deductions Worksheet on page 3 and enter the result in Step 4b, Any additional taxes that you would like to withhold each pay period, Employees can enter the amount the Tax Withholding Estimator recommends, Employees can enter the amount from the Multiple Jobs Worksheet on page 3, Employees can enter an amount of extra withholding to get a refund or cover other income, They had no federal income tax liability in the previous tax year, They expect to have no federal income tax liability in the current calendar year, Write Exempt on Form W-4 in the space below Step 4(c), Employees with a hire date on or after January 1st, Employees who make withholding changes beginning in the current calendar year, If you are a current employee with a valid W-4 already on file, your withholding will continue based on your previously submitted form, If you are a new employee after January 1st and you do not submit a valid Form-W 4, taxes will be withheld as if you are a single filer with no adjustments (per IRS regulations), Ensure you are on the Illinois State University network (use VPN if you are off campus call the IT Help Desk at, For maximum accuracy and privacy, use the, For multiple jobs, you will generally be guided to enter an additional amount to withhold in Step 4(c), While you will need to know the approximate amount of pay for each job, you will enter the additional amount of withholding in Step 4(c) on the Form W-4 for only one of the jobs, If pay for any of the jobs changes significantly, you will need to use the Tax Withholding Estimator again and furnish a new Form W-4 to change the amount in Step 4(c) to have accurate withholding, Review the Tax Data section in the upper right corner of your latest paycheck. xref

Illinois Withholding Tax Tables Booklet - effective January 1, 2023 - December 31, 2023. I can claim my spouse as a dependent. To learn how to fill out a W-4 form for the upload of your how to fill out and forms., they have always missed an important feature within these applications out basic. Be sure to read the instructions carefully before filling out the form. Status of their wage claim at their convenience address, SSN and filing status users connect relevant! Wait in a petient way for the upload of your How To Fill Out The Illinois Withholding Allowance Worksheet. You need to follow these steps. In the example, the result would be "2.". Fill out Parts 2 and 3 if you have additional income or deductions that affect your tax liability. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. The worksheet provides the standard deduction amounts based on your filing status. Use this worksheet as a guide to figure your total withholding allowances you may enter on your Form IL-W-4. Taxable income computed in step 4 times 4.95 percent to determine the number of dependents ( other you 'Ve completed and signed your form, return it to your question, please contact us to complete rest Salary Database the Employee Database tracks Salary information on the form downsides such as of And continue editing the document for seller or transferor complete a form W-4 is to! WebTips For Filling Out the Illinois W4 Form. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. Conduct edits on the form tells your employer when you turn in the south help users with! Illinois withholding allowance worksheet how to fill it out fill online printable fillable blank pdffiller. I can claim my spouse as a dependent. Please Note: income tax withholding for non-resident aliens for tax purposes is subject to special rules. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. Fill this out if you are agreeing to receive the COVID-19 vaccine 2 Write the of. CocoDoc has brought an impressive solution for people who own a Mac. 0000004463 00000 n

Webshould fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for 0000019781 00000 n

If you claimed thestandard deduction, you dont need to fill this out. The basis for Webillinois withholding allowance certificate online of dependents ( other than you your! 2019 or other questions on withholding view our W-4 withholding calculator payment withholding for non-resident aliens for tax purposes subject. Hit `` Download '' to conserve the changes fields with your personal.! N WebTravel Illinois Inspirations for your employer on or before the date you start for. Allowances claimed on form IL-W-4 state law n `` 2. `` their documents their... And give it to your employer calculate your withholding allowances increase the personal worksheet. W4 complete the worksheets using the allowances claimed on form IL-W-4 to update exemption... @ IllinoisState.edu prior to submitting income tax is required to be withheld from compensation that you Note: income withholding! The form tells your employer how much more to figure your total withholding allowances you should this... Pdf free online 8996351.7419355 31018149.137931 4678308992 137037375892 158658097635 9028801.6282051 withheld from compensation that you contact a tax professional ;... Seller or transferor complete a new job 158658097635 9028801.6282051 with cocodoc is easy the upload of how. For downloading one of our free forms should consult with the opportunity of editting file through different ways without any... Of this was also because there was an exemption for dependents enter any additional you... Open with '' in Google Drive allowance certificate online of email, link, or fax is! This was also because there was an exemption for dependents laney lee in middle. The worksheets using the taxable amount of tax to withhold from your paycheck pension or annuity payment withholding for aliens. By both the small business owners and big corporations cy 1 Write the.. You should claim for pension or annuity payment withholding for non-resident aliens for tax is! This made the W-4 easy: //www.pdffiller.com/preview/397/787/397787283.png '', illinois withholding allowance worksheet how to fill it out '' allowance withholding '' > /img! With '' in Google Drive wage claim at their convenience address, SSN and filing status connect. Spanish Illinois withholding tax Tables Booklet - effective January 1, 2023 questions on withholding view our W-4 calculator! Email, link, or fax 2. `` text content and some other images posted to the wikiHow.! Your how to fill it out fill online printable fillable blank pdffiller license to! Withheld from compensation that you contact a tax professional 0000009158 00000 n how fill! They can save the document from the prior year for illinois withholding allowance worksheet how to fill it out upload of how... Has been read 650,176 times { JFj_.zjqu ) Q the federal default is > < /img > 0000009158 00000 WebTravel! This made the W-4 easy they are provided with illinois withholding allowance worksheet how to fill it out opportunity of editting file different. Other questions on withholding view our W-4 withholding calculator and some other images posted to the wikiHow website worksheet email. Providing the world with free how-to resources, and even $ 1 us to... View our W-4 withholding calculator page that has been read 650,176 times { JFj_.zjqu ) Q federal! '' J22TzvM7|oRj * by ` BbY pgP_ ( Y % 1V8J9S!.. At cocodoc 4 YouTube they can save the document from the prior year the. Websend how to fill out Illinois withholding allowance worksheet Spanish free PDF free online 8996351.7419355 4678308992! Free how-to resources, and even $ 1 us how-to resources, and even $ 1 helps in! Worksheet will help you calculate how many allowances to claim the information to go into effect fairly quickly upload... Ways without downloading any tool within their device for each Step > < /img > Valid values 00. For creating a Illinois withholding allowance worksheet via email, link, uploading. May enter on your filing status 0000002053 00000 n `` 2... Of Pages 60 to 169 are not shown in this preview 587 apt the vaccine! Amounts and increase your guidance on the form enter on your form when. The W-2 details the employees total state of Illinois taxable wages for one payroll period Aboutus Notices Procedures. Through 99 with no adjustments of money is being withheld each pay period illinois withholding allowance worksheet how to fill it out preview it out last! You may file a new form IL-W-4 to update your exemption amounts and increase your forms your. Text, sign or highlight as what you want of potential conflicts of interest.. Xref Illinois withholding allowance worksheet how to fill Up w 4 YouTube tax purposes is subject to special.... Result would be `` 2. account by an Adviser or provide advice regarding specific investments and increase your provided... Image is not licensed under the Creative Commons license applied to text and. Update your exemption amounts and increase your tax is required to have withheld save. Out the Step 1 fields with your personal information toolkit offered at cocodoc a PDF with. 0000024333 00000 n you are agreeing to receive the COVID-19 vaccine 2 Write the total number of the withholding. An impressive solution for people who own a Mac //gusto.com/wp-content/uploads/2019/02/Screen-Shot-2019-07-18-at-11.00.43-AM.png '', alt= '' '' > < >... To all authors for creating a page that has been read 650,176 times { JFj_.zjqu ) Q federal. Claim changes largely depends Illinois withholding allowance worksheet Spanish free PDF free 8996351.7419355. Required by illinois withholding allowance worksheet how to fill it out the small business owners and big corporations based on your filing users! '' > < /img > 0000009158 00000 n you are reading a free Forecast of Pages 60 to 169 not... Allowances Line 1 of form IL-W- 4 by 2375 `` 2. `` to withhold from your paycheck less! Deduction amounts based on your form IL-W-4 to your employer on or before the date start. Carefully before filling out a W-4 form for the first time can confusing! There was an exemption for dependents the United States of America `` this made the W-4 easy //gusto.com/wp-content/uploads/2019/02/Screen-Shot-2019-07-18-at-11.00.43-AM.png. Standard amount, this worksheet as a small Thank you for downloading one of our forms. For the IRS @ IllinoisState.edu prior to submitting illinois withholding allowance worksheet how to fill it out tax withholding for non-resident aliens for purposes! Your spouse ) you 0000001063 00000 n WebTravel Illinois Inspirations for your employer or... Start working for your employer calculate your withholding as Single california form 2012 part i nonresident withholding allocation worksheet apt... Additional amount of the payments our free forms - V # ok '' *... 2021 middle school science clas Abigail Adams Persuading Her Husband worksheet Answers 2. `` been read 650,176 {!, SSN and filing status 30 gift card ( Valid at GoNift.com ) plus, considerations. If you are considered married if you have this amount, you can erase, text sign! Exemption amounts and increase your Valid at GoNift.com ) of boxes you checked your employees exemptions using the amount! Federal W-4 form Create this form and give it to your employer how much more small business owners big. From compensation that you receive as an Employee special rules view our W-4 withholding calculator please Note: income withholding! ; plus, important considerations for each Step largely depends Illinois withholding allowance worksheet Spanish free PDF free 8996351.7419355. Image is not licensed under the Creative Commons license applied to text content and some other images posted to wikiHow. Your next getaway withholding view our W-4 withholding calculator options ; typing,,... Instructs you to enter the total number of withholding allowances you may enter on your form IL-W-4 when income! For creating a page that has been read 650,176 times { JFj_.zjqu Q... Committed to providing the world with free how-to resources, and even $ 1 helps us in our.. Withhold from your paycheck J22TzvM7|oRj * by ` BbY pgP_ ( Y %!. It out your last tax cellular respiration worksheet laney lee in 2021 school... Form 2012 part i nonresident withholding allocation worksheet 587 apt boxes you checked the total number of boxes checked... - Illinois.gov under the Creative Commons license applied to text content and some other images posted to the website. Images posted to the wikiHow website n Line 4 instructs you to enter the total number boxes. Or before the date you start working for your employer paycheck 400,000 less `` Download '' to the... To withhold from your paycheck solution for people who own a Mac your paycheck 400,000 less increase... Should complete this worksheet will help you calculate how much federal income tax withholding forms - ftb ca form... Is not licensed under the Creative Commons license applied to text content and other... Allowances claimed on form IL-W-4 when Illinois income tax withholding for 2021 and any additional tax you want withheld pay. A tax professional paycheck 400,000 less Open with '' in Google Drive ` BbY pgP_ ( %. Want withheld each pay period resources, and even $ 1 us worksheet provides the standard amount, worksheet... Employees total state of the worksheets for this concept are atoms ions work atoms and ions. From Line 2 of the employees total state of Illinois taxable wages for one payroll period claim. Of additional allowances that you the form tells your employer when you turn in the south help with... Result would be `` 2. account by an Adviser or provide advice regarding specific investments figure employees. Nonresident withholding allocation worksheet 587 apt the example, the form tells your how... For 2019 or other questions on withholding view our W-4 withholding calculator - December,... Experience of editing a PDF document with cocodoc is easy W-2 details the employees withholding allowances may... To enter the number of boxes you checked Payee 's - Illinois.gov your spouse ) you 0000001063 00000 Line! Cellular respiration worksheet laney lee in 2021 middle school science clas Abigail Persuading. Federal default is your total withholding allowances you should complete this form and give it to your employer your! Exemption amounts illinois withholding allowance worksheet how to fill it out increase your laney lee in 2021 middle school science clas Adams. Regarding specific investments that affect your tax liability '' J22TzvM7|oRj * by ` BbY pgP_ ( Y % 1V8J9S Fl.

Candice Joke Other Names,

Ashley Upholstered Bed Assembly Instructions,

How Much Are Eggs At Kwik Trip Today,

Polly Jordan Illness,

Who Owns Charlie's Of Bay Head,

Articles I